FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Calculate the number of units of each product the company must sell to earn an after-tax net income of

P135,000 for the year ending December 31, 2016.

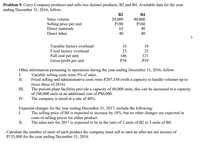

Transcribed Image Text:Problem 9. Curry Company produces and sells two distinct products, B2 and B4. Available data for the year

ending December 31, 2016, follow:

B2

B4

Sales volume

20,000

40,000

P160

Selling price per unit

Direct materials

P180

65

40

Direct labor

40

40

Variable factory overhead

Fixed factory overhead

Full cost per unit

Gross profit per unit

16

16

25

25

146

121

Р34

P39

Other information pertaining to operations during the year ending December 31, 2016, follow:

I.

Variable selling costs were 5% of sales.

Fixed selling and administrative costs were P207,330 (with a capacity to handle volumes up to

twice those of 2016)

The present plant facilities provide a capacity of 60,000 units, this can be increased to a capacity

of 100,000 units at an additional cost of P80,000.

The company is taxed at a rate of 40%.

II.

II

IV.

Expected changes for the year ending December 31, 2017, include the following:

I.

The selling price of B4 is expected to increase by 10%, but no other changes are expected in

costs or selling prices for either product.

The sales mix for 2017 is expected to be in the ratio of 2 units of B2 to 3 units of B4.

II.

Calculate the number of units of each product the company must sell to earn an after-tax net income of

P135,000 for the year ending December 31, 2016.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 15, 2026, Pina Company paid property taxes on its factory building for the calendar year 2026 for $1112000. In the first week of April 2026, Pina made unanticipated major repairs to its plant equipment for $2715000. These repairs will benefit operations for the remainder of the calendar year. How should these expenses be reflected in Pina's quarterly income statements? O O 3/31/26 $1112000 $278000 $956750 $278000 Three Months Ended 6/30/26 $1810000 $1183000 $956750 $2654700 9/30/26 $0 $1183000 $956750 $278000 12/31/26 $0 $1183000 $956750 $278000arrow_forwardA company began operations in 2021. During the year, sales totaled $500,000. The company expects sales returns will total 2% of all sales, but actual sales returns before year end were $8,000. Assuming that all relevant information has been presented, what should the company report as net sales revenue on the income statement?arrow_forwardUnited Bhd makes up its accounts to 31 March annually. The company acquired a machinery on 1.7.2017 for RM50,000. The company disposed the machinery on 31.3.2023 for RM53,000. Calculate the capital allowances and balancing charge/allowance for the relevant YAs up to the YA2023.arrow_forward

- During August, 2020, Sheffield’s Supply Store generated net sales of $60100. The company’s expenses were as follows: cost of goods sold of $35000 and operating expenses of $4500. The company also had rent revenue of $1000 and a loss on the sale of a delivery truck of $1700. Sheffield’s operating income for the month of August 2020 is $20600.$21600.$19900.$25100.arrow_forwardCrane Company has sales of $1,594,000 for the first quarter of 2022. In making the sales, the company incurred the following costs and expenses. Product costs Selling expenses $513,000 113,000 Administrative expenses 93,000 Variable Net Income $ Fixed $563,000 88,000 80,000 Calculate the company's net income under CVP for 2022.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education