EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

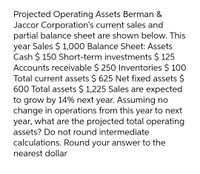

Transcribed Image Text:Projected Operating Assets Berman &

Jaccor Corporation's current sales and

partial balance sheet are shown below. This

year Sales $ 1,000 Balance Sheet: Assets

Cash $ 150 Short-term investments $ 125

Accounts receivable $ 250 Inventories $ 100

Total current assets $ 625 Net fixed assets $

600 Total assets $ 1,225 Sales are expected

to grow by 14% next year. Assuming no

change in operations from this year to next

year, what are the projected total operating

assets? Do not round intermediate

calculations. Round your answer to the

nearest dollar

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Projected Operating Assets Berman & Jaccor Corporation's current sales and partial balance sheet are shown below. Sales Balance Sheet: Assets Cash $ Short-term investments Accounts receivable Inventories Total current assets Net fixed assets Total assets This year $1,000 $100 $ 90 $ 300 $250 $740 $400 $1,140 Sales are expected to grow by 8% next year. Assuming no change in operations from this year to next year, what are the projected total operating assets? Do not round intermediate calculations. Round your answer to the nearest dollar.arrow_forwardBerman & Jaccor Corporation's current sales and partial balance sheet are shown below. This year Sales $ 1,000 Balance Sheet: Assets Cash $ 150 Short-term investments $ 110 Accounts receivable $ 250 Inventories $ 250 Total current assets $ 760 Net fixed assets $ 400 Total assets $ 1,160 Sales are expected to grow by 8% next year. Assuming no change in operations from this year to next year, what are the projected total operating assets? Do not round intermediate calculations. Round your answer to the nearest dollar.arrow_forwardHere are the abbreviated financial statements for Planner’s Peanuts: INCOME STATEMENT, 2019 Sales $ 8,600 Cost 7,100 Net income $ 1,500 BALANCE SHEET, YEAR-END 2018 2019 2018 2019 Assets $ 6,500 $ 7,000 Debt $ 853 $ 1,000 Equity 5,647 6,000 Total $ 6,500 $ 7,000 Total $ 6,500 $ 7,000 Assume the payout ratio is 50%. Calculate the internal growth rate where no external debt or equity is to be issued. Note: Do not round intermediate calculations. Enter your answer as a whole percent. Calculate the sustainable growth rate where the firm maintains a fixed debt ratio but issues no equity. Note: Do not round intermediate calculations. Enter your answer as a whole percent.arrow_forward

- The Optical Scam Company has forecast a sales growth rate of 20 percent for next year. Current assets, fixed assets, and short-term debt are proportional to sales. The current financial statements are shown here: Sales Costs Taxable income Taxes Net income Dividends Addition to retained earnings Current assets Fixed assets Total assets Assets Current assets Fixed assets INCOME STATEMENT Total assets $ 7,230,000 18,390,000 $ 1,149,982 1,724,853 Assets b-2. External financing needed c. Sustainable growth rate $ 25,620,000 a. Calculate the external funds needed for next year using the equation from the chapter. Note: Do not round intermediate calculations. External financing needed b-1. Prepare the firm's pro forma balance sheet for next year. Note: Do not round intermediate calculations. BALANCE SHEET Short-term debt Long-tern debt Common stock Accumulated retained earnings $ 30,500,000 26,077,300 $ 4,422,700 1,547,945 $ 2,874,755 Liabilities and Equity Total equity Total liabilities and…arrow_forwardHere are the abbreviated financial statements for Planner’s Peanuts: INCOME STATEMENT, 2019 Sales $ 3,500 Cost 2,700 Net income $ 800 BALANCE SHEET, YEAR-END 2018 2019 2018 2019 Assets $ 4,500 $ 5,000 Debt $ 833 $ 1,000 Equity 3,667 4,000 Total $ 4,500 $ 5,000 Total $ 4,500 $ 5,000 Assume the payout ratio is 50%. a. Calculate the internal growth rate where no external debt or equity is to be issued. (Do not round intermediate calculations. Enter your answer as a whole percent.) b. Calculate the sustainable growth rate where the firm maintains a fixed debt ratio but issues no equity. (Do not round intermediate calculations. Enter your answer as a whole percent.)arrow_forwardFollowing are financial statement numbers and ratios for Martin Corp. for the year ended December 31, Year 1. Total revenue (in millions) $47,248 Net operating profit margin (NOPM) 8.8% Net operating asset turnover (NOAT) 3.3 If we expected revenue growth of 3.5% in the next year, what would projected revenue be for Year 2? Select one: a. $47,248.0 b. $44,598.3 c. None of these are correct d. $48,901.7 e. $53,205.0arrow_forward

- Following are financial statement numbers and ratios for Salsa Incorporated for the year ended December 31, Year 1 (in millions). NOPAT $572.7 NOA $3,460.8 Net operating profit margin (NOPM) 15.9% Net operating asset turnover (NOAT) 1.04If we expected revenue growth of 7% in the next year, what would projected revenue be for the year ended December 31, Year 2?arrow_forwardFollowing is information from Skyway Inc. for the year (in thousands). Total annual revenue $3,206,980 Total revenue growth rate 5.0% Terminal revenue growth rate 2% Net operating profit margin (NOPM) 8.2% Net operating asset turnover (NOAT) 3.42 Projected total revenue for the following year would be: Select one: a. $3,469,952 b. None of these are correct c. $3,316,659 d. $3,271,120 e. $3,367,329arrow_forwardPro forma balance sheet Peabody & Peabody has 2019 sales of $10 million. It wishes to analyze expected performance and financing needs for 2021, which is 2 years ahead. Given the following information, respond to parts a and b. (1) The percent of sales for items that vary directly with sales are as follows: Accounts receivable, 12% Inventory, 18% Accounts payable, 14% Net profit margin, 3% (2) Marketable securities and other current liabilities are expected to remain unchanged. (3) A minimum cash balance of $480,000 is desired. (4) A new machine costing $650,000 will be acquired in 2020, and equipment costing $850,000 will be purchased in 2021. Total depreciation in 2020 is forecast as $290,000, and in 2021 $390,000 of depreciation will be taken. (5) Accruals are expected to rise to $500,000 by the end of 2021. (6) No sale or retirement of long-term debt is expected. (7) No sale or repurchase of common stock is expected. (8) The dividend payout of 50% of net profits is expected to…arrow_forward

- Pro forma balance sheet Peabody & Peabody has 2019 sales of $10.5 million. It wishes to analyze expected performance and financing needs for 2021—2 years ahead. Given the following information, respond to parts a. and b. (1) The percents of sales for items that vary directly with sales are as follows: Accounts receivable; 11.9%, Inventory; 17.7%; Accounts payable, 13.6%; Net profit margin, 3.5%. (2) Marketable securities and other current liabilities are expected to remain unchanged. (3) A minimum cash balance of $482,000 is desired. (4) A new machine costing $653,000 will be acquired in 2020, and equipment costing $848,000 will be purchased in 2021. Total depreciation in 2020 is forecast as $288,000, and in 2021 $388,000 of depreciation will be taken. (5) Accruals are expected to rise to $504,000 by the end of 2021. (6) No sale or retirement of long-term debt is expected. (7) No sale or repurchase of common stock is expected. (8) The dividend payout of…arrow_forwardLandvision Inc. had net income in 2020 for $120,000. Here are some of the extra financial ratios from the annual report Profit margin 20%, Return on Assets 35%, Debt to Asset Ratio30% Please calculate the ROE ratio O A. 70% B. 60% O C. 50% O D. 25%arrow_forwardPlease provide correct answer general accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning