Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

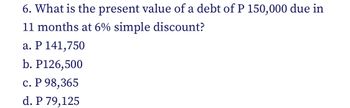

Transcribed Image Text:6. What is the present value of a debt of P 150,000 due in

11 months at 6% simple discount?

a. P 141,750

b. P126,500

c. P 98,365

d. P 79,125

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- 6. Find the proceeds of a Php 67,500 loan borrowed last February 16 and due on July 25 of the same year if the discount interest rate is 9.25%.arrow_forwardTime left 0:19:16 A debt of P22, 000 with 12% interest compounded semi-annually is to be amoruzcu by semi-annual payments over the next 5 years. The first due is 6 months. Determine the semi-annual payments. Oa P2,898.10 Ob P2,998.10 c. P2,989.10 Od. P2,899.10arrow_forwardAt what simple interest rate will Rs. 1400 earn Rs. 224 in 2 years O a 8% 0b 8.23 % OC 9% Od 9.23%arrow_forward

- (b) What is the present value of $32.500 to be received at the end of each of 6 periods, discounted at 9%?arrow_forward5. A debt is amortized for 4 years by a series of payments that decreases annually by P 500, the first payment being P 5,000. What is the equivalent future worth of the debt @5 % compounded annually?arrow_forward8. 6. 10 0. EOY 3. 20 21 22 23 24 26 27 28 29 30 CF $300 ? A deposit was made at the EOY 2021, as shown in the CF table above. Five equal withdrawals are to be made, starting at the EOY 26, that will deplete the account. If the interest rate is 6% compounded annually, what is the amount of these future withdrawals? 25arrow_forward

- 7. How much is the maturity value that must be paid to the creditor if the credit term is 5% of Php 20,000 due 3 months from the time the amount was borrowed?arrow_forwardEe 68.arrow_forward18) Which of these is true regarding the following statement? "Interest rate is 6% compounded monthly". Select one: a. nominal interest rate = 18% b. nominal interest rate = 12% c. nominal interest rate = 1% d. nominal interest rate = 6% 19) What is the present value of $500.00 to be paid in two years if the interest rate is 5 percent? Select one: a. $476.25 b. $550.00 c. $500.00 d. $453.51 20) How many years will it take to double your investment of $ 2000 if it has an interest rate of 6% compounded annually? Select one: a. 24 years b. 20 years c. 12 years d. 10 yearsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education