FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

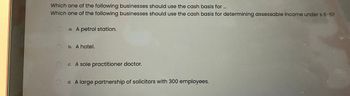

Transcribed Image Text:Which one of the following businesses should use the cash basis for...

Which one of the following businesses should use the cash basis for determining assessable income under s 6-5?

a. A petrol station.

b. A hotel.

c. A sole practitioner doctor.

d. A large partnership of solicitors with 300 employees.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Multiple choice: 1. The drawing account should be used to show A. The amount the owner has invested in the Business B. The amount the owner has taken out of the business C. The amount the business has earned D. The amount yhe business has spent 2. The purchase of an asset on account and making a partial payment results in all of the following EXCEPT A. An increase in an asset account B. A decrease in the Cash account C. A balanced accounting equation D. An increase in owner's equityarrow_forward4. Categorize each of the following as an operating activity (O), financing activity (F), or investing activity (1): a. Paying wages b. Repaying loans Selling land Selling goods Borrowing money Selling an old, used machine Paying rent Buying a building Paying dividends ن C. d. e. f. g. h. i. j. k. 1. Collecting cash from customers Buying a machine Selling an old buildingarrow_forwardA business renders services to a customer for OR16,000 on account. Which account is credited? Select one a. Accounts payable b. Cash c Accounts receivable d. service revenue CEA MYCe o o o oarrow_forward

- 1. prepare two t accounts for each transaction. on each t account, write the 2. write the debit or credit amount in each taccount to show the transactions transactions: mar. 1. received cash from owner as an investment, $4,000.00. 3. paid cash for supplies, $95.00. 4. bought supplies on account from supply depot, $120.00. 6. paid cash for insurance, $250.00. 9. paid cash on account to supply depot, $80.00. account title of one of the accounts affected by the transaction.arrow_forwardb) Complete the following table showing which accounts to be debited and which are to be credited in the spaces provided. a. Started a business with cash in hand b. Bought furniture & fittings by credit purchase, payable to Min Min Sdn Bhd C. Paid commission by cheque to an agent for product sold. d. The owner withdrew cash from the bank for self-use. Pay salaries to employees by online banking with total of RM 30,000 e. Debit Creditarrow_forwardAnswer this with explanationarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education