Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

If the alternatives are independent and the MARR is 15% per year, the one(s) that should be selected is (are):

a. only D

b. only D and E

c. only B, D, and E

d. only E

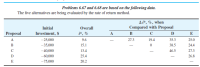

Transcribed Image Text:Problems 6.67 and 6.68 are based on the following data.

The five alternatives are being evaluated by the rate of return method.

Ai*, %, when

Compared with Proposal

Initial

Overall

Proposal

Investment, $

i*, %

В

C

D

E

A

-25,000

9.6

27.3

19.4

35.3

25.0

B

-35,000

15.1

38.5

24.4

-40,000

13.4

46.5

27.3

D

-60,000

25.4

26.8

-75,000

20.2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A firm requires a payback period of 2 years or less. According to the payback period rule, which of the following projects is acceptable to this firm? Year Project A Project B Project C 0 -$86 -$128 -$77 1 30 40 100 2 40 20 -50 3 50 10 4 60 130 a. If you use payback period as a decision rule, you would choose (No answer given) Project A Project B Project Carrow_forwardCan you please help me with question (d)? My answers seem to be incorrectarrow_forwardConsider three mutually exclusive alternatives, each with a 15-year useful life. If the MARR is 12%, which alternative should be selected? Solve the problem by benefit–cost ratio analysis.arrow_forward

- The following information is for five mutually exclusive alternatives that have 20-year useful lives. The decision maker may choose any one of the options or reject them all. Prepare a choice table.arrow_forwardFor the following table, assume a MARR of 15%per year and a useful life for each alternative of eightyears which equals the study period. The rank-orderof alternatives from least capital investment to greatestcapital investment is Z → Y → W → X. Completethe incremental analysis by selecting the preferredalternative. “Do nothing” is not an option. (6.4)FE PRACTICE PROBLEMS 307Z → Y Y → W W → X! Capital −$250 −$400 −$550investment! Annual cost 70 90 15savings! Market 100 50 200value! PW(15%) 97 20 ???(a) Alternative W (b) Alternative X(c) Alternative Y (d) Alternative ZThe following mutually exclusive investment alternatives have been presented to you.arrow_forwardDecision D6, which has three possible choices (X, Y, or Z), must be made in year 3 of a 6-year study period in order to maximize E(PW). Using an MARR of 18% per year, the investment required in year 3, and the estimated cash flows for years 4 through 6, determine which decision should be made in year 3. D6 X Y Z High (X) Low (X) High (Y) Low (Y) High High (Z) Low (Z) Low High Low High Investment, Cash Flow, (Year Cash Flow, $1000 Year 3 3) (Year 4) 3 4 $-260,000 $50 $40 $30 $30 $190 $-30 Low $-52,000 $-250,000 The present worth of X is $ The present worth of Y is $ The present worth of Z is $ Select decision branch Y Cash Flow, $1000 (Year 5) 5 $50 $30 $40 $30 $170 $-30 Cash Flow, $1000 (Year 6) 6 $50 $20 $50 $30 $150 $-30 Outcome Probability 0.72 0.28 0.45 0.55 0.7 0.3arrow_forward

- Compare alternatives A and B with the present worth method if the MARR is 14% per year. Which one would you recommend? Assume repeatability and a study period of 16 years. Capital Investment Operating Costs The PW of Alternative A is $ - 108236. (Round to the nearest dollar.) The PW of Alternative B is $ -95429. (Round to the nearest dollar.) Alternative B should be selected. A $55,000 $6,000 at end of year 1 and increasing by $600 per year thereafter $6,000 every 4 years 16 years $12,000 if just overhauled Overhaul Costs Life Salvage Value Click the icon to view the interest and annuity table for discrete compounding when the MARR is 14% per year. B $15,000 $12,000 at end of year 1 and increasing by $1,200 per year thereafter None 8 years negligible Darrow_forwardFor the following two alternatives, if the MARR is 10% per year (a)which one has a shorter payback period (b) which one do you select if you use the PW analysis. (c) is your selection different in (a) and (b)? Why? (d) use Spreadsheet to solve a and b. Alternative A: initial cost = $300,000 Revenue = $60,000 Alternative B: initial costs = $300,000 Revenue starts from n=1 at $10,000 and increases by $15,000 per year The expected life is 10 years for each alternative.arrow_forwardBased on ΔIRR and the information below, if the MARR is 20% and n = 5 years, Alternative ________should be selected. It's individual IRR is_______. Alternative_______has the lowest individual IRR at_______. Alternative w: Initial Cost, $2000; Annual Benefit, $700 Alternative x: Initial Cost, $1000; Annual Benefit, $330 Alternative y: Initial Cost, $2410; Annual Benefit, $840 Alternative z: Initial Cost, $3000; Annual Benefit, $1000arrow_forward

- The average deferral limit for Jackson St.'s NHCE group is 2.87%. What is the maximum that their HCEs can contribute to the plan? Select one: 4.87% 5.74% 3.59% 4.12%arrow_forwardIf a project costing $40,000 has a profitability index of 1.00 and the discount rate was 8%, then the project's internal rate of return was Group of answer choices less than 8%. undeterminable. greater than 8%. equal to 8%.arrow_forward5. QuizCo would like to use the IRR method to choose between projects A and B below. QuizCo's MARR is 10%. Each project lasts 5 years. (a) Calculate the IRR for each project. Check with Excel using the IRR function, the rate function, and Goal Seek. Include the Excel output in your Assignment. (b) Calculate the incremental IRR. (c) Which project should be selected based on incremental IRR? Project First Cost Annual Savings 12,000 13,000 A 3450 3700arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education