College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666160

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

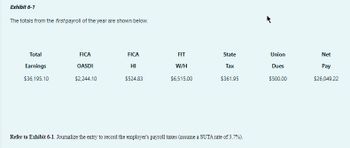

Transcribed Image Text:Exhibit 6-1

The totals from the first payroll of the year are shown below.

Total

Earnings

$36,195.10

FICA

OASDI

$2,244.10

FICA

НІ

$524.83

FIT

W/H

$6,515.00

State

Tax

$361.95

Refer to Exhibit 6-1. Journalize the entry to record the employer's payroll taxes (assume a SUTA rate of 3.7%).

Union

Dues

$500.00

Net

Pay

$26,049.22

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- CALCULATION OF TAXABLE EARNINGS AND EMPLOYER PAYROLL TAXES AND PREPARATION OF JOURNAL ENTRY Selected information from the payroll register of Joanies Boutique for the week ended September 14, 20--, is as follows. Social Security tax is 6.2% on the first 118,500 of earnings for each employee. Medicare tax is 1.45% of gross earnings. FUTA tax is 0.6% and SUTA tax is 5.4% on the first 7,000 of earnings. Calculate the amount of taxable earnings for unemployment. Social Security, and Medicare taxes, and prepare the journal entry to record the employers payroll taxes as of September 14, 20--.arrow_forwardThe totals line from Nix Companys payroll register for the week ended March 31, 20--, is as follows: Payroll taxes are imposed as follows: Social Security tax, 6.2%; Medicare tax, 1.45%; FUTA tax, 0.6%; and SUTA tax, 5.4%. REQUIRED 1. a. Prepare the journal entry for payment of this payroll on March 31, 20--. b. Prepare the journal entry for the employers payroll taxes for the period ended March 31, 20--. 2. Nix Company had the following balances in its general ledger before the entries for requirement ( 1 ) were made: a. Prepare the journal entry for payment of the liabilities for federal income taxes and Social Security and Medicare taxes on April 15, 20--. b. Prepare the journal entry for payment of the liability for FUTA tax on April 30, 20--. c. Prepare the journal entry for payment of the liability for SUTA tax on April 30, 20--.arrow_forwardCALCULATING PAYROLL TAXES EXPENSE AND PREPARING JOURNAL ENTRY Selected information from the payroll register of Wrays Drug Store for the week ended July 14,20--, is shown below. The SUTA tax rate is 5.4%, and the FUTA tax rate is 0.6%, both on the first 7,000 of earnings. Social Security tax on the employer is 6.2% on the first 118,500 of earnings, and Medicare tax is 1.45% on gross earnings. REQUIRED 1. Calculate the total employer payroll taxes for these employees. 2. Prepare the journal entry to record the employer payroll taxes as of July 14,20--.arrow_forward

- The following information about the payroll for the week ended December 30 was obtained from the records of Qualitech Co.: Tax rates assumed: Social security, 6% Medicare, 1.5% State unemployment (employer only), 5.4% Federal unemployment (employer only), 0.8% Instructions 1. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the following entries: a. December 30, to record the payroll. b. December 30, to record the employers payroll taxes on the payroll to be paid on December 31. Of the total payroll for the last week of the year, 35,000 is subject to unemployment compensation taxes. 2. Assuming that the payroll for the last week of the year is to be paid on January 5 of the following fiscal year, journalize the following entries: a. December 30, to record the payroll. b. January 5, to record the employers payroll taxes on the payroll to be paid on January 5. Because it is a new fiscal year, all 675,000 in salaries is subject to unemployment compensation taxes.arrow_forwardCALCULATION AND JOURNAL ENTRY FOR EMPLOYER PAYROLL TAXES Portions of the payroll register for Barneys Bagels for the week ended July 15 are shown below. The SUTA tax rate is 5.4%, and the FUTA tax rate is 0.6%, both of which are levied on the first 7,000 of earnings. The Social Security tax rate is 6.2% on the first 118,500 of earnings. The Medicare rate is 1.45% on gross earnings. Calculate the employers payroll taxes expense and prepare the journal entry to record the employers payroll taxes expense for the week ended July 15 of the current year.arrow_forwardCALCULATION AND JOURNAL ENTRY FOR EMPLOYER PAYROLL TAXES Earnings for several employees for the week ended March 12, 20--, are as follows: Calculate the employers payroll taxes expense and prepare the journal entry as of March 12, 20--, assuming that FUTA tax is 0.6%, SUTA tax is 5.4%, Social Security tax is 6.2%, and Medicare tax is 1.45%.arrow_forward

- Recording payroll and payroll taxes The following information about the payroll for the week ended October 4 was obtained from the records of Simkins Mining Co.: Instructions Illustrate the effect un (he accounts and financial statements of recording the liability for the October 4 employer payroll taxes.arrow_forwardIn the space provided below, prepare the journal entry to record the November payroll for all employees assuming that the payroll is paid on November 30 and that Joness cumulative gross pay (cell I13) is 85,000.arrow_forwardRecording payroll and payroll taxes The following information about the payroll for the week ended October 4 was obtained from the records of Simkins Mining Co.: Instructions For the October 4 payroll, determine the employee FICA tax payable.arrow_forward

- Recording payroll and payroll taxes The following information about the payroll for the week ended October 4 was obtained from the records of Simkins Mining Co.: Instructions Determine the following amounts for the employer payroll taxes related to the October 4 payroll: (a) FICA tax payable, (b) state unemployment tax payable, and (c) federal unemployment tax payable.arrow_forwardWallace Corporation summarizes the following information from its weekly payroll records during April. Prepare the two journal entries to record the payment of the payroll and the accrual of its payroll taxes for April. Assume an 8% FICA rate for both employees and the employer. Also assume a 5.4% state unemployment tax rate, a 0.6% federal unemployment tax rate, and that all wages are subject to all payroll taxes. Round to the nearest dollar.arrow_forwardSUTA taxes on July 31, 20--. WORKERS COMPENSATION INSURANCE AND ADJUSTMENT Columbia Industries estimated that its total payroll for the coming year would be 385,000. The workers compensation insurance premium rate is 0.2%. REQUIRED 1. Calculate the estimated workers compensation insurance premium and prepare the journal entry for the payment as of January 2, 20--. 2. Assume that Columbia Industries actual payroll for the year is 396,000. Calculate the total insurance premium owed and prepare a journal entry as of December 31, 20--, to record the adjustment for the underpayment. The actual payment of the additional premium will take place in January of the next year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,