College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

Kindly answer the following questions in problems 9-13 and 9-14.

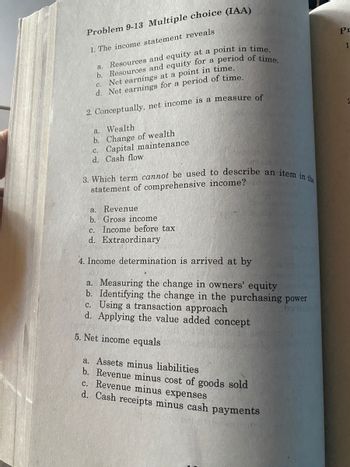

Transcribed Image Text:Problem 9-13 Multiple choice (IAA)

1. The income statement reveals

a. Resources and equity at a point in time.

b. Resources and equity for a period of time.

C.

Net earnings at a point in time.

d. Net earnings for a period of time.

2. Conceptually, net income is a measure of

a. Wealth

b. Change of wealth

c. Capital maintenance

d. Cash flow

3. Which term cannot be used to describe an item in the

statement of comprehensive income?

a. Revenue

b. Gross income

c. Income before tax

d. Extraordinary

4. Income determination is arrived at by

a. Measuring the change in owners' equity

b. Identifying the change in the purchasing power

09368

c. Using a transaction approach

d. Applying the value added concept

5. Net income equals

a. Assets minus liabilities

b. Revenue minus cost of goods sold

c. Revenue minus expenses

d. Cash receipts minus cash payments

Pr

1

Transcribed Image Text:in the

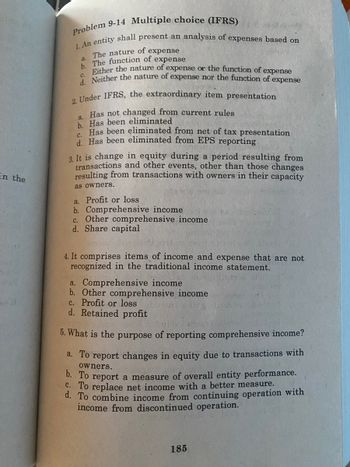

Problem 9-14 Multiple choice (IFRS)

1. An entity shall present an analysis of expenses based on

a. The nature of expense

b. The function of expense

Either the nature of expense or the function of expense

d. Neither the nature of expense nor the function of expense

C.

2. Under IFRS, the extraordinary item presentation

a. Has not changed from current rules

b. Has been eliminated

C.

Has been eliminated from net of tax presentation

d. Has been eliminated from EPS reporting

3. It is change in equity during a period resulting from

transactions and other events, other than those changes

resulting from transactions with owners in their capacity

as owners.

a. Profit or loss

b. Comprehensive income

c. Other comprehensive income

d. Share capital

4. It comprises items of income and expense that are not

recognized in the traditional income statement.

a. Comprehensive income

b. Other comprehensive income

c. Profit or loss

d. Retained profit

5. What is the purpose of reporting comprehensive income?

a. To report changes in equity due to transactions with

owners.

b. To report a measure of overall entity performance.

C. To replace net income with a better measure.

d. To combine income from continuing operation with

income from discontinued operation.

185

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vertical analysis can be used to analyze changes except O a. on a balance sheet. O b. on an income statement. C. on a statement of cash flows. O d. over time.arrow_forward(participation expected < You would find asset, liability, and equity accounts on which of the following statements? OA. Statement of cash flows B. Balance sheet OC. Statement of retained earnings OD. Income statementarrow_forwardMark for Review Question 26 of 30 The ratio quantifies the degree of available liquid assets is Liquidity coverage ration Temporay assets to total assets O Temporary assets to volatile liabilities Veiatie liabilities to total assetsarrow_forward

- Which of the following is the correct formula for calculating rate of return on total assets? A. (Net income minus− Interest expense) / Average total asset B. Total equity / Total assets C. (Net income + Interest expense) / Average total assets D. (Net income minus− Interest expense) / Total assetsarrow_forward11arrow_forwardWhich statement is most directly affected by a change to net income? A. balance sheet B. income statement C. statement of retained earnings D. statement of cash flowsarrow_forward

- For each of the following independent situations, place an (X) by the transactions that would be included in the statement of cash flows. Table 2.6arrow_forwardWhich of the following financial statements is prepared as of a particular point in time rather than for a period of. time? Multiple Choice Statement of cash flows. Income statement. Statement of shareholders' equity. Balance sheet.arrow_forwardQuestion Content Area The present value index is computed using which of the following formulas? a. Amount to Be Invested ÷ Total Present Value of Net Cash Flow b. Amount to Be Invested ÷ Average Rate of Return c. Total Present Value of Net Cash Flow ÷ Average Rate of Return d. Total Present Value of Net Cash Flow ÷ Amount to Be Investedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning