FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

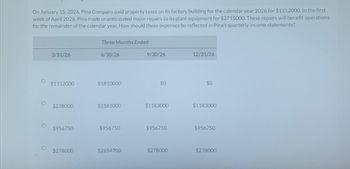

Transcribed Image Text:On January 15, 2026, Pina Company paid property taxes on its factory building for the calendar year 2026 for $1112000. In the first

week of April 2026, Pina made unanticipated major repairs to its plant equipment for $2715000. These repairs will benefit operations

for the remainder of the calendar year. How should these expenses be reflected in Pina's quarterly income statements?

O

O

3/31/26

$1112000

$278000

$956750

$278000

Three Months Ended

6/30/26

$1810000

$1183000

$956750

$2654700

9/30/26

$0

$1183000

$956750

$278000

12/31/26

$0

$1183000

$956750

$278000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- sarrow_forwardThomas Company had the following information related to September 2020: 1) Depreciation on the store equipment was $60,000 for the month. 2) Sales of merchandise inventory for the month of September were $1,800,000, of which $1,200,000 was paid in cash and the remaining amount sold on credit. The cost of the merchandise sold was $1,080,000. 3) The next payroll will be $144,000 and will be paid on October 12. This payroll will cover wages earned during the last week of September and the first week of October. 4) The utility bill of $72,000 for the month of September was both received and paid in early October. 5) Thomas sold a company car for a gain of $12,000 on September 22. 6) On September 3, Thomas paid $6,000 for August’s telephone bill. 7) On October 1, Thomas received the September telephone bill, which totaled $12,000. The bill will be paid in mid-October. 8) Wages paid in cash to employees during the month totaled $288,000. This amount included $60,000 paid for work done in…arrow_forwardRahman Company, a manufacturer of steel products, began operations on January 1, 2020. Rahman has a December 31 fiscal year-end and adjusts its accounts annually. Selected transactions related to its Brampton plant are as follows: Jan. 1, 2020 Paid cash for six (6) stamping machines for a total price of $15,300 plus delivery costs of $200 per unit Dec. 31, 2020 Recorded depreciation at year end. Assume that the stamping machines have a 5 year useful life and a residual (salvage) value of 10% of the original cost. Dec. 31, 2021 Recorded depreciation at year end. Jan. 1, 2022 One (1) stamping machine was sold for $1,250. . Dec. 31, 2022 Exchanged one (1) stamping machine for a welding machine. The list price of the welding machine was $8,000 and Rahman received a trade-in allowance for the stamping machine of $2,000 (remainder paid in cash). A new welding machine could be bought (without a trade-in) for $7,500. The fair market value of the stamping machine was $1,000.…arrow_forward

- Dry Valley Corporation reported the following items in its adjusted trial balance for the year ended December 31, 2026: Income from continuing operations before income taxes Gain on disposal of discontinued component Loss from operations of discontinued component Dry Valley is subject to a 20% tax rate. Instructions $120,000 28,000 (60,000) Prepare the December 31, 2026, income statement for Dry Valley Corporation, starting with income from continuing operations before income taxes.arrow_forwardDo parts a to d Accounting for Income Taxes Yoda Company is in the process of accounting for its income taxes for the year ended December 31, 2020. The following information came from Yoda's accounting and taxation records: Accounting income before income taxes for 2020 $ 98,967 Depreciation expense for property, plant, and equipment for 2020 $ 222,227 Capital cost allowance to be claimed on Yoda's 2020 income tax return $ 244,450 Book value of property, plant, and equipment at December 31, 2019 $ 1,399,268 Undepreciated capital cost of property, plant, and equipment at December 31, 2019 $ 1,203,370 Assume that there were no additions or disposals of property, plant, and equipment during 2020. In 2020, Yoda began offering a 1-year warranty on all merchandise sold. Following are details pertaining to this warranty: Warranty expense for 2020 for accounting purposes $ 38,860…arrow_forwardComputing and Reporting Deferred Income TaxesEarly in January 2019, Oler, Inc., purchased equipment costing $24,000. The equipment had a 2‑year useful life and was depreciated in the amount of $12,000 in 2019 and 2020. Oler deducted the entire $24,000 on its tax return in 2019. This difference was the only one between its tax return and its financial statements. Oler’s income before depreciation expense and income taxes was $354,000 in 2019 and $367,500 in 2020. The tax rate in each year was 25%. Requireda. What amount of deferred tax liability should Oler report in 2019 and 2020? 2019 2020 b. Prepare the journal entries to record income taxes for 2019 and 2020. General Journal Description Debit Credit Income taxes payable To record income taxes for 2019. Income tax expense To record income taxes for 2020. c. Repeat requirement b if in 2019 the U.S. enacts a permanent tax rate change to be effective in…arrow_forward

