Database System Concepts

7th Edition

ISBN: 9780078022159

Author: Abraham Silberschatz Professor, Henry F. Korth, S. Sudarshan

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Python

1040 Tax Form

1. Calculate the adjusted gross income. To calculate your taxes owed, you take the wages and subtract the standard deductions. This gives you your adjusted gross income (AGI).

2. Calculate the tax refund or taxes owed. You then use the tables below with the AGI to calculate the taxes. If the taxes are greater then what was paid, you owe taxes. If the taxes were less, you get a refund.

For both single and married filers

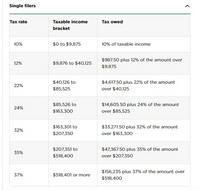

Transcribed Image Text:Single filers

Tax rate

Taxable income

Tax owed

bracket

10%

$0 to $9,875

10% of taxable income

$987.50 plus 12% of the amount over

12%

$9,876 to $40,125

$9,875

$40,126 to

$4,617.50 plus 22% of the amount

22%

$85,525

over $40,125

$85,526 to

$14,605.50 plus 24% of the amount

24%

$163,300

over $85,525

$163,301 to

$33,271.50 plus 32% of the amount

32%

$207,350

over $163,300

$207,351 to

$47,367.50 plus 35% of the amount

35%

$518,400

over $207,350

$156,235 plus 37% of the amount over

37%

$518,401 or more

$518,400

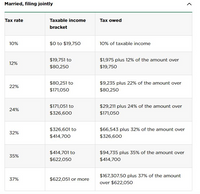

Transcribed Image Text:Married, filing jointly

Tax rate

Taxable income

Tax owed

bracket

10%

$0 to $19,750

10% of taxable income

$19,751 to

$1,975 plus 12% of the amount over

12%

$80,250

$19,750

$80,251 to

$9,235 plus 22% of the amount over

22%

$171,050

$80,250

$171,051 to

$29,211 plus 24% of the amount over

24%

$326,600

$171,050

$326,601 to

$66,543 plus 32% of the amount over

32%

$414,700

$326,600

$414,701 to

$94,735 plus 35% of the amount over

35%

$622,050

$414,700

$167,307.50 plus 37% of the amount

37%

$622,051 or more

over $622,05o

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, computer-science and related others by exploring similar questions and additional content below.Similar questions

- Q1In manual car gear system, pressing down the clutch pedal allows the driver to change the car’s gears to drive the vehicle on the road with different speed. Following are the dummy details about gear number and their relevant speed limit. 1st Gear 0 – 10 mile per hour (mph) 2nd Gear 10 – 20 mile per hour (mph) 3rd Gear 20 – 60 mile per hour (mph) 4th Gear 60 – 100 mile per hour (mph) Suppose an expert driver is going from Haji Camp Peshawar to Sarhad University Peshawar using the following route drawn as Yellow line with three roundabouts (Red Circles). In manual car gear system, pressing down the clutch pedal allows the driver to change the car’s gears to drive the vehicle on the road with different speed. Following are the dummy details about gear number and their relevant speed limit. 1st Gear 0 – 10 mile per hour (mph) 2nd Gear 10 – 20 mile per hour (mph) 3rd Gear 20 – 60 mile per hour (mph) 4th Gear 60 – 100 mile per hour (mph) Suppose an expert driver is going…arrow_forwardDraw hierarchy charts or flowcharts that depict the programs described below. Sales TaxDesign a hierarchy chart or flowchart for a program that calculates the total of aretail sale. The program should ask the user for:– The retail price of the item being purchased– The sales tax rateOnce these items have been entered, the program should calculate and display:– The sales tax for the purchase– The total of the salearrow_forwardTask using C language Two spacecrafts are traveling at different speeds from Earth to Mars. While spacecraft A doubles its speed every day, spacecraft B triples its speed in the same period. Given their initial speeds, your task is to determine how many days spacecraft B will take to travel faster than spacecraft A. If the initial speed of spacecraft A is 7, it will be 14 after 1 day, 28 after 2 days, and so on. If the initial speed of spacecraft B is 4, it will be 12 after 1 day, 36 after 2 days, and so on. If the initial speed of spacecrafts A and B are 7 and 4, respectively, B will be faster than A after 2 days, as the speed of A will be 28 and the speed of B will be 36. Requirements Follow the format of the examples below. You will be given several test cases in a single run, and you must provide an answer for all of them. Use #define Examples (your program must follow this format precisely) Example #1 Number of cases: 3Speed of A: 7Speed of B: 4Case #1: 2 day(s)Speed of A:…arrow_forward

- Python Programming Only Please Write a program that calculates the amount of money a person would earn over a periodof time if his or her salary is one penny the first day, two pennies the second day, andcontinues to double each day. The program should ask the user for the number of days.Display a table showing what the salary was for each day, then show the total pay at theend of the period. The output should be displayed in a dollar amount, not the number ofpennies.arrow_forwardPythonarrow_forwardc++arrow_forward

