Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

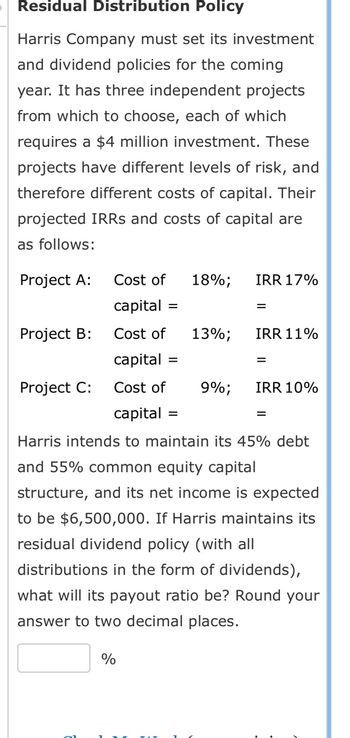

Transcribed Image Text:Residual Distribution Policy

projects

Harris Company must set its investment

and dividend policies for the coming

year. It has three independent

from which to choose, each of which

requires a $4 million investment. These

projects have different levels of risk, and

therefore different costs of capital. Their

projected IRRs and costs of capital are

as follows:

Cost of

capital =

Cost of

capital

Cost of

capital =

Harris intends to maintain its 45% debt

and 55% common equity capital

structure, and its net income is expected

to be $6,500,000. If Harris maintains its

residual dividend policy (with all

distributions in the form of dividends),

what will its payout ratio be? Round your

answer to two decimal places.

Project A:

Project B:

Project C:

%

18%;

=

13%;

9%;

IRR 17%

=

IRR 11%

=

IRR 10%

=

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The internal rate of return (IRR) refers to the compound annual rate of return that a project generates based on its up-front cost and subsequent cash flows. Consider the case of Blue Llama Mining Company: Blue Llama Mining Company is evaluating a proposed capital budgeting project (project Sigma) that will require an initial investment of $900,000. Blue Llama Mining Company has been basing capital budgeting decisions on a project’s NPV; however, its new CFO wants to start using the IRR method for capital budgeting decisions. The CFO says that the IRR is a better method because returns in percentage form are easier to understand and compare to required returns. Blue Llama Mining Company’s WACC is 9%, and project Sigma has the same risk as the firm’s average project. The project is expected to generate the following net cash flows: Year Cash Flow Year 1 $300,000 Year 2 $425,000 Year 3 $475,000 Year 4 $450,000 Which of the following is the correct…arrow_forwardThe Suboptimal Glass Company uses a process of capital rationing in its decision making. The firm's cost of capital is 14 percent. It will invest only $50, 500 this year. It has determined the IRR for each of the following projects: Project Project Size Internal Rate of Return A $ 10, 100 17.0% B 30, 300 16.0 C 25,250 15.0 D 10, 100 17.5 E 10, 100 18.0 F 20, 200 24.0 G 15,150 12.0 a. Pick out the projects that the firm should accept. (You may select more than one answer. Click the box with a check mark for the correct answer and click to empty the box for the wrong answer.) check all that apply 1 Project Bunanswered Project Cunanswered Project Dunanswered Project Eunanswered Project Funanswered Project Gunanswered Project Aunanswered b. If projects E and F are mutually exclusive, how would that affect your overall answer? That is, which projects would you accept in spending the $ 50, 500? (You may select more than one answer. Click the box with a check mark for the correct answer and…arrow_forwardYour company is currently considering two investment projects. Each project requires an upfront expenditure of $25 million. You estimate that the cost of capital is 10% and the investments will produce the after tax cash flows on the attached image . a)Calculate the payback period for both projects,then compare to identify which project the firm should undertake. b)Evaluate the advantages and disadvantages of using the payback method in investment decisions and assess the situations where it should be used .arrow_forward