- Thomas Company had the following information related to September 2020: 1) Depreciation on the store equipment was $60,000 for the month. 2) Sales of merchandise inventory for the month of September were $1,800,000, of which $1,200,000 was paid in cash and the remaining amount sold on credit. The cost of the merchandise sold was $1,080,000. 3) The next payroll will be $144,000 and will be paid on October 12. This payroll will cover wages earned during the last week of September and the first week of October. 4) The utility bill of $72,000 for the month of September was both received and paid in early October. 5) Thomas sold a company car for a gain of $12,000 on September 22. 6) On September 3, Thomas paid $6,000 for August’s telephone bill. 7) On October 1, Thomas received the September telephone bill, which totaled $12,000. The bill will be paid in mid-October. 8) Wages paid in cash to employees during the month totaled $288,000. This amount included $60,000 paid for work done in…arrow_forwardThomas Company had the following information related to September 2020: 1) Depreciation on the store equipment was $60,000 for the month. 2) Sales of merchandise inventory for the month of September were $1,800,000, of which $1,200,000 was paid in cash and the remaining amount sold on credit. The cost of the merchandise sold was $1,080,000. 3) The next payroll will be $144,000 and will be paid on October 12. This payroll will cover wages earned during the last week of September and the first week of October. 4) The utility bill of $72,000 for the month of September was both received and paid in early October. 5) Thomas sold a company car for a gain of $12,000 on September 22. 6) On September 3, Thomas paid $6,000 for August’s telephone bill. 7) On October 1, Thomas received the September telephone bill, which totaled $12,000. The bill will be paid in mid-October. 8) Wages paid in cash to employees during the month totaled $288,000. This amount included $60,000 paid for work done in…arrow_forwardAt the end of 2021, Schrutte Inc. in its first year of operations, had pretax financial income of $650,000. The company had extra depreciation taken for tax purposes in the amount of $975,000. Estimated expenses that were deducted for financial income but not yet paid amounted to $425,000. It is estimated that the expenses will be paid in 2022. The tax rate for all years is 25% In the journal entry at the end of the year that records income tax expense, deferred taxes and income taxes payable, what is the entry to the Income Tax Payable account? Question 19 options: a) credit Income Tax Payable account by $162,500 b) credit Income Tax Payable account by $300,000. c) credit to Income Tax Payable account by $25,000. d) credit Income Tax Payable account by $512,500.arrow_forward

- Ion Corporation, a calendar year C corporation, was formed on September 1, 2020, and opened for business on October 1, 2020. After its formation but prior to opening for business, Ion incurred the following expenditures. Accounting $10,500 Advertising 20,700 Employee payroll 12,800 Rent 4,000 Utilities 2,200 Round the per-month amount to two decimal places and use the rounded amount in subsequent computations. Round the final answer to the nearest dollar. Assuming the company makes the § 195 election, the maximum amount of these expenditures that Ion can deduct in 2020 isarrow_forwardFor the year ended December 31, 2023, Tamarisk Ltd. reported income before income taxes of $98,000. In 2023, Tamarisk Ltd. paid $45,000 for rent; of this amount, $15,000 was expensed in 2023. The remaining $30,000 was treated as a prepaid expense for accounting purposes and would be expensed equally over the 2024-2025 period. The full $45,000 was deductible for tax purposes in 2023. The company paid $68,000 in 2023 for membership in a local golf club (which was not deductible for tax purposes). In 2023 Tamarisk Ltd. began offering a 1-year warranty on all merchandise sold. Warranty expenses for 2023 were $42,000, of which $35,000 was actual repairs for 2023 and the remaining $7,000 was estimated repairs to be completed in 2024. Meal and entertainment expenses totalled $20,000 in 2023, only half of which were deductible for income tax purposes. Depreciation expense for 2023 was $200,000. Capital Cost Allowance (CCA) claimed for the year was $223,000. Tamarisk was subject to a 20%…arrow_forwardOn May 1, 2020, Vaughn Manufacturing began construction of a building. Expenditures of $620400 were incurred monthly for 5 months beginning on May 1. The building was completed and ready for occupancy on September 1, 2020. For the purpose of determining the amount of interest cost to be capitalized, the weighted-average accumulated expenditures on the building during 2020 were O $2481600. O $3102000. O $517000. O $620400.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education