FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:Required:

a. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost variance. Enter a favorable variance as

a negative number using a minus sign and an unfavorable variance as a positive number.

Direct Materials Price Variance

Direct Materials Quantity Variance

Total Direct Materials Cost Variance

b. Determine the direct labor rate variance, direct labor time variance, and total direct labor cost variance. Enter a favorable variance as a negative

number using a minus sign and an unfavorable variance as a positive number.

Direct Labor Rate Variance

Direct Labor Time Variance

Total Direct Labor Cost Variance

c. Determine the variable factory overhead controllable variance, fixed factory overhead volume variance, and total factory overhead cost variance. Enter

a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number.

Variable factory overhead controllable variance

Fixed factory overhead volume variance

Total factory overhead cost variance

Draviou

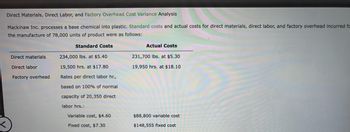

Transcribed Image Text:Direct Materials, Direct Labor, and Factory Overhead Cost Variance Analysis

Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred fc

the manufacture of 78,000 units of product were as follows:

Standard Costs

Direct materials

Direct labor

Factory overhead

234,000 lbs. at $5.40

19,500 hrs. at $17.80

Rates per direct labor hr.,

based on 100% of normal

capacity of 20,350 direct

labor hrs.:

Variable cost, $4.60

Fixed cost, $7.30

Actual Costs

231,700 lbs. at $5.30

19,950 hrs. at $18.10

$88,800 variable cost

$148,555 fixed cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Chulak Company uses a standard costing system. The following data are available for the month: Actual quantity of direct materials purchased 25,000 pounds Standard price of direct materials $2 per pound Material price variance $2,500 unfavorable The actual price per pound of direct materials purchased during the month isarrow_forwardJohnson Manufacturing uses a standard cost system. Standards for direct materials are as follows: Direct materials (pounds per unit of output) Cost per pound of direct materials 6 $7 The company produced 800 units and actually used 5,250 pounds of direct materials. What is the journal entry to record the materials usage? OA. Work in Process 33,600 Direct Materials Efficiency Variance 3,150 Raw Materials Inventory 36,750 B. Work in Process 39,900 Direct Materials Efficiency Variance 3,150 Raw Materials Inventory 36,750 OC. Work in Process 36,750 Direct Materials Efficiency Variance 3,150 Raw Materials Inventory 39,900 OD. Work in Process 36,750 Direct Materials Efficiency Variance 3,150 Raw Materials Inventory 33,600arrow_forwardMiguez Corporation makes a product with the following standard costs: Standard Quantity or Hours Standard Price or Rate Standard Cost Per Unit Direct materials 2.3 liters $ 7.00 per liter $ 16.10 Direct labor 0.7 hours $ 22.00 per hour $ 15.40 Variable overhead 0.7 hours $ 2.00 per hour $ 1.40 The company budgeted for production of 2,600 units in September, but actual production was 2,500 units. The company used 5,440 liters of direct material and 1,680 direct labor-hours to produce this output. The company purchased 5,800 liters of the direct material at $7.20 per liter. The actual direct labor rate was $24.10 per hour and the actual variable overhead rate was $1.90 per hour. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The labor rate variance for September is: Multiple Choice $3,675 F $3,528 U $3,528 F $3,675 Uarrow_forward

- Tharaldson Corporation makes a product with the following standard costs: Standard Quantity or Hours Standard Price or Rate Standard Cost Per Unit Direct materials 6.0 ounces $ 9.00 per ounce $ 54.00 Direct labor 0.7 hours $ 11.00 per hour $ 7.70 Variable overhead 0.7 hours $ 9.00 per hour $ 6.30 The company reported the following results concerning this product in June. Originally budgeted output 3,600 units Actual output 3,200 units Raw materials used in production 21,000 ounces Purchases of raw materials 20,900 ounces Actual direct labor-hours 5,000 hours Actual cost of raw materials purchases $ 42,100 Actual direct labor cost $ 13,600 Actual variable overhead cost $ 3,800 The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The materials quantity variance for June is:arrow_forwardBulluck Corporation makes a product with the following standard costs: Direct materials Direct labor Variable overhead Standard Quantity or Hours 3.5 grams 0.7 hours 0.7 hours The company reported the following results concerning this product in July. Actual output Raw materials used in production Actual direct labor-hours Purchases of raw materials Actual price of raw materials purchased Actual direct labor rate Actual variable overhead rate Standard Price or Rate $ 1.00 per gram $ 11.00 per hour $ 2.00 per hour The variable overhead rate variance for July is: 3,000 units 11,370 grams 1,910 hours 12,100 grams $ 1.20 per gram $11.40 per hour $ 2.10 per hour The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.arrow_forwardUnits produced Production runs per quarter Direct materials cost per unit Direct labor cost per unit Supervision Setup labor Incoming inspection Total overhead Manufacturing overhead in the plant has three main functions: supervision, setup labor, and Incoming material Inspection. Data on manufacturing overhead for a representative quarter follow: $ 288,750 336,000 241,500 $ 866,250 Standard 14,000 a. Using current costing system b. Using proposed ABC system 50 $30 50 Required: a. Compute the unit costs for the two products, Standard and Premium, using the current costing system at Benton (using direct labor costs as the allocation basis for overhead). b. Compute the unit costs for the two products, Standard and Premium, using the proposed ABC system at Benton. Note: For all requirements, do not round Intermediate calculations. Round your answers to 2 decimal places. S S Answer is complete but not entirely correct. Premium 3,500 25 $64 75 Unit cost Standard 120.00 X S 117.67 X S…arrow_forward

