FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

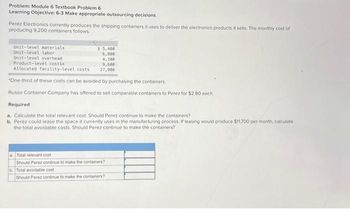

Transcribed Image Text:Problem: Module 6 Textbook Problem 6

Learning Objective: 6-3 Make appropriate outsourcing decisions

Perez Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of

producing 9.200 containers follows.

Unit-level materials

Unit-level labor

Unit-level overhead

Product-level costs

Allocated facility-level costs

$5,400

6,800

4,100

9,600

27,900

"One-third of these costs can be avoided by purchasing the containers.

Russo Container Company has offered to sell comparable containers to Perez for $2.80 each..

Required

a. Calculate the total relevant cost. Should Perez continue to make the containers?

b. Perez could lease the space it currently uses in the manufacturing process. If leasing would produce $11,700 per month, calculate

the total avoidable costs. Should Perez continue to make the containers?

a Total relevant cost

Should Perez continue to make the containers?

b. Total avoidable cost

Should Perez continue to make the containers?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- eBook Question Content Area Extreme Sports sells logo sports merchandise. The company is contemplating whether or not to continue its custom embroidery service. All of the company’s direct fixed costs can be avoided if a segment is dropped. The information is available for the segments. CustomEmbroidery LogoApparel Sales $60,000 $250,000 Variable costs 29,000 110,000 Contribution margin $31,000 $140,000 Direct fixed costs 22,000 39,000 Allocated common fixed costs 13,000 49,000 Net income $(4,000) $52,000 A. What will be the impact on net income if the embroidery segment is dropped? Net income $fill in the blank 1 B. Assume that if the embroidery segment is dropped, apparel sales will increase 10%. What is the impact on the contribution margin and net income solely for the apparel? Contribution margin $fill in the blank 3 Net income $fill in the blank 5 C. Identify one cost that is…arrow_forwardmabled: Exam 5 Saved Assume a company manufactures many products, one of which normally sells for $48 per unit. The company's accounting syster cost for this product: Direct materials Direct labor Manufacturing overhead Total cost Per Unit $ 18 12 10 $ 40 The company estimates that $3 of its manufacturing overhead varies with respect to the number of units produced. The remainder unaffected by the volume of units produced within the relevant range. A customer has approached the company with an offer to buy 300 units of a customized version of the product mentioned above f this order using existing manufacturing capacity. To accommodate the customer's desired product design, the company would incu per unit of $3. It would also have to buy a special tool for $580 that has no other use or resale value after the special order is compl this order will not have any effect on sales to other customers, what is the financial advantage (disadvantage) of accepting the speci Multiple Choice $(300)…arrow_forwardHow to figure outarrow_forward

- Please help with Part Barrow_forwardNeed help w homeworkarrow_forwardQuestion 6 Technology Inc. Ltd sells desktop computer printers for $65 per unit. Unit product costs are: Direct materials $12 Direct labor 20 Manufacturing overhead 6 Total $38 A special order to purchase 10,000 desktop computer printers has recently been received from another company, and Technology Inc. has the idle capacity to fill the order. The company will incur an additional $1.50 per printer for additional labor costs due to a slight modification the buyer wants to be made to the original product. One-third of the manufacturing overhead costs are fixed and will be incurred no matter how many units are produced. $2,100 of existing fixed administrative costs will be allocated to the order as “part of the cost of doing business”.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education