FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

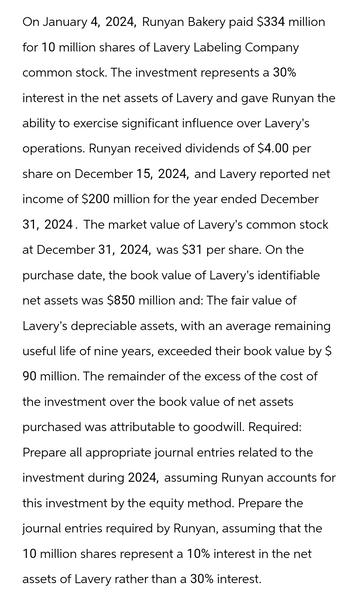

Transcribed Image Text:On January 4, 2024, Runyan Bakery paid $334 million

for 10 million shares of Lavery Labeling Company

common stock. The investment represents a 30%

interest in the net assets of Lavery and gave Runyan the

ability to exercise significant influence over Lavery's

operations. Runyan received dividends of $4.00 per

share on December 15, 2024, and Lavery reported net

income of $200 million for the year ended December

31, 2024. The market value of Lavery's common stock

at December 31, 2024, was $31 per share. On the

purchase date, the book value of Lavery's identifiable

net assets was $850 million and: The fair value of

Lavery's depreciable assets, with an average remaining

useful life of nine years, exceeded their book value by $

90 million. The remainder of the excess of the cost of

the investment over the book value of net assets

purchased was attributable to goodwill. Required:

Prepare all appropriate journal entries related to the

investment during 2024, assuming Runyan accounts for

this investment by the equity method. Prepare the

journal entries required by Runyan, assuming that the

10 million shares represent a 10% interest in the net

assets of Lavery rather than a 30% interest.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In an accretion/dilution analysis of an acquisition, if the purchase price exceeds the book value of the target’s assets, discuss the key components of the balance sheet that will be adjusted on the pro forma financials.arrow_forwardRecord the entry for additional depreciation expense on revaluation of equipment due to conversion from U.S. GAAP to IFRS. Note: Enter debits before credits. Date Account Title Debit Credit 12/31/2021arrow_forwardThe step in setting working capital balances, "set the permanent current asset balances" involves:arrow_forward

- Under IFRS, when a company chooses the revaluation model as its accounting policy for measuring property, plant, and equipment, which of the following statements is correct? a. When an asset is revalued, the entire class of property, plant, and equipment to which the asset belongs must be revalued. b. When an asset is revalued, individual assets within a class of property, plant, and equipment to which that asset belongs can be revalued. c. Revaluations of property, plant, and equipment must be made every three years. d. An increase in an asset’s book value as a result of the first revaluation must be recognized as a component of profit and loss.arrow_forwardWhich of the following results in an increase in the Equity in the Investee Income acct. when applying the equity method? Amortizations of purchase price over book value on date of purchase Amortization since date of purchase of purchase price over book value on date of purchase Sale of portion of the investment at a gain to the investor Investors share of gross profit from intra-entity inventory sale for the prior year Sale of a portion of the investment at a lossarrow_forwardIn interest capitalization related to self constructed assets, all of the following must occur before the capitalization window begins except: A.Expenditures for the assets have been incurred B.Depreciation of the asset being built has been recognized C.Activities that are necessary to get the asset ready for its intended use are in progress D.Interest has to be incurredarrow_forward

- Consolidated Balance Sheet Working Paper, Identifiable Intangibles International Auto (IA) acquires all of the stock of Genuine Parts (GP) and reports the acquisition as a stock investment on its own books. The acquisition involves the following payments. All amounts are in thousands. Cash paid to GP shareholders $10,000 2,400 Cash paid to consultants and lawyers Fair value of new IA stock issued, 1,000 shares, $4 par 72,000 1,800 500 Stock registration fees, paid in cash Fair value of earnings contingency The earnings contingency, if paid, will occur three years subsequent to the acquisition. The balance sheet accounts of GP and IA, just prior to the acquisition, are as follows: International Auto (in thousands) Current assets Fixed assets, net Trademarks Current liabilities Long-term liabilities Common stock, par value Additional paid-in capital Retained earnings Accumulated other comprehensive income Treasury stock Total Book Value Dr (Cr) $60,000 840,000 178,000 (50,000) (700,000)…arrow_forwardFair value as a method of asset measurement is defined as: Multiple Choice O O the cost of an asset adjusted for the depreciation or amortization accumulated over its lifetime. price that would be received to sell assets in an orderly transaction between market participants on a given date. the net amount of cash into which an asset could be converted in the ordinary course of business. the value of what is given in exchange for the asset at its initial acquisition.arrow_forwardInstruction: Using the asset method, prepare the original entry of the transaction and the necessary adjusting entry at the end of the accounting period. Dec. 31, 2019arrow_forward

- Determine the initial cost of property, plant, and equipment and intangible assets acquired in exchange for equity securities or through donation.arrow_forwardHh1.arrow_forwardSales and exchanges of personal use and investment use property are generally reported first on form 8949 sales and other dispositions capital assets the total reported on form 8949 are they carry to which form or schedule?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education