FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Help with February

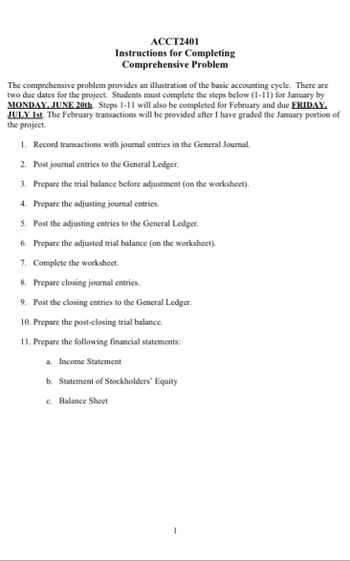

Transcribed Image Text:ACCT2401

Instructions for Completing

Comprehensive Problem

The comprehensive problem provides an illustration of the basic accounting cycle. There are

two due dates for the project. Students must complete the steps below (1-11) for January by

MONDAY, JUNE 20th. Steps 1-11 will also be completed for February and due FRIDAY.

JULY 1st. The February transactions will be provided after I have graded the January portion of

the project.

1. Record transactions with journal entries in the General Journal.

2. Post journal entries to the General Ledger.

3. Prepare the trial balance before adjustment (on the worksheet).

4. Prepare the adjusting journal entries.

5. Post the adjusting entries to the General Ledger.

6. Prepare the adjusted trial balance (on the worksheet).

7. Complete the worksheet.

8. Prepare closing journal entries.

9. Post the closing entries to the General Ledger.

10. Prepare the post-closing trial balance.

11. Prepare the following financial statements:

a.

Income Statement

b. Statement of Stockholders' Equity

c. Balance Sheet

1

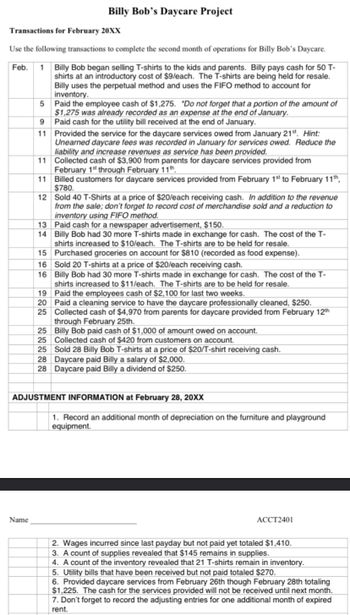

Transcribed Image Text:Transactions for February 20XX

Use the following transactions to complete the second month of operations for Billy Bob's Daycare.

Feb. 1 Billy Bob began selling T-shirts to the kids and parents. Billy pays cash for 50 T-

shirts at an introductory cost of $9/each. The T-shirts are being held for resale.

Billy uses the perpetual method and uses the FIFO method to account for

inventory.

5

9

11

Name

11

11

12

13

14

Billy Bob's Daycare Project

19

20

25

Paid the employee cash of $1,275. "Do not forget that a portion of the amount of

$1,275 was already recorded as an expense at the end of January.

Paid cash for the utility bill received at the end of January.

Provided the service for the daycare services owed from January 21st. Hint:

Unearned daycare fees was recorded in January for services owed. Reduce the

liability and increase revenues as service has been provided.

Collected cash of $3,900 from parents for daycare services provided from

February 1st through February 11th.

Billed customers for daycare services provided from February 1st to February 11th,

$780.

Sold 40 T-Shirts at a price of $20/each receiving cash. In addition to the revenue

from the sale; don't forget to record cost of merchandise sold and a reduction to

inventory using FIFO method.

Paid cash for a newspaper advertisement, $150.

Billy Bob had 30 more T-shirts made in exchange for cash. The cost of the T-

shirts increased to $10/each. The T-shirts are to be held for resale.

Purchased groceries on account for $810 (recorded as food expense).

15

16 Sold 20 T-shirts at a price of $20/each receiving cash.

16

Billy Bob had 30 more T-shirts made in exchange for cash. The cost of the T-

shirts increased to $11/each. The T-shirts are to be held for resale.

Paid the employees cash of $2,100 for last two weeks.

Paid a cleaning service to have the daycare professionally cleaned, $250.

Collected cash of $4,970 from parents for daycare provided from February 12th

through February 25th.

25 Billy Bob paid cash of $1,000 of amount owed on account.

25 Collected cash of $420 from customers on account.

25 Sold 28 Billy Bob T-shirts at a price of $20/T-shirt receiving cash.

28 Daycare paid Billy a salary of $2,000.

28 Daycare paid Billy a dividend of $250.

ADJUSTMENT INFORMATION at February 28, 20XX

1. Record an additional month of depreciation on the furniture and playground

equipment.

ACCT2401

2. Wages incurred since last payday but not paid yet totaled $1,410.

3. A count of supplies revealed that $145 remains in supplies.

4. A count of the inventory revealed that 21 T-shirts remain in inventory.

5. Utility bills that have been received but not paid totaled $270.

6. Provided daycare services from February 26th though February 28th totaling

$1,225. The cash for the services provided will not be received until next month.

7. Don't forget to record the adjusting entries for one additional month of expired

rent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Put the following steps in the accounting cycle in the correct order (1-9). Journalize transactions and events Three Journalize and post the adjusting journal entires Three Analyze transactions and events from source documents One Prepare the post-closing trial balance Nine Post the journal entires to the general ledger Choose. + Prepare the unadjusted trial balance Choose. Prepare the adjusted trial balance Choose. +arrow_forwardRequirements Sheet in Workbook Requirement 1—Prepare the Journal Entries in the General Journal Journal Entries Requirement 2—Post Journal Entries to the General Ledger General Ledger Requirement 3—Prepare a Trial Balance Trial Balance Requirement 4—Prepare the Adjusting Entries Adjusting Entries Requirement 5—Post Adjusting Entries to the General Ledger General Ledger Requirement 6—Prepare an Adjusted Trial Balance Adjusted Trial Balance Requirement 7—Prepare the Financial Statements Financial Statements Requirement 8—Prepare the Closing Entries Closing Entries Requirement 9—Post Closing Entries to the General Ledger General Ledger Requirement 10—Prepare the Post Closing Trial Balance Post-Closing Trial Balance During its first month of operation, the Quick Tax Corporation, which specializes in tax preparation, completed the following transactions. July 1 Began business by making a deposit in a company…arrow_forwardImgesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education