- Java - Name Formatarrow_forwardpython multiple choice Code Example 4-1 def get_username(first, last): s = first + "." + last return s.lower() def main(): first_name = input("Enter your first name: ") last_name = input("Enter your last name: ") username = get_username(first_name, last_name) print("Your username is: " + username) main() 5. Refer to Code Example 4-1: What is the scope of the variable named s ?a. globalb. localc. global in main() but local in get_username()d. local in main() but global in get_username()arrow_forward8. Property Tax A county collects property taxes on the assessment value of property, which is 0u percent of the property’s actual value For example, if an acre of land is valued at $10,000, its assessment value is $6.000 The property tax is then 64¢ for each $100 of the assessment value. The tax for the acre assessed at $6,000 will be $38.40. Design a modular program that asks for the actual value of a piece of property and displays the assessment value and property tax.arrow_forward

- Python Programming Only Please: Write a program that asks the user to enter a person’s age. The program should displaya message indicating whether the person is an infant, a child, a teenager, or an adult. Following are the guidelines: • If the person is 1 year old or less, he or she is an infant.• If the person is older than 1 year, but younger than 13 years, he or she is a child.• If the person is at least 13 years old, but less than 20 years old, he or she is a teenager.• If the person is at least 20 years old, he or she is an adult.arrow_forwardProgram Unit Score Calculator Console App Write a Python Console Application program that allows the user to enter the marks for different assessments in a unit, and computes the total mark and grade for the unit. Here is the program logic specification: There are six assessment activities Quiz1, Quiz2, Quiz3, Quiz4, Lab Journal, Major Assignment and Final Exam. The four quizzes are worth 5 marks each, the Lab Journal is worth 10 marks, the Major Assignment is worth 30 marks and the Final Exam is worth 40 marks. The algorithm for computing the total mark for the unit is: Total Mark = Quiz1+Quiz2+Quiz3+Quiz4+Major Assignment+ Lab Journal + Final Exam The following screenshot shows a successful test run:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Database System ConceptsComputer ScienceISBN:9780078022159Author:Abraham Silberschatz Professor, Henry F. Korth, S. SudarshanPublisher:McGraw-Hill Education

Database System ConceptsComputer ScienceISBN:9780078022159Author:Abraham Silberschatz Professor, Henry F. Korth, S. SudarshanPublisher:McGraw-Hill Education Starting Out with Python (4th Edition)Computer ScienceISBN:9780134444321Author:Tony GaddisPublisher:PEARSON

Starting Out with Python (4th Edition)Computer ScienceISBN:9780134444321Author:Tony GaddisPublisher:PEARSON Digital Fundamentals (11th Edition)Computer ScienceISBN:9780132737968Author:Thomas L. FloydPublisher:PEARSON

Digital Fundamentals (11th Edition)Computer ScienceISBN:9780132737968Author:Thomas L. FloydPublisher:PEARSON C How to Program (8th Edition)Computer ScienceISBN:9780133976892Author:Paul J. Deitel, Harvey DeitelPublisher:PEARSON

C How to Program (8th Edition)Computer ScienceISBN:9780133976892Author:Paul J. Deitel, Harvey DeitelPublisher:PEARSON Database Systems: Design, Implementation, & Manag...Computer ScienceISBN:9781337627900Author:Carlos Coronel, Steven MorrisPublisher:Cengage Learning

Database Systems: Design, Implementation, & Manag...Computer ScienceISBN:9781337627900Author:Carlos Coronel, Steven MorrisPublisher:Cengage Learning Programmable Logic ControllersComputer ScienceISBN:9780073373843Author:Frank D. PetruzellaPublisher:McGraw-Hill Education

Programmable Logic ControllersComputer ScienceISBN:9780073373843Author:Frank D. PetruzellaPublisher:McGraw-Hill Education

Database System Concepts

Computer Science

ISBN:9780078022159

Author:Abraham Silberschatz Professor, Henry F. Korth, S. Sudarshan

Publisher:McGraw-Hill Education

Starting Out with Python (4th Edition)

Computer Science

ISBN:9780134444321

Author:Tony Gaddis

Publisher:PEARSON

Digital Fundamentals (11th Edition)

Computer Science

ISBN:9780132737968

Author:Thomas L. Floyd

Publisher:PEARSON

C How to Program (8th Edition)

Computer Science

ISBN:9780133976892

Author:Paul J. Deitel, Harvey Deitel

Publisher:PEARSON

Database Systems: Design, Implementation, & Manag...

Computer Science

ISBN:9781337627900

Author:Carlos Coronel, Steven Morris

Publisher:Cengage Learning

Programmable Logic Controllers

Computer Science

ISBN:9780073373843

Author:Frank D. Petruzella

Publisher:McGraw-Hill Education