College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

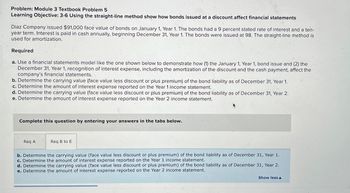

Transcribed Image Text:Problem: Module 3 Textbook Problem 5

Learning Objective: 3-6 Using the straight-line method show how bonds issued at a discount affect financial statements

Diaz Company issued $91,000 face value of bonds on January 1, Year 1. The bonds had a 9 percent stated rate of interest and a ten-

year term. Interest is paid in cash annually, beginning December 31, Year 1. The bonds were issued at 98. The straight-line method is

used for amortization.

Required

a. Use a financial statements model like the one shown below to demonstrate how (1) the January 1, Year 1, bond issue and (2) the

December 31, Year 1, recognition of interest expense, including the amortization of the discount and the cash payment, affect the

company's financial statements.

b. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, Year 1.

c. Determine the amount of interest expense reported on the Year 1 income statement.

d. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, Year 2.

e. Determine the amount of interest expense reported on the Year 2 income statement.

Complete this question by entering your answers in the tabs below.

Req A

Req B to E

b. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, Year 1.

c. Determine the amount of interest expense reported on the Year 1 income statement.

d. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, Year 2.

e. Determine the amount of interest expense reported on the Year 2 income statement.

Show less A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- MASTERY PROBLEM Jackson, Inc.s fiscal year ends December 31. Selected transactions for the period 20-1 through 20-8 involving bonds payable issued by Jackson are as follows: 20-1 Oct. 31 Issued 600,000 of 10-year, 7%, callable bonds dated October 31, 20-1, for 612,000. Interest is payable semiannually on October 31 and April 30. The bond indenture provides that Jackson is to pay to the trustee bank 20,000 by May 15 of each year (except the tenth year) as a sinking fund for the retirement of the bonds on call or at maturity. Dec. 31 Made the adjusting entry for interest payable and amortized two months premium on the bonds (straight-line method). 20-2 Jan. 2 Reversed the adjusting entry for interest payable and bond premium amortization. Apr. 30 Paid the semiannual interest on the bonds and amortized six months premium. May 15 Paid the sinking fund trustee 20,000. Oct. 31 Paid the semiannual interest on the bonds and amortized six months premium. Dec. 31 Made the adjusting entry for interest payable and amortized two months premium on the bonds. 31 Sinking fund earnings for the year were 900. 20-8 May 15 Paid the sinking fund trustee 20,000. Oct. 31 Paid the semiannual interest on the bonds and amortized six months premium. 31 Redeemed the bonds, which were called at 97. The balance in the bond premium account is 3,600 after the payment of interest and amortization of premium have been entered. The cash balance in the sinking fund is 200,000, which is applied to the redemption. Jackson paid the sinking fund trustee the additional cash needed to pay off the bonds. (Hint: First make the entry for payment to the sinking fund, then make the entry for redemption of the bonds.) REQUIRED 1. Enter the preceding transactions in general journal form. 2. Calculate the carrying value of the bonds as of December 31, 20-2.arrow_forwardCornerstone Exercise 9-24 Issuance of Long-Term Debt EWO Enterprises issues $4,500,000 of bonds payable. Required: Prepare the necessary journal entries to record the issuance of the bonds assuming the bonds were issued (a) at par, (b) at 104.5, and (c) at 99.arrow_forwardPreparing a Bond Amortization Schedule answer 4-6 pleasearrow_forward

- Preparing a Bond Amortization Schedule answer 1-3arrow_forwardBrief Exercise 10-08 Metlock, Inc. issues $264,000, 10-year, 10% bonds at 99. Prepare the journal entry to record the sale of these bonds on March 1, 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Enter an account title enter a debit amount enter a credit amount Enter an account title enter a debit amount enter a credit amount Enter an account title enter a debit amount enter a credit amountarrow_forward7barrow_forward

- Brief Exercise 10-09 Oriole Company issues $325,000, 20-year, 7% bonds at 103. Prepare the journal entry to record the sale of these bonds on June 1, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Enter an account title enter a debit amount enter a credit amount Enter an account title enter a debit amount enter a credit amount Enter an account title enter a debit amount enter a credit amountarrow_forwardProblem 4 - Bonds Payable Question Information: REQ A Bond Face Stated Effective Life PAR/PREMIUM/DISCOUNT Issuance Value Interest Interest Rate Rate A $ 100,000 6% 6% 10 years B $ 400,000 8% 6% 10 years C $ 600,000 6% 8% 5 years Insert Computations or Amortization Data analytics or Excel Data tools here: REQ B Compute the proceeds of each bond issuance A B C REQ C For Each, indicate whether the balance sheet value of the bond liability will increase, decrease or remain constant over the life of the bond A B C REQ D For Eaqch bond issuance indicate whether the interest expense recognized each period will increase decrease or remain constant over the life of the bond A B Carrow_forwardBrief Exercise 10-10 Flounder Corp. issued 1,500 9%, 9-year, $1,000 bonds dated January 1, 2022, at face value. Interest is paid each January 1.(a) Prepare the journal entry to record the sale of these bonds on January 1, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 1, 2022 enter an account title for the journal entry on January 1,2017 enter a debit amount enter a credit amount enter an account title for the journal entry on January 1,2017 enter a debit amount enter a credit amount (b) Prepare the adjusting journal entry on December 31, 2022, to record interest expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31, 2022 enter an account title for the journal entry on December 31,2017…arrow_forward

- Question Content Area On January 1, a $932,000, 10%, 5-year bond was issued for $904,040. Interest is paid semiannually on January 1 and July 1. If the issuing corporation uses the straight-line method to amortize the discount on bonds payable, the semiannual amortization amount is a. $27,960 b. $2,796 c. $46,600 d. $5,592arrow_forwardQUESTION 10 A $545,000 bond issue on which there is an unamortized discount of $44.000 is redeemed ior $474,000. Journalize the redemption of the bonds using the straight-line method and the chart of accounts below. Gain on Redemption of Bonds Interest Expense Interest Payable Interest Revenue Bonds Payable Cash Discount on Bonds Payable Loss on Redemption of Bonds Premiun on Bonds Payable Enter your answers into the table below. Key the account names carefully (exactly as shown above) and follow formatting instructions below. DO NOT USE A DECIMAL WITH ZEROES FOR WHOLE DOLLAR AMOUNTS AND USE COMMAS APPROPRIATELY. WHEN THE DEBIT/CREDIT DOES NOT REQUIRE AN ENTRY, LEAVE IT BLANK. Account Debit Credit THIS QUESTION WILL ALSO BE CHECKED MANUALLY (to make adjustments for typos). Click Save and Submit to saue and submit Clil Saue 47l aacars to naarrow_forwardQuestion 5* Jones Company issued $50,000, 5 year, 8% bonds at 98 % plus accrued interest. The interest is paid semiannually on March 1 and September 1. The bonds are dated March 1, Year 1. The date of sale is May 1, Year 1. Make the journal entry to record the first interest payment on September 1, year 1.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning