FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Problem AI-4B Journal entries for payroll transactions LO2, 3, Q 4

A company has three employees, each of whom has been employed since January 1, earns $3,000 per month,

and is paid on the last day of each month. On March 1, the following accounts and balances appeared in its

ledger.

a. Employees' Income Taxes Payable, $1,298.25 (liability for February).

b. EI Payable, $358.56 (liability for February).

c. CPP Payable, $804.36 (liability for February).

d. Employees' Medical Insurance Payable, $1,380.00 (liability for January and February).

During March and April, the company completed the following related to payroll:

Mar. 17 Issued cheque #635 payable to the Receiver General for Canada. The cheque was in payment of the

February employee income taxes, EI, and CPP amounts due.

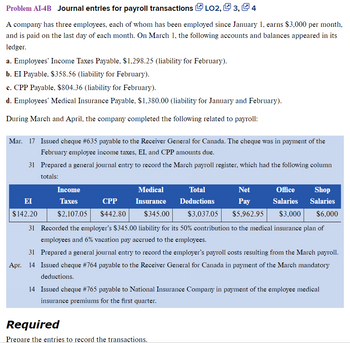

31 Prepared a general journal entry to record the March payroll register, which had the following column

totals:

Office Shop

Salaries Salaries

$3,000 $6,000

31 Recorded the employer's $345.00 liability for its 50% contribution to the medical insurance plan of

employees and 6% vacation pay accrued to the employees.

31 Prepared a general journal entry to record the employer's payroll costs resulting from the March payroll.

Apr. 14 Issued cheque #764 payable to the Receiver General for Canada in payment of the March mandatory

deductions.

EI

$142.20

Medical

Income

Taxes

CPP Insurance

$2,107.05 $442.80 $345.00

Total

Deductions

Net

Pay

$3,037.05 $5,962.95

Required

Prepare the entries to record the transactions.

14 Issued cheque #765 payable to National Insurance Company in payment of the employee medical

insurance premiums for the first quarter.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 156 Principles of Cost Accounting Journal entries for payroll A partial summary of the payroll data for Burrington Manufactur- ing Company for each week of June is as follows: ЕЗ-5 LO2 LO3 June 7 June 14 June 21 June 28 Gross earnings . $ 36,500 $ 34,200 $ 37,300 $ 38,400 Deductions: FICA tax, 8% $? $? $? $? Tax-sheltered annuity. 1,825 1,780 1,855 1,870 Income tax 4,215 4,120 4,320 4,410 Health insurance 600 600 600 600 Total deductions $? $? $? $? Net earnings $? $? $? $? a. Compute the missing amounts in the summary, assuming that no employees have reached the $100,000 FICA maximum. b. For each payroll period, prepare journal entries to (1) record the payroll and (2) record the payments to employees.arrow_forwardJournalize Period Payroll The payroll register of Patel Heritage Co. indicates $1,200 of social security withheld and $300 of Medicare tax withheld on total salaries of $20,000 for the period. Federal withholding for the period totaled $3,600. Retirement savings withheld from employee paychecks were $2,650 for the period. Provide the journal entry for the period's payroll. If an amount box does not require an entry, leave it blank. _________ __________ _______________ Complete the chart above as your journal.arrow_forwardRequired information Exercise 9-13A (Static) Computation of net pay and payroll expense LO 9-5 [The following information applies to the questions displayed below] The following information is available for the employees of Webber Packing Company for the first week of January, Year t 1. Kayla earns $28 per hour and 1½ times her regular rate for hours over 40 per week. Kayla worked 52 hours the first week in January, Kayla's federal income tax withholding is equal to 15 percent of her gross pay. Webber pays medical insurance of $50 per week for Kayla and contributes $50 per week to a retirement plan for her. 2. Paula earns a weekly salary of $1,600, Paula's federal income tax withholding is 18 percent of her gross pay. Webber pays medical insurance of $80 per week for Paula and contributes $100 per week to a retirement plan for her. 3. Vacation pay is accrued at the rate of 2 hours per week (based on the regular pay rate) for Kayla and $60 per week for Paula. Assume the Social Security…arrow_forward

