FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

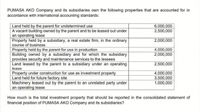

Transcribed Image Text:PUMASA AKO Company and its subsidiaries own the following properties that are accounted for in

accordance with international accounting standards:

6,000,000

2,500,000

Land held by the parent for undetermined use

A vacant building owned by the parent and to be leased out under

an operating lease

Property held by a subsidiary, a real estate firm, in the ordinary

course of business

Property held by the parent for use in production

Building owned by a subsidiary and for which the subsidiary

provides security and maintenance services to the lessees

Land leased by the parent to a subsidiary under an operating

lease

Property under construction for use as investment property

Land held for future factory site

Machinery leased out by the parent to an unrelated party under

an operating lease

2,000,000

4,000,000

2,000,000

2,500,000

4,000,000

3.500,000

1,000,000

How much is the total investment property that should be reported in the consolidated statement of

financial position of PUMASA AKO Company and its subsidiaries?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Company A exchanges equipment with Company B, resulting in a gain for company A. The transaction has commercial substance. Which of the following statements is TRUE regarding this transaction as it related to company A? The entire amount of the gain would be recognized Only a part of the gain would be recognized None of the gain would be recongnized Because the transaction has commercial substance. Company A is in the same economic position as it was before the exchange took place.arrow_forwardSendelbach Corporation is a U.S.-based organization with operations throughout the world. One of its subsidiaries is headquartered in Toronto. Although this wholly owned company operates primarily in Canada, it engages in some transactions through a branch in Mexico. Therefore, the subsidiary maintains a ledger denominated in Mexican pesos (Ps) and a general ledger in Canadian dollars (C$). As of December 31, 2020, the subsidiary is preparing financial statements in anticipation of consolidation with the U.S. parent corporation. Both ledgers for the subsidiary are as follows: Main Operation—Canada Debit Credit Accounts payable C$ 57,410 Accumulated depreciation 49,000 Buildings and equipment C$ 189,000 Cash 48,000 Common stock 72,000 Cost of goods sold 225,000 Depreciation expense 9,100 Dividends, 4/1/20 41,000 Gain on sale of equipment, 6/1/20 7,200 Inventory 101,000 Notes…arrow_forwardDiscuss the related party party disclosure required in the financial statements of Terrier plc only.arrow_forward

- How does a parent company determine the appropriate method for translating the financial statements of a foreign subsidiary?arrow_forwardProblem 22-1 (IFRS) Classic Company and its subsidiaries own the following properties that are accounted for in accordance with international accounting standards: Land held by the parent for undetermined use 5,000,000 A vacant building owned by the parent and to be leased out under an operating lease Property held by a subsidiary, a real estate firm, in the ordinary course of business Property held by the parent for use in production Building owned by a subsidiary and for which the subsidiary provides security and maintenance services to the lessees Land leased by the parent to a subsidiary under an operating lease 2,500,000 Property under construction for use as investment property Land held for future factory site Machinery leased out by the parent to an unrelated party under an operating lease 1,000,000 Required: 1. Compute the total investment property that should be reported in the consolidated statement of financial position of Classic Company and its subsidiaries. 2. Indicate…arrow_forwardParent Ltd (Parent) controls a subsidiary Sub Ltd (Sub), in which it owns 70 per cent of the issued capital since 30 June 20X3. The following transactions are relevant for the preparation of the consolidated financial statements for the financial year ending 30 June 20X7. Transaction 1: During the financial year ending 30 June 20X4, Sub sold an item of plant to Parent at a loss. Parent is still using the plant at 30 June 20X7. Transaction 2: Sub paid an interim dividend in August 20X5. Parent is exempt from income tax on dividends received from the subsidiary. Transaction 3: During the financial year ending 30 June 20X7, Parent sold inventory to Sub for a price greater than its cost to Parent. One-third of this inventory is still on hand at 30 June 20X7. Transaction 4: On 1 November 20X6, Parent borrowed $50 000 from Sub at an interest rate of 10 per cent per annum. The interest on the loan is payable every six months starting 1 May 20X7. The loan is still outstanding at 30 June…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education