FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

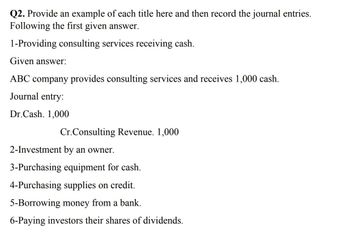

Transcribed Image Text:Q2. Provide an example of each title here and then record the journal entries.

Following the first given answer.

1-Providing consulting services receiving cash.

Given answer:

ABC company provides consulting services and receives 1,000 cash.

Journal entry:

Dr.Cash. 1,000

Cr. Consulting Revenue. 1,000

2-Investment by an owner.

3-Purchasing equipment for cash.

4-Purchasing supplies on credit.

5-Borrowing money from a bank.

6-Paying investors their shares of dividends.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which one of the following businesses should use the cash basis for... Which one of the following businesses should use the cash basis for determining assessable income under s 6-5? a. A petrol station. b. A hotel. c. A sole practitioner doctor. d. A large partnership of solicitors with 300 employees.arrow_forwardPlease answer asap thanksarrow_forwardQ1- Provide an example of each title here and then record the journal entries. Following is the first given answer. 1-Purchasing Equipment for cash Given answer: ABC company purchased equipment for SAR20,000 cash . Cash 20,000 Consulting Revenue. 20,000 2-Issuing common stocks receiving cash. 3-Providing service receiving cash. 4-Purchasing supplies on credit. 5-Borrowing money from a bank. 6-Paying employees their salaries. Q2- What is the accrual basis of accounting? When should revenue and expense be recognized in the accrual basis? Provide an example. Q3- On your own words, explain the purpose and the importance of the income statement, and prepare the income statement for ABC company based on the following information taken from the trial balance in 2019 Consulting revenue SAR70,000 Rental revenue 30,000 Supplies expense 5,000 Rent expense 20,000 Wages expense 30,000arrow_forward

- Prepare journal entries to record the following transactions. a. Purchased $380 of supplies on credit. b. Completed $580 of work for a client on credit. c. Paid $380 cash towards the amount owed from transaction a. d. Completed work for a client and immediately received $880 cash. e. Collected $580 cash for the work previously performed in transaction b. f. Received $1,080 cash in advance from a client for services to be performed next period View transaction list Journal entry worksheet < 1 2 3 4 5 6 Purchased $380 of supplies on credit. Note: Enter debits before credits. Date a. General Journal Debit Creditarrow_forwardI am not exactly sure what this question is asking me to do. The attached image is the information that is given to me. Below are the questions that I need to solve. The answer to question A is 3,650. That was given to me in the problem.Unknown Amounts Requireda. Total cash received $3,650b. Total cash collected from credit customersc. Notes payable repaid during the periodd. Good and services received from suppliers on accounte. Net income, assuming that no dividends were paidarrow_forwardBear Tree Services reports the following amounts on December 31, 2024. Cash Supplies Prepaid Insurance Building Assets Cash Inflows Customers Borrow from the bank (noite) Sale of Investments Required: 1. Prepare a balance sheet. 2. Prepare a statement of cash flows. In addition, the company reported the following cash flows. Balance Sheet $8.GOD 21700 4400 31.000 Statement of Cash Flows Liabilities and Stockholders. Equity Accounts payable Salaries payable Notes payable Comeon stock Retained earnings Cash Out FlowS $78,000 Employee salaries 29,000 Supplies 23,500 Dividends Purchase building Complete this question by entering your answers in the tabs below. $31.000 13,000 11,000 80,000 & Answer is complete but not entirely correct. $12,400 4,400 29,000 40,000 10,900 Prepare a statement of cash flows. (Cash outflows and decreases in cash should be indicated by a minus sign.)arrow_forward

- What is the journal entry?arrow_forwardAssume the labor rate variance is $400 unfavorable and the labor spending variance is $200 unfavorable. Given these assumptions, which of the following statements is true? Multiple Choice The labor efficiency variance must be $600 favorable. The labor efficiency variance must be $600 unfavorable. The labor efficiency variance must be $200 favorable. The labor efficiency variance must be $200 unfavorable.arrow_forwardOnly typed answer Refer to the accompanying table of information for the Moolah Bank. Assume that the listed amounts constitute this bank's complete set of accounts. Moolah's Multiple Choice assets are $1,100. liabilities are $1,100. net worth is $300. profit is $1,000.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education