- Calculating Payroll Taxes Expense and Preparing Journal Entry Selected information from the payroll register of Ebeling's Dairy for the week ended July 7, 20--, is shown below. The SUTA tax rate is 5.4%, and the FUTA tax rate is 0.6%, both on the first $7,000 of earnings. Social Security tax on the employer is 6.2% on the first $128,400 of earnings, and Medicare tax is 1.45% on gross earnings. Taxable Earnings Employee Name Cumulative PayBefore CurrentEarnings CurrentWeekly Earnings UnemploymentCompensation SocialSecurity Click, Katelyn $6,660 $850 Coombs, Michelle 6,380 750 Fauss, Erin 23,010 1,220 Lenihan, Marcus 6,900 980 McMahon, Drew 125,200 5,260 Newell, Marg 25,150 1,110 Stevens, Matt 28,970 1,240arrow_forwardChp. 8arrow_forwardQuestion text Lidge Company of Texas (TX) is classified as a monthly depositor and pays its employees monthly. The following payroll information is for the second quarter of 20--. WITHHOLDINGS EMPLOYER'S Wages OASDI HI FIT OASDI HI April $86,100 $ 5,338.20 $1,248.46 $ 9,650 $ 5,338.20 $1,248.45 May 92,500 5,735.00 1,341.26 10,005 5,735.00 1,341.25 June 73,400 4,550.80 1,064.30 8,995 4,550.80 1,064.30 Totals $252,000 $15,624.00 $3,654.02 $28,650 $15,624.00 $3,654.00 The number of employees on June 12, 20-- was 11. a. Complete the following portion of Form 941. What are the payment due dates of each of the monthly liabilities assuming all deposits were made on time, and the due date of the filing of Form 941 (year 20--)?arrow_forward

- Wage and tax statement data on employer FICA tax Obj. 2 Ehrlich Co. began business on January 2. Salaries were paid to employees on the last day of each month, and social security tax, Medicare tax, and federal income tax were withheld in the required amounts. An employee who is hired in the middle of the month receives half the monthly salary for that month. All required payroll tax reports were filed, and the correct amount of payroll taxes was remitted by the company for the calendar year. Early in the following year, before the Wage and Tax Statements (Form W-2) could be prepared for distribution to employees and for filing with the Social Security Administration, the employees’ earnings records were inadvertently destroyed. None of the employees resigned or were discharged during the year, and there were no changes in salary rates. The social security tax was withheld at the rate of 6.0% and Medicare tax at the rate of 1.5% on salary. Data on dates of employment, salary rates, and…arrow_forwardCalculation of Taxable Earnings and Employer Payroll Taxes and Preparation of Journal Entry Selected information from the payroll register of Joanie's Boutique for the week ended September 14, 20--, is as follows: Social Security tax is 6.2% on the first $128,400 of earnings for each employee. Medicare tax is 1.45% of gross earnings. FUTA tax is 0.6% and SUTA tax is 5.4% on the first $7,000 of earnings.arrow_forwardCan you please check if this is correctarrow_forward

- PAGE 11 ACCOUNTING FOUATION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY Widmer Company had gross wages of $200,000 during the week ended June 17. The amount of wages subject to social security tax was $200,000, while the amount of wages subject to federal and state unemployment taxes was $30,000. Tax rates are as follows: General Journal a. Journalize the entry to record the payroll for the week of June 17. b. Journalize the entry to record the payroll tax expense incurred for the week of June 17. Social security 6.0% Medicare 1.5% State unemployment 5.4% Federal unemployment 0.8% The total amount withheld from employee wages for federal taxes was $40,500. General Journal Instructions Required: a. Journalize the entry to record the payroll for the week of June 17. b. Journalize the entry to record the payroll tax expense incurred for the week of June 17 1 2 4 DATE DESCRIPTION 5 9 7 B 9 10 JOURNALarrow_forwardPayroll Register and Payroll Journal Entry Mary Losch operates a travel agency called Mary’s Luxury Travel. She has five employees, all of whom are paid on a weekly basis. The travel agency uses a payroll register, individual employee earnings records, and a general journal. Mary’s Luxury Travel uses a weekly federal income tax withholding table. Refer to Figure 8-4 in the text. The payroll data for each employee for the week ended March 22, 20—, are given. Employees are paid 1½ times the regular rate for working over 40 hours a week. Name No. ofAllowances MaritalStatus Total HoursWorked Mar. 16–22 Rate Total EarningsJan. 1–Mar. 15 Bacon, Andrea 4 M 44 $14.00 $6,300.00 Cole, Andrew 1 S 40 15.00 6,150.00 Hicks, Melvin 3 M 44 13.50 5,805.00 Leung, Cara 1 S 36 14.00 5,600.00 Melling, Melissa 2 M 40 14.50 5,945.00 Social Security tax is withheld from the first $128,400 of earnings at the rate of 6.2%. Medicare tax is withheld at the rate of 1.45%, and city…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education