FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

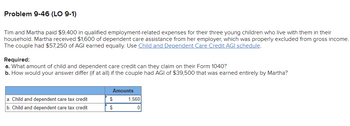

Transcribed Image Text:Problem 9-46 (LO 9-1)

Tim and Martha paid $9,400 in qualified employment-related expenses for their three young children who live with them in their

household. Martha received $1,600 of dependent care assistance from her employer, which was properly excluded from gross income.

The couple had $57,250 of AGI earned equally. Use Child and Dependent Care Credit AGI schedule.

Required:

a. What amount of child and dependent care credit can they claim on their Form 1040?

b. How would your answer differ (if at all) if the couple had AGI of $39,500 that was earned entirely by Martha?

a. Child and dependent care tax credit

b. Child and dependent care tax credit

Amounts

$

$

1,560

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Problem 12-31 (LO. 4) Paul and Karen Kent are married, and both are employed (Paul earned $44,000 and Karen earned $9,000 in 2020). Paul and Karen have two dependent children, Samuel and Joy, both under the age of 13. Paul and Karen pay $3,800 ($1,900 for each child) to Sunnyside Day Care Center (422 Sycamore Road, Ft. Worth, TX 76028; Employer Identification Number 11- 2345678), to care for their children while they are working. Click to view Applicable Rate of Credit based on Adjusted Gross Income. a. Assuming that Paul and Karen file a joint return, what, if any, is their tax credit for child and dependent care expenses? b. Complete Form 2441 for Paul and Karen; their AGI is $53,750, and their tax liability before any available child care credit is $2,825. Neither Paul nor Karen received any child care benefits from their employers. Enter amounts as positive numbers. Form 2441 OMB No. Child and Dependent Care Expenses 1545-0074 Department of> Attach to Form 1040, 1040-SR, or the…arrow_forwardB4.arrow_forward6. In relation to the Income of Minors, which of the following is a prescribed person under ITAA36 Div. 6AA:Select one:a. Lulu who is permanently disabled and aged 16b. Carl who is married and is 17 years oldc. Nine-year-old Lucy whose parents are entitled to a carer allowanced. Ten-year-old Franke whose guardians are entitled to a double orphan pensionarrow_forward

- Wanda gets her health insurance covered in an employee benefits package. Her employer pays 45% of her annual premium for basic health insurance, and 35% for dental and vision insurance. Iif the health insurance premium is $11.540, and the vision and dental are together $1.230 annually. What is the total amount Wanda pays for insurance each year? Select one O a $8,362 Ob. 57,146.50 c. $8.300,50 d. $7,200arrow_forwardCENU COC Marty and Dee have 2 qualifying children for the child and dependent care credit. They paid $5,200 for their eligible work-related expenses. Marty's W-2 shows $56,720 in wages box 1. Dee was a full-time student for 10 months. The dollar limit for their work-related childcare expenses is. Select one: O a $2,500 b. $3,000 c. $5,200 d. $8,000 - e. None of these 4 ~nd bör danskt- Pinde ---- to non Powered by TOPY 2008-2023 Interactyx Limited. All rights reserved. Statement of Rights and Responsibilitiesarrow_forwardRequired information Problem 6-66 (LO 6-1) (Algo) [The following information applies to the questions displayed below.] This year Diane intends to file a married-joint return. Diane received $192,100 of salary and paid $8,600 of interest on loans used to pay qualified tuition costs for her dependent daughter, Deb. This year Diane has also paid moving expenses of $4,550 and $30,600 of alimony to her ex-spouse, Jack, who she divorced in 2013. Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Problem 6-66 Part-b (Algo) b. Suppose that Diane also reported income of $10,900 from a half share of profits from a partnership. Disregard any potential self- employment taxes on this income. What AGI would Diane report under these circumstances? X Answer is complete but not entirely correct. $ 159,000 X Diane's AGIarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education