FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

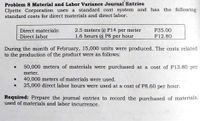

Transcribed Image Text:Problem 8 Material and Labor Variance Journal Entries

Clyette Corporation uses a standard cost system and has the following

standard costs for direct materials and direct labor.

Direct materials:

Direct labor

2.5 meters @ P14 per meter

1.6 hours @ P8 per hour

P35.00

P12.80

During the month of February, 15,000 units were produced. The costs related

to the production of the product were as follows:

• 50,000 meters of materials were purchased at a cost of P13.80 per

meter.

40,000 meters of materials were used.

25,000 direct labor hours were used at a cost of P8.60 per hour.

Required: Prepare the journal entries to record the purchased of materials,

used of materials and labor incurrence.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Direct Materials and Direct Labor Variance Analysis Abbeville Fixture Company manufactures units in a small manufacturing facility. The units are made from brass. Manufacturing has 30 employees. Each employee presently provides 40 hours of labor per week. Information about a production week is as follows: Standard wage per hour $15.6 Standard labor time per unit 15 min. Standard number of lbs. of brass 2 lbs. Standard price per lb. of brass $11.25 Actual price per lb. of brass $11.5 Actual lbs. of brass used during the week 17,922 lbs. Number of units produced during the week 8,700 Actual wage per hour $16.07 Actual hours for the week (30 employees × 40 hours) 1,200 hrs. Required: a. Determine the standard cost per unit for direct materials and direct labor. Round the cost per unit to two decimal places. Direct materials standard cost per unit $fill in the blank 1 Direct labor standard cost per unit $fill in the blank 2 Total standard cost per unit $fill in…arrow_forwardQuestion Grant Company's standard materials cost per unit of output is $10.00 (2.00 pounds x $5.00 per pound). During July, the company purchases and uses 2,420 pounds of materials costing $12,826 in making 1,100 units of finished product. Compute the total material variance. O $726 unfavorable O $1,826 favorable O $2,926 unfavorable O $1,826 unfavorablearrow_forwardQuestion 3 Owen plc manufactures one product, and the entire product is sold as soon as it is produced. The company operates a standard costing system and analysis of variances is made every month. The standard cost card for a product is as follows. Materials (4 Kg at £4 per Kg) Labour (4 Hours at £5 per hr) Variable overheads (5 hrs at £2 per hr) Fixed overheads (6 hrs at £3 per hr) Budgeted selling price is £80 per unit Budgeted production Budgeted sales There is no opening inventory The actual results are as follows: Sales: 8,400 units for £613,200 Production: 9,900 units Actual costs: Materials (35,464 kg): £163,455 Labour: £ 234,515 Variable overheads: £97,348 Fixed overheads: £ 144,074 £ per Unit 16 20 10 18 £64 8.900 units 8,200 units Required: a) Prepare a flexed budget and calculate the total variances b) Using the data, analyse each of the cost variances: Materials; Labour; Variable Overheads and; Fixed Overheads c) Using data, calculate the Sales price variance and the Sales…arrow_forward

- Current Attempt in Progress Blossom Company's standard labor cost of producing one unit of Product DD is 3.40 hours at the rate of $10.50 per hour. During August, 42,900 hours of labor are incurred at a cost of $10.70 per hour to produce 12,400 units of Product DD. (a) Compute the total labor variance. Total labor variance $ (b) Compute the labor price and quantity variances. Labor price variance Labor quantity variance $ (c) $ Labor price variance 16350 Compute the labor price and quantity variances, assuming the standard is 3.6 hours of direct labor at $10.85 per hour. $ Labor quantity variance $ Unfavorablearrow_forwardDirect Materials and Direct Labor Variance Analysis Abbeville Fixture Company manufactures units in a small manufacturing facility. The units are made from brass. Manufacturing has 30 employees. Each employee presently provides 40 hours of labor per week. Information about a production week is as follows: Standard wage per hour $12 Standard labor time per unit 15 min. Standard number of lbs. of brass 1.5 lbs. Standard price per lb. of brass $11.25 Actual price per lb. of brass $11.5 Actual lbs. of brass used during the week 9,734 lbs. Number of units produced during the week 6,300 Actual wage per hour $12.36 Actual hours for the week (30 employees × 40 hours) 1,200 hrs. Required: a. Determine the standard cost per unit for direct materials and direct labor. Round the cost per unit to two decimal places. Direct materials standard cost per unit $fill in the blank 1 Direct labor standard cost per unit $fill in the blank 2 Total standard cost per unit $fill in…arrow_forwardDirect Materials and Direct Labor Variance Analysis Abbeville Company manufactures faucets in a small manufacturing facility. The faucets are made from brass. Manufacturing has 40 employees. Each employee presently provides 32 hours of labor per week. Information about a production week is as follows: Standard wage per hr. $10.80 Standard labor time per faucet 10 min. Standard number of lb. of brass 1.30 lb. Standard price per lb. of brass $9.75 Actual price per lb. of brass $10.00 Actual lb. of brass used during the week 11,600 lb. Number of faucets produced during the week 8,700 Actual wage per hr. $11.10 Actual hrs. per week 1,280 hrs. Required: a. Determine the standard cost per faucet for direct materials and direct labor. Round the cost per unit to two decimal places. b. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost variance. Enter a favorable variance as a negative number using a minus…arrow_forward

