FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

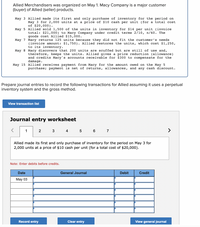

Transcribed Image Text:Allied Merchandisers was organized on May 1. Macy Company is a major customer

(buyer) of Allied (seller) products.

May 3 Allied made its first and only purchase of inventory for the period on

May 3 for 2,000 units at a price of $10 cash per unit (for a total cost

of $20,000).

May 5 Allied sold 1,500 of the units in inventory for $14 per unit (invoice

total: $21,000) to Macy Company under credit terms 2/10, n/60. The

goods cost Allied $15,000.

May 7 Macy returns 125 units because they did not fit the customer's needs

(invoice amount: $1,750). Allied restores the units, which cost $1,250,

to its inventory.

May 8 Macy discovers that 200 units are scuffed but are still of use and,

therefore, keeps the units. Allied gives a price reduction (allowance)

and credits Macy's accounts receivable for $300 to compensate for the

damage.

May 15 Allied receives payment from Macy for the amount owed on the May 5

purchase; payment is net of returns, allowances, and any cash discount.

Prepare journal entries to record the following transactions for Allied assuming it uses a perpetual

inventory system and the gross method.

View transaction list

Journal entry worksheet

1

2

3 4

7

>

Allied made its first and only purchase of inventory for the period on May 3 for

2,000 units at a price of $10 cash per unit (for a total cost of $20,000).

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

May 03

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Current Attempt in Progress Bramble Ltd. had beginning inventory of 54 units that cost $105 each. During September, the company purchased 206 units on account at $105 each, returned 6 units for credit, and sold on account 153 units at $201 each. Prepare journal entries for the September transactions, assuming that Bramble uses a periodic inventory system. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Debit Credit (To record purchase on account) (To record purchase return) Preparjalneries for the Sopomber tramming that perdicimentary titles are automatically indented whes the amount is entered De not indest manually. If ne entry is required, Entry for the account ctles and enter O for the amounts List el dret estr les defane crentes) Account Titles and…arrow_forwardThe units of an item available for sale during the year were as follows: Date Line Item Description Value Jan. 1 Inventory 2,900 units at $5 Feb. 17 Purchase 2,800 units at $7 Jul. 21 Purchase 3,200 units at $9 Nov. 23 Purchase 1,100 units at $11 There are 1,400 units of the item in the physical inventory at December 31. The periodic inventory system is used. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. a. Determine the inventory cost by the first-in, first-out method. b. Determine the inventory cost by the last-in, first-out method. c. Determine the inventory cost by the weighted average cost method. Round your answer to the nearest dollararrow_forwardDONT GIVE ANSWER IN IMAGE FORMATarrow_forward

- sarrow_forwardProvide 7 entries in worksheetarrow_forwardInventory records for Capetown, Incorporated revealed the following: Number of Date April 1 April 20 Transaction Units Unit Cost Beginning Inventory Purchase 460 310 $ 2.39 2.51 Capetown sold 630 units of inventory during the month. Cost of goods sold assuming LIFO would be: (Do not round your intermediate calculations. Round your answer to the nearest dollar amount.)arrow_forward

- Journalize each of the following transactions assuming a perpetual inventory system and PST at 8% along with 5% GST. June (1) Purchased $2,000 of merchandise; terms 1/10, n/30. (5) Sold $ 1,000 of merchandise for $1,400; terms n/15. Please answers in Journal entry worksheetarrow_forwardSubject : Accountingarrow_forwardCompute cost of goods sold assuming periodic inventory procedures and inventory priced at FIFO.arrow_forward

- Journal entries based on perpetual inventory: Sales of 5 products on credit to the customer at a price of $50.arrow_forward! Required information [The following information applies to the questions displayed below.] Allied Merchandisers was organized on May 1. Macy Co. is a major customer (buyer) of Allied (seller) products. May 3 Allied made its first and only purchase of inventory for the period on May 3 for 1,000 units at a price of $11 cash per unit (for a total cost of $11,000). 5 Allied sold 500 of the units in inventory for $15 per unit (invoice total: $7,500) to Macy Co. under credit terms 2/10, n/60. The goods cost Allied $5,500. 7 Macy returns 50 units because they did not fit the customer's needs (invoice amount: $750). Allied restores the units, which cost $550, to its inventory. 8 Macy discovers that 50 units are scuffed but are still of use and, therefore, keeps the units. Allied gives a price reduction (allowance) and credits Macy's accounts receivable for $350 to compensate for the damage. 15 Allied receives payment from Macy for the amount owed on the May 5 purchase; payment is net of…arrow_forwardOriole Company's record of transactions concerning part WA6 for the month of September was as follows. Purchases September 1 (balance on hand) 3 (a1) نا 12 292 2 16 300 200 @ 300 @ 300 @ 500 @ 300 @ $13.00 Average-cost per unit $ @ 13.10 13.25 13.30 13.30 13.40 Sales September 4 17 27 30 400 600 300 200 Calculate average-cost per unit. Assume that perpetual inventory records are kept in units only. (Round answer to 2 decimal places, eg. 2.76.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education