FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

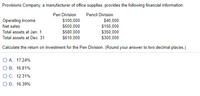

Provisions Company, a manufacturer of office supplies, provides the following financial information:

|

|

Pen Division

|

Pencil Division

|

|

Operating income

|

$100,000

|

$40,000

|

|

Net sales

|

$500,000

|

$150,000

|

|

Total assets at Jan. 1

|

$580,000

|

$350,000

|

|

Total assets at Dec. 31

|

$610,000

|

$300,000

|

Calculate the return on investment for the Pen Division. (Round your answer to two decimal places.)

Transcribed Image Text:Provisions Company, a manufacturer of office supplies, provides the following financial information:

Pen Division

Pencil Division

Operating income

$100,000

$40,000

Net sales

$500,000

$150,000

Total assets at Jan. 1

$580,000

$610,000

$350,000

$300,000

Total assets at Dec. 31

Calculate the return on investment for the Pen Division. (Round your answer to two decimal places.)

O A. 17.24%

O B. 16.81%

O C. 12.31%

O D. 16.39%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Textile Division of Electrotech Corporation reported the following results for a recent year Sales $9,000,000 Expenses 7,500,000 Total assets (1/1) 6,000,000 Total assets (12/31) 6,200,000 Refer to the Textile Division. What was the profit margin for The Textile Division? Select one: а. 17% b. 24% C. 69% d. 25%arrow_forwardTwo companies are expected to have annual sales of 1,000,000 decks of playing cards next year. Estimates for next year are presented below: Company 1 Company 2 Selling price per deck Cost of paper deck Printing ink per deck $ 3.00 0.62 0.13 $3.00 0.65 Labor per deck 0.75 0.15 1.25 Variable overhead per deck 0.30 0.35 Fixed costs $960.000 $252,000 Given these data, which of the following responses is correct? (In units) A B C. D. Breakeven point for Co. 1 533,334 533,334 800,000 800,000 Breakeven point for Co. 2 105,000 105.000 420.000 420,000 Volume at which profits of Co. 1 and Co. 2 are equal 1,000.000 1.180.000 1,000,000 1,180.000 None B A D C Data concerning NikNik Corporation's activity for the 6 months appear below: Machine Electrical Cost Hours January P3,120 February 4,460 March 3.500 April 5,040 May 2,900 June 3,200 4.000 6.000 4,800 5,800 3.600 4,200 Using the high-low method of analysis, estimate the variable electrical cost per machine hour (nearest centavo).arrow_forwardThe following data relate to the operations of Shilow Company, a wholesale distributor of consumer goods: Current assets as of March 31: Cash Accounts receivable Inventory Building and equipment, net Accounts payable Common stock Retained earnings a. The gross margin is 25% of sales. b. Actual and budgeted sales data: March (actual) April May $ 7,600 $ 20,400 $ 40,200 $128,400 $ 23,925 $ 150,000 $ 22,675 $51,000 $ 67,000 $ 72,000 June July $ 97,000 $ 48,000 c. Sales are 60% for cash and 40% on credit. Credit sales are collected in the month following sale. The accounts receivable at March 31 are a result of March credit sales. d. Each month's ending inventory should equal 80% of the following month's budgeted cost of goods sold. e. One-half of a month's inventory purchases is paid for in the month of purchase; the other half is paid for in the following month. The accounts payable at March 31 are the result of March purchases of Inventory. £ Monthly expenses are as follows:…arrow_forward

- Juniper Design, provides design services to residential developers. Last year, the company had net operating income of $420,000 on sales of $2,100,000. The company's average operating assets were $2,300,000 and its minimum required rate of return was 15%. Provide the missing data in the following table for a distributor of martial arts products: Note: Enter "Turnover" and "ROI" answers to 1 decimal place. Sales Net operating income Average operating assets Margin Turnover Return on investment (ROI) Alpha $ 364,000 8% 5.0 % Division Bravo $ 325,000 $52,000 % 40.0 % Charlie $66,900 15 % 30.0 %arrow_forwardFinch Company began its operations on March 31 of the current year. Finch has the following projected costs: April May June $155,600 $192,800 $213,600 Manufacturing costs* Insurance expense** 880 Depreciation expense 2,180 Property tax expense*** 590 *Of the manufacturing costs, three-fourths is paid for in the month they are incurred; one-fourth is paid in the following month. **Insurance expense is $880 a month; however, the insurance is paid four times yearly in the first month of the quarter (i.e., January, April, July, and October). ***Property tax is paid once a year in November. 880 2,180 590 880 2,180 590 The cash payments expected for Finch Company in the month of May are O a. $183,500 O b. $144,600 Oc. $38,900 O d. $222,400arrow_forwardScribe Company, a manufacturer of writing instruments, provides the following financial information: Operating income Net sales Total assets at Jan. 1 Pen Division Pencil Division $100,000 $30.000 $500,000 $150,000 $580,000 $255,000 $610,000 $275,000 Total assets at Dec. 31 Calculate the return on investment for the Pencil Division. (Round your answer to two decimal places.) OA. 11.32% OB. 10.91% OC. 11.76% OD. 16.81%arrow_forward

- Financial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered from an accounting intern, who has asked for your guidance on how to prepare an income statement format that will be distributed to management. Subtotals and totals are included in the information, but you will need to calculate the values. Pretax income? Gross profit? Allocated costs (uncontrollable) $2,035 Labor expense 41,580 Sales 188,000 Research and development (uncontrollable) 310 Depreciation expense17,000 Net income/(loss) ? Cost of goods sold 118,440 Selling expense 1,240 Total expenses ? Marketing costs (uncontrollable) 800 Administrative expense 690 Income tax expense (21% of pretax income) ? Other expenses 310arrow_forwardi am confused for this question please provide correct answerarrow_forwardThe following is the year ended data for Tiger Company: Sales Revenue $58,000 Cost of Goods Manufactured 21,000 Beginning Finished Goods Inventory 1,100 Ending Finished Goods Inventory 2,200 Selling Expenses 15,000 Administrative Expenses 3,900 What is the gross profit? A. $22,100 B. $38,100 C. $19,200 D.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education