FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:v2.cengagenow.com

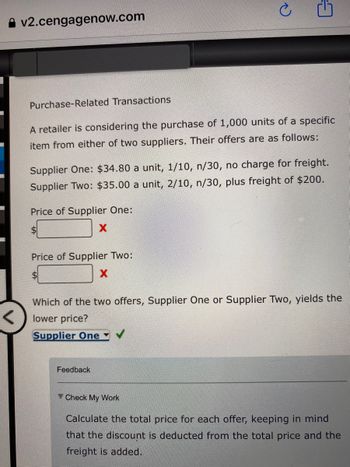

Purchase-Related Transactions

A retailer is considering the purchase of 1,000 units of a specific

item from either of two suppliers. Their offers are as follows:

Supplier One: $34.80 a unit, 1/10, n/30, no charge for freight.

Supplier Two: $35.00 a unit, 2/10, n/30, plus freight of $200.

Price of Supplier One:

$

X

Price of Supplier Two:

X

Which of the two offers, Supplier One or Supplier Two, yields the

lower price?

Supplier One

Feedback

Check My Work

Calculate the total price for each offer, keeping in mind

that the discount is deducted from the total price and the

freight is added.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How would you record this transaction in a journal entry? Accepted a sales return from Eastern for an item having an original gross sales price of $6000. The original sale to eastern occurred in November with terms 2/15, n/30.arrow_forwardInformation pertaining to the inventory of Palette Company follows. LIFO Selling Replacement Cost Price Cost Category: Supreme Item A $5,600 $6,400 $4,800 Item B 7,200 7,200 7,680 Item C 17,600 17,600 16,800 Category: Classic Item X 28,800 28,800 30,400 Item Y 35,200 42,400 41,600 Item Z 56,000 48,000 52,800 The company has a normal profit margin of 20% of selling price and has no additional costs to complete or sell the items. What is the lower-of-cost-or-market value of the company's inventory applying the rule to (a) each individual item and (b) to each inventory category? Select one: a. Inventory item: $147,200; Inventory Category: $147,200 b. Inventory item: $150,400; Inventory Category: $150,400 c. Inventory item: $143,520; Inventory Category: $150,400 d. Inventory item: $141,120; Inventory Category: $147,520arrow_forwardGiven the information available in the table below, what is the Wholesaler's Selling Price to the Retailer? SELLING MARGIN CHANNEL MEMBER COST PRICE % Supplier/Manufacturer $179.52 $224.40 20% not Wholesaler ??? 15% available not Retailer $300.00 12% available Consumer $300.00 O $256.00 O $224.40 O $240.00 $264.00arrow_forward

- Purchase-Related Transactions A retailer is considering the purchase of 250 units of a specific item from either of two suppliers. Their offers are as follows: Supplier One: $400 a unit, total of $100,000, 1/10, n/30, no charge for freight.Supplier Two: $399 a unit, total of $99,750, 2/10, n/30, plus freight of $975. Price of Supplier One:$ Price of Supplier Two:$ Which of the two offers, Supplier One or Supplier Two, yields the lower price?arrow_forwardStar Company recognized $500 of cost of goods sold. Note that Star is only recording the cost of goods sold part of the transaction and not the sales revenue. Star uses the perpetual inventory system. Which of the following answers reflects the effect of recognizing the cost of goods sold on the financial statements? Balance Sheet Income Statement Assets = A. 500 B. (500) C. (500) D. (500) Multiple Choice O O оо Liabilities + - Option B Option A Option C Option D (500) Stockholders' Equity 500 (500) n/a (500) Revenue n/a n/a n/a n/a - Expense 500 500 500 n/a Net Income (500) (500) (500) n/a Statement of Cash Flows n/a n/a 500 Operating Activity n/aarrow_forwardCherokee Incorporated is a merchandiser that provided the following information Number of units sold Selling price per unit Variable selling expense per unit Variable administrative expense per unit Total fixed selling expense Total fixed administrative expense Beginning merchandise inventory Ending merchandise inventory Merchandise purchases Required: . Prepare a traditional income statement. 2. Prepare a contribution format income statement. Amount 12,000 $ 17 $ 1 $ 3 $ 19,000 $ 15,000 $ 11,000 $ 24,000 $ 86,000 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a traditional income statement. Cherokee, Incorporated Traditional Income Statement Selling and administrative expenses: 0arrow_forward

- Question - Company sells three different categories of tools (small, medium, and large). The cost and market value of its inventory of tools is as follows. Cost Market Value Small $ 63,200 $ 72,000 Medium 2,89,400 2,60,800 Large 1,52,100 1,72,800 Determine the value of the company's inventory under the lower-of- cost-or-market value approach.arrow_forwardSuppose a certain appliance store purchases the following items. Calculate the extended total after the trade discounts for each line, the invoice subtotal, and the invoice total. (Round your answers to the nearest cent.) Trade Extended Quantity Unit Merchandise Unit List Discounts Total 150 Blenders $49.95 20/15/15 2$ ea. 400 ea. Toasters $37.88 20/10/10 $ 18 doz. Coffee Mills $244.30 30/9/6 $ 12 doz. Juicers $440.00 25/10/5 $ Invoice subtotal Extra 5-% volume discount on total order 24 Invoice total $arrow_forwardSuppose a certain appliance store purchases the following items. Calculate the extended total after the trade discounts for each line, the invoice subtotal, and the invoice total. (Round your answers to the nearest cent.) Trade Extended Quantity Unit Merchandise Unit List Discounts Total 150 Blenders $39.95 20/15/15 24 ea. 400 ea. Toasters $37.88 20/10/10 2$ 18 doz. Coffee Mills $244.30 30/9/7 2$ 12 doz. Juicers $440.00 25/10/5 2$ Invoice subtotal 2$ Extra 5% volume discount on total order $ Invoice total 2$arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education