FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

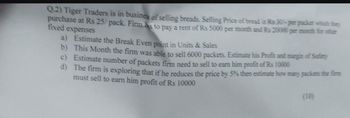

Transcribed Image Text:Q.2) Tiger Traders is in business of selling breads. Selling Price of bread is Rs 30-per packet which they

purchase at Rs 25/pack. Firm hs to pay a rent of Rs 5000 per month and Rs 20000 per month for other

fixed expenses

a) Estimate the Break Even point in Units & Sales

b) This Month the firm was able to sell 6000 packets. Estimate his Profit and margin of Safety

c) Estimate number of packets firm need to sell to earn him profit of Rs 10000

d) The firm is exploring that if he reduces the price by 5% then estimate how many packets the firm

must sell to earn him profit of Rs 10000

(10)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 7 steps

Knowledge Booster

Similar questions

- Mang Eduard operates a buy and sell business. He sells umbrellas in hisshop near the city mall. He gets his umbrellas from a local dealer. Each umbrella costs90.00 pesos each. Expecting rainy season to come, Mang Eduard purchased 4dozens of umbrellas every week. The supplier then charges 200.00 pesos per dozen for freight. Mang Eduard can sell 12 umbrellas every day. Remember to use the factors to consider in projecting revenues and refer to tables 4, 5 and 6 as your guide. Suppose Mang Eduard purchases and sales is the same every month, fill in the necessary information in table 6. Table 4 Projected Cost of Goods Sold (Monthly) Projected Volume Merchandise/ Cost per Unit Average No. of Projected Costs of Products Items Sold (Monthly) Purchases (Monthly) (A) F = (D x 30 days) J = (A x F) 90 Totalarrow_forwardramon hernandez saw the following advertisement for a used volkswagen bug and decided to work out the numbers to be sure the ad had no errors. cash price $7,880 down payment $0 annual percentage rate 14.53% deferred price $11,131.80 or 60 payments at $185.53 per month a. calculate the amount financed: $7,880 b. calculate the finance charge. (round your answer to the nearest cent.): $3,251.80 c. calculate the apr by table lookup. (use table 14.1(b).) (round your answers to 2 decimal places.): 14.50% to 14.75% d. calculate the monthly payment by formula. (round your answer to the nearest cent.): ?? Calculate the monthly payment by table lookup at 14.50% (Use table 14.2 round your answer to the nearest cent): ??arrow_forwardIf a company pays you .69 cents in US dollars per 1,000 views and you have to make $30,000 US dollars by the end of the month. How many views do you need to make $30,000? Please explain and include all used formulas and calculations.arrow_forward

- Suppose that you work for a Kentucky Bourbon distillery and you export to the European Union. The price of the bourbon is 45EUR and the cost is 20USD. What will happen to your profits if the USD appreciates? Assume that the pass-through rate for Bourbon is 45%. (your company is American and your home currency is USD). Fall Remain unchamged Increase Not enough informationarrow_forwardShow solution and explanation please thank uarrow_forwardNeed help with answerss! will upvotearrow_forward

- A retailer buys an alarm set for RM 850. Operating expenses are 5 % based on cost. The retailer wants a 30% net profit based on the selling price. Find a) the breakeven selling price. b) the retail price. c) the gross profit.arrow_forwardYour firm sells high-end road and mountain bikes and related accessories. The following information is available to estimate customer lifetime value for a new customer: Average order: $ 535 Frequency of orders: 1.6 /year Average margin: 60 % markup on retail Customer retention rate: 62% Promotional/communication costs/yr $ 31 Your discount rate: 11 % Customer acquisition cost $ 177 What is the maximum amount your firm can afford to spend to increase customer retention from 62 % to 78 %? Report your answer rounded to the nearest dollar. To answer the question, calculate CLV at the higher retention rate and subtract the CLV at the lower retention rate. The difference will be the maximum amount the company can afford to spend to increase customer retention.arrow_forward3.- The Company Surteco sells 10.000 units of their wrapped moluldings for 1.5€/unit, per year. They are offering 3/10, n30, and the discount is taken by 40% of the customers. What is the total value of the Accounts receivable? In order to gain market share against Lamidecor, their competitor, they are thinking about offering 4/5,n45. What is now the new value for accounts receivable if the % of discount taken is still 40%?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education