- A manufacturer of video games develops a new game over two years. This costs $850,000 per year with one payment made immediately and the other at the end of two years. When the game is released, it is expected to make $1.20 million per year for three years after that. What is the net present value (NPV) of this decision if the cost of capital is 10%? OA. $1,462,112 OB. $1,005,202 OC. $913,820 OD. $1,736,258arrow_forward7. Fiftycent Inc., has hired you to advise the firm on a capital budgeting issue involving two unequal-lived, mutually exclusive projects, S and T. The cash flows for each project are presented in the following table. Calculate the NPV and the annualized net present value (ANPV) in order to copy for each project using the firm's cost of capital of 9.0%. Which project would you recommend? (Click on the icon here the contents of the data table below into a spreadsheet.) Initial Investment Year 1 2 456 A WN 3 4 7 Project S $42,000 The NPV for project S is $ The NPV for project T is $ The ANPV for project S is $ The ANPV for project T is $ Which project would you recommend? The firm should choose project (1) - (1) OS OT $17,750 24,600 36,800 - Cash Inflows Project T $67,500 $26,400 22,600 37,000 19,700 10,900 15,350 9,780 (Round to the nearest cent.) (Round to the nearest cent.) 203 005 (Round to the nearest cent.) (Round to the nearest cent.) (Select from the drop-down menu.) bau bao otis…arrow_forwardThe internal rate of return (IRR) refers to the compound annual rate of return that a project generates based on its up-front cost and subsequent cash flows. Consider this case: Blue Llama Mining Company is evaluating a proposed capital budgeting project (project Delta) that will require an initial investment of $1,400,000. Blue Llama Mining Company has been basing capital budgeting decisions on a project’s NPV; however, its new CFO wants to start using the IRR method for capital budgeting decisions. The CFO says that the IRR is a better method because percentages and returns are easier to understand and to compare to required returns. Blue Llama Mining Company’s WACC is 7%, and project Delta has the same risk as the firm’s average project. The project is expected to generate the following net cash flows: Year Cash Flow Year 1 $300,000 Year 2 $425,000 Year 3 $400,000 Year 4 $425,000 Q1. Which of the following is the correct calculation of project Delta’s…arrow_forward

- (Capital rationing) The Cowboy Hat Company of Stillwater, Oklahoma, is considering seven capital investment proposals for which the total funds available are limited to a maximum of $11 million. The projects are independent and have the costs and profitability indexes associated with them shown in the popup window: a. Under strict capital rationing, which projects should be selected? b. What problems are there with capital rationing? MCKEN a. Under strict capital rationing, which projects should be selected? (Select the best choice below.) OA. Projects C and F B. Projects D and G OC. Projects C and D OD. Projects D, F and OE. Projects C, D and G Data table (Click on the following icon in order to copy its contents into a spreadsheet.) PROFITABILITY INDEX COST $3,000,000 1.15 2,000,000 1.06 1.34 1.36 6,000,000 5,000,000 3,000,000 6,000,000 1.16 1.25 4,000,000 1.12 PROJECT A ABCDEFG C Bool 1 X Question Viewerarrow_forwardRyan Corporation is considering three investment projects: X, Y, and Z. Project X would require an investment of $20,000, Project Y of $69,000, and Project Z of $83,000. No other cash outflows would be involved. The present value of the cash inflows would be $23,200 for Project X, $77,970 for Project Y, and $94,620 for Project Z. Rank the projects according to the profitability index from most profitable to least profitable. (Ignore income taxes.) (A) Z, X, Y B) X,Z,Y C) Y, X, Z D) Z, Y, Xarrow_forwardA company is considering a 10-year capital investment project. The project has annual positive cash flows each year. The accounting manager has calculated the NPV of the same project using three different costs of capital (8%, 10% and 18 %) as discount rates. Select the most logical combination of NPVS from the choices given. Note: You cannot calculate the NPVS nor do you need to. O $(5,743) $3,152 $6,612 O $(5,743) $6,612 $3,152 $3,152 $6,512 $(5,743) O $6,512 $3,152 $(5,743) O None of the abovearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education