FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Prepare

![Required information

[The following information applies to the questions displayed below.]

Information on Kwon Manufacturing's activities for its first month of operations follows:

a. Purchased $102,000 of raw materials on credit.

b. Materials requisitions show the following materials used for the month.

Job 201

$ 50,200

Job 202

25,600

Total direct materials

75,800

Indirect materials

10,620

Total materials used

$ 86,420

c. Time tickets show the following labor used for the month.

Job 201

$ 41,200

Job 202

14,600

Total direct labor

Indirect labor

Total labor used

55,800

26,200

$ 82,000

d. Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate of 80% of direct materials cost.

e. Transferred Job 201 to Finished Goods Inventory.

f. Sold Job 201 for $169,760 on credit.

g. Incurred the following actual other overhead costs for the month.

$ 34,000

700

1,000

5,000

$ 40,700

Depreciation of factory equipment

Rent on factory building (payable)

Factory utilities (payable)

Expired factory insurance

Total other factory overhead costs](https://content.bartleby.com/qna-images/question/6f96dd47-ce3e-4fb6-9f29-e38e62f29b56/f2963ce7-4590-455d-8c96-e379a2756706/feug5c5_thumbnail.png)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

Information on Kwon Manufacturing's activities for its first month of operations follows:

a. Purchased $102,000 of raw materials on credit.

b. Materials requisitions show the following materials used for the month.

Job 201

$ 50,200

Job 202

25,600

Total direct materials

75,800

Indirect materials

10,620

Total materials used

$ 86,420

c. Time tickets show the following labor used for the month.

Job 201

$ 41,200

Job 202

14,600

Total direct labor

Indirect labor

Total labor used

55,800

26,200

$ 82,000

d. Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate of 80% of direct materials cost.

e. Transferred Job 201 to Finished Goods Inventory.

f. Sold Job 201 for $169,760 on credit.

g. Incurred the following actual other overhead costs for the month.

$ 34,000

700

1,000

5,000

$ 40,700

Depreciation of factory equipment

Rent on factory building (payable)

Factory utilities (payable)

Expired factory insurance

Total other factory overhead costs

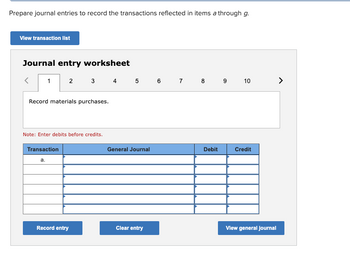

Transcribed Image Text:Prepare journal entries to record the transactions reflected in items a through g.

View transaction list

Journal entry worksheet

1

2

Record materials purchases.

Transaction

a.

Note: Enter debits before credits.

3 4 5 6 7 8 9 10

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Why are transactions recorded in the journal? Group of answer choices To ensure that total debit equal total credits To help prepare the financial statements To ensure that all transactions are posted to the ledger To have a chronological record of all transactionsarrow_forwardWhat is the process of recording a transaction in the journal called? Group of answer choices journalizing posting charting ledgeringarrow_forwardWhich of the following items is considered an original source document? Select one: a. accounts receivable b. company expense account c. purchase order d. general ledgerarrow_forward

- The Ledger Where are the opening balances located when posting the journal entries? When are they used? Explain and provide example please.arrow_forwardWhat is the purpose of a journal? What is the purpose of a general ledger?arrow_forwardList the general ledger accounts that are associated with Vendors.arrow_forward

- What is the purpose of the adjusting journal entries?arrow_forwardDescribe and name the four special journals and identify the types of transactions that are recorded in each of these journals.arrow_forwardWhat is the purpose of posting J.F numbers that are entered in the journal at the time entries are posted to the accounts.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education