- Provide correct answerarrow_forward15arrow_forwardDirect Materials and Direct Labor Variance Analysis Abbeville Company manufactures faucets in a small manufacturing facility. The faucets are made from brass. Manufacturing has 50 employees. Each employee presently provides 36 hours of labor per week. Information about a production week is as follows: Standard wage per hr. $13.80 Standard labor time per faucet 15 min. Standard number of lb. of brass 1.80 lb. Standard price per lb. of brass $10.00 Actual price per lb. of brass $10.25 Actual lb. of brass used during the week 12,800 lb. Number of faucets produced during the week 6,900 Actual wage per hr. $14.20 Actual hrs. per week 1,800 hrs. Required: a. Determine the standard cost per faucet for direct materials and direct labor. Round the cost per unit to two decimal places. Direct materials standard cost per unit $ Direct labor standard cost per unit $ Total standard cost per unit $ b. Determine the direct materials price variance, direct…arrow_forward

- Direct Materials, Direct Labor, and Factory Overhead Cost Variance Analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufact of 7,200 units of product were as follows: Direct materials Standard Costs 9,400 lb. at $5.80 1,800 hrs. at $16.50 Direct labor Factory overhead Rates per direct labor hr., based on 100% of normal Actual Costs 9,300 lb. at $5.60 1,840 hrs. at $16.90 capacity of 1,880 direct labor hrs.: Variable cost, $3.50 $6,240 variable cost Fixed cost, $5.50 $10,340 fixed cost Each unit requires 0.25 hour of direct labor. Required: a. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Direct materials price variance Direct materials quantity variance X Favorable X…arrow_forwardDirect Materials, Direct Labor, and Factory Overhead Cost Variance Analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 78,000 units of product were as follows: Standard Costs Actual Costs Direct materials 226,200 lbs. at $5.10 223,900 lbs. at $5.00 Direct labor 19,500 hrs. at $16.40 19,950 hrs. at $16.60 Factory overhead Rates per direct labor hr., based on 100% of normal capacity of 20,350 direct labor hrs.: Variable cost, $3.70 $71,430 variable cost Fixed cost, $5.80 $118,030 fixed cost Each unit requires 0.25 hour of direct labor. Required: a. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Direct Materials Price Variance Direct Materials Quantity Variance Total…arrow_forwardDirect Materials and Direct Labor Variance Analysis Abbeville Company manufactures faucets in a small manufacturing facility. The faucets are made from brass. Manufacturing has 70 employees. Each employee presently provides 40 hours of labor per week. Information about a production week is as follows: $17.40 20 min. 1.20 lb. Standard wage per hr. Standard labor time per faucet Standard number of lb. of brass Standard price per lb. of brass Actual price per lb. of brass Actual lb. of brass used during the week Number of faucets produced during the week Actual wage per hr. Actual hrs. for the week Required: $11.50 $11.75 7,400 lb. 6,000 $17.90 2,800 hrs. a. Determine the standard cost per unit for direct materials and direct labor. Do not round your intermediate calculations and round the cost per unit to two decimal places. Direct materials standard cost per unit Direct labor standard cost per unit Total standard cost per unit materials cost variance. Do not round your intermediatearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education