Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

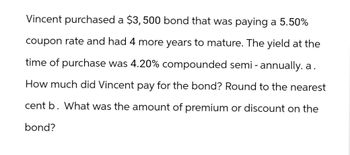

Transcribed Image Text:Vincent purchased a $3,500 bond that was paying a 5.50%

coupon rate and had 4 more years to mature. The yield at the

time of purchase was 4.20% compounded semi-annually. a.

How much did Vincent pay for the bond? Round to the nearest

cent b. What was the amount of premium or discount on the

bond?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- bond contract rate =7% semi- anual bond -$10,000 bond market =6% semi annual bond life = 10 years 1) find the selling price of this bond 2) will it be sold at a discount or premium 3) do the journal entry for the issuance 4) calculate the discount/premium authorization per period (use the slightline method ) 5) do the entry for the payment of cash interest period 6) do the entry for the amortization of the discount /premium per period 7)find total interest expense per period 8) show the balance sheet presentation of the bond after two periods have elapsedarrow_forwardA $1,000 bond quoted at 98 could be purchased or sold for a. $980. b. $1,098. c. $1,000. Od. between $1,000 and $1,098, depending on the maturity date of the bond.arrow_forward6. MC.11.166 If $1,000,000 of 8% bonds are issued at 98 1/2, the amount of cash received from the sale is a. $985,000 b. $1,000,000 c. $1,080,000 O d. $1,027,500 7. EX.11.173 Cramer Corp. issued $20,000,000 of 5-year, 9% bonds at a market (effective) interest rate of 10%, receiving cash of $19,227,757. Interest on the bonds is payable semiannually. Journalize the entry to record the first semiannual interest payment, and the amortization of the bond discount, using the interest method? If an amount box does not require an entry, leave it blank. If required, round your answers to nearest whole dollar.arrow_forward

- Bonds: issued 8% / 2 yr / Par $7,000 bond Market value 6% What is selling price?arrow_forward1c. Sold $80,000 of the bonds at 101 plus accrued interest of $250. DATE Debit Credit X/Xarrow_forwardRecord bond issue record the first semiannual interest payment record the second semiannual interest paymentarrow_forward

- If $1,059,000 of 12% bonds are issued at 102 3/4, the amount of cash received from the sale is a. $1,186,080 b. $1,088,123 c. $1,059,000 d. $794,250arrow_forwardDd.53.arrow_forwardAssignment 12. Bonds MENTS COURSES Attempt 1 of 3 1 2 3 4 5 6. Bob Adams purchased a $1,000 bond at 67. The bond pays 4%. What was the cost of the bond? What was the annual interest ? What is the yield (to the nearest tenth of a percent)? Use a thousands comma where applicable. cost of the bond: $ annual interest: $ yield (to the nearest tenth of a percent): NEXT QUESTION ASK FOR HELP hparrow_forward

- Do not give image formatarrow_forwardQUESTION 5 On 1 January 2017, Entity A bought a $250,000 5.25% bond for $236,000. It incurred issue costs of $2,820. Interest is received in arrears. The bond will be redeemed at a premium over the face value on 31 December 2019. The effective interest rate is 8.75%. The fair value of the bond was as follows: 31 December 17 : $265,600 31 December 18 : $256,480 31 December 19 : $273,560 REQUIRED: (1) Measure the amounts recognised in the Statement of Financial Position for the financial asset on 31 December 2018 if Entity A originally planned to hold the bond until the redemption date. (2) Measure the amounts of Gain or Loss on remeasurement recognised in the Statement of Profit or Loss and Other Comprehensive Income for the financial asset for the year of 2018 if Entity A originally planned to hold the bond to maturity and may also sell the bond when the possibility of an investment with a higher return arises. (3) Measure the amounts of Gain or Loss on remeasurement…arrow_forwardYou plan to invest $12,000 per year into a retirement account. If you earn a compound annual rate of return of 11%, how many years will it take you to reach a balance of $1,500,000? Question 2 options: 22.83 25.79 24.24 21.09 26.76arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education