- Nevada Corporation makes a product with the following standard costs: Standard Price or Rate Standard Quantity or Hours 6.4 ounces $ 0.4 hours S 0.4 hours $ 3.00 per ounce 13.00 per hour 5.00 per hour The company reported the following results concerning this product in March. Direct materials Direct labor Variable overhead. Originally budgeted output Actual output Raw materials used in production Actual direct labor-hours Purchases of raw materials Actual price of raw materials Actual direct labor rate Actual variable overhead rate $ S $ O $3,277 F O $3,390 U O $3,390 F O $3,277 U Standard Cost Per Unit S S S 4,800 units 4,900 units 30,230 ounces 1,910 hours 32,600 ounces 2.90 per ounce 12.40 per hour 4.90 per hour 19.20 5.20 2.00 The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The materials quantity variance for March is:arrow_forwardThe following information relates to production activities of Mercer Manufacturing for the year. Actual direct materials used 17,300 pounds at $4.70 per pound Actual direct labor used 17,935 hours at $32 per hour Actual units produced 32,600 Standard quantity and price per unit for direct materials 0.50 pound at $4.65 per pound Standard quantity and rate per unit for direct labor 0.50 hour at $33 per hour AR = Actual RateSR = Standard RateAQ = Actual QuantitySQ = Standard QuantityAP = Actual PriceSP = Standard Price (1) Compute the direct materials price and quantity variances.(2) Compute the direct labor rate and efficiency variances.arrow_forwardMajer Corporation makes a product with the following standard costs: Standard Quantity or Hours Standard Price or Rate Standard Cost Per Unit Direct materials 6.5 ounces $ 2.00 per ounce $ 13.00 Direct labor 0.8 hours $ 18.00 per hour $ 14.40 Variable overhead 0.8 hours $ 2.00 per hour $ 1.60 The company reported the following results concerning this product in February. Originally budgeted output 4,600 units Actual output 5,300 units Raw materials used in production 30,500 ounces Actual direct labor-hours 2,110 hours Purchases of raw materials 34,400 ounces Actual price of raw materials $ 97.10 per ounce Actual direct labor rate $ 87.60 per hour Actual variable overhead rate $ 6.10 per hour The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The variable overhead efficiency variance for February is:arrow_forward

- Miguez Corporation makes a product with the following standard costs: Direct materials Direct labor Variable overhead Standard Quantity or Hours 4.0 liters 0.7 hours 0.7 hours Standard Price or Rate $ 8.70 per liter $ 39.00 per hour $ 3.70 per hour Standard Cost Per Unit $ 34.80 $ 27.30 $ 2.59 The company budgeted for production of 4,300 units in September, but actual production was 4,200 units. The company used 7,140 liters of direct material and 1,850 direct labor-hours to produce this output. The company purchased 7,500 liters of the direct material at $8.90 per liter. The actual direct labor rate was $41.10 per hour and the actual variable overhead rate was $3.60 per hour. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The variable overhead rate variance for September is: Multiple Choice О $294 F О О о $185 U $185 F $294 Uarrow_forwardSantiago Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 74,000 units of product were as follows: Actual Costs Direct Materials, Direct Labor, and Factory Overhead Cost Variance Analysis Standard Costs Direct materials 192,400 lbs. at $5.10 per lb. 190,500 lbs. at $5.00 per lb. Direct labor 18,500 hrs. at $16.90 per hr. 18,930 hrs. at $17.30 per hr. Factory overhead Rates per direct labor hr., based on 100% of normal capacity of 19,310 direct labor hrs.: Variable cost, $3.70 Fixed cost, $5.80 $67,770 variable cost $111,998 fixed cost Each unit requires 0.25 hour of direct labor. Required: a. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Direct Materials Price Variance Direct…arrow_forwardTharaldson Corporation makes a product with the following standard costs: Direct materials Direct labor Variable overhead Standard Quantity or Hours 7.1 ounces 0.2 hours 0.2 hours Standard Price or Rate Standard Cost Per Unit $ 28.40 $ 4.00 per ounce $ 11.00 per hour $ 2.20 $ 4.00 per hour $ 0.80 The company reported the following results concerning this product in June. Originally budgeted output Actual output Raw materials used in production 2,500 units 3,000 units 21,500 ounces Purchases of raw materials Actual direct labor-hours Actual cost of raw materials purchases Actual direct labor cost Actual variable overhead cost 22,500 ounces 560 hours $ 45,100 $ 12,500 $ 3,250 The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The labor rate variance for June is: Multiple Choice $306 F $6.340 U $306 U $6,340 Farrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education