FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

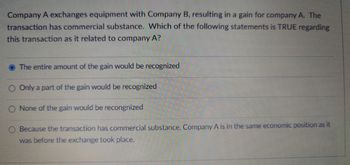

Transcribed Image Text:Company A exchanges equipment with Company B, resulting in a gain for company A. The

transaction has commercial substance. Which of the following statements is TRUE regarding

this transaction as it related to company A?

The entire amount of the gain would be recognized

Only a part of the gain would be recognized

None of the gain would be recongnized

Because the transaction has commercial substance. Company A is in the same economic position as it

was before the exchange took place.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- In reference to the determination of goodwill impairment, which of the following statements is correct? Question 2Answer a. The goodwill impairment test under ASC 350-20-35 is a three-step process. b. Under FASB, firms must first compare carrying values (book values) at the headquarter level. c. Firms can reverse previously recognized impairment losses. d. If the reporting unit's fair value exceeds its carrying value, goodwill is unimpaired.arrow_forwardUnder IFRS, revenue from barter transactions should be measured based on the fair value of revenue from: A . similar barter transactions with unrelated parties.arrow_forwardLong-term operating assets can be reported on the balance sheet at fair value instead of historical cost. Does this statement apply to IFRS and U.S. GAAP? Group of answer choices It does not apply to IFRS and U.S. GAAP. It applies to U.S. GAAP only. It applies to both IFRS and U.S. GAAP. It applies to IFRS only.arrow_forward

- Which of the following conditions would support recognition of revenue? The seller’s price to the buyer is being negotiated. Delivery has occurred or services have been provided. Collection is possible. Significant risks and rewards of ownership of the goods will soon be transferred to the purchaser by the seller.arrow_forwardIf an entity recognises the revenue associated with a contract with a customer over time (rather than at a point in time), would this approach be considered more conservative than an approach that defers profit recognition until the completion of the contract (that is, at a future point in time)?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education