FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

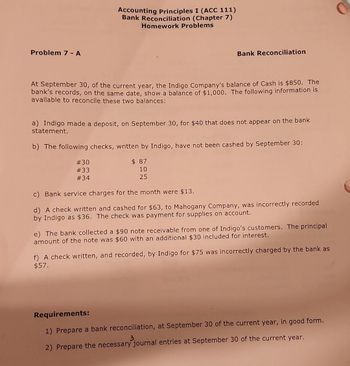

Transcribed Image Text:Problem 7 - A

Accounting Principles I (ACC 111)

Bank Reconciliation (Chapter 7)

Homework Problems

Bank Reconciliation

At September 30, of the current year, the Indigo Company's balance of Cash is $850. The

bank's records, on the same date, show a balance of $1,000. The following information is

available to reconcile these two balances:

a) Indigo made a deposit, on September 30, for $40 that does not appear on the bank

statement.

#30

#33

#34

b) The following checks, written by Indigo, have not been cashed by September 30:

$ 87

10

25

c) Bank service charges for the month were $13.

d) A check written and cashed for $63, to Mahogany Company, was incorrectly recorded

by Indigo as $36. The check was payment for supplies on account.

e) The bank collected a $90 note receivable from one of Indigo's customers. The principal

amount of the note was $60 with an additional $30 included for interest.

f) A check written, and recorded, by Indigo for $75 was incorrectly charged by the bank as

$57.

Requirements:

1) Prepare a bank reconciliation, at September 30 of the current year, in good form.

3.

2) Prepare the necessary journal entries at September 30 of the current year.

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hello please give me Answerarrow_forwardRequired information Problem 6-4A (Algo) Preparing a bank reconciliation and recording entries LO P3 [The following information applies to the questions displayed below.] The following information is available to reconcile Branch Company's book balance of cash with its bank statement cash balance as of July 31. a. On July 31, the company's Cash account has a $25,640 debit balance, but its July bank statement shows a $28,276 cash balance. b. Check Number 3031 for $1,620, Check Number 3065 for $586, and Check Number 3069 for $2,388 are outstanding checks as of July 31. c. Check Number 3056 for July rent expense was correctly written and drawn for $1,230 but was erroneously entered in the accounting records as $1,220. d. The July bank statement shows the bank collected $7,500 cash on a note for Branch. Branch had not recorded this event before receiving the statement. e. The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet…arrow_forwardaj.8arrow_forward

- Thanks!arrow_forwardQUESTION 9 The Gatedown Company's bank statement has an ending cash balance of $14,110.00. The cash account in the general ledger has a balance of $12,477.00. Based on the following reconciling items, prepare a bank reconciliation. a) Bank service charge of $20.00 b) Deposit in transit $3,190.00 c) A check was returned NSF $645.00 d) Outstanding check $688.00 e) Note collected by the bank, credit memoranda, $4,800.00 What is the total of subtractions to arrive at the book balance? A) 645.00 B) 555.00arrow_forwardplease provide correct solution of this questionarrow_forward

- Question Content Area Thompson Corporation gathered the following reconciling information in preparing its October bank reconciliation: Cash balance per bank, 10/31 $15,965 Note receivable collected by bank 4,859 Outstanding checks 9,437 Deposits in transit 4,203 Bank service charge 201 NSF check 1,307 Using the above information, determine the cash balance per books (before adjustments) for Thompson Corporation. a.$19,316 b.$7,380 c.$14,082 d.$10,731arrow_forwardIn a bank reconciliation, to adjust for the bank's deducting $980 for a company check that you wrote and booked for $890 requires A. increasing the book balance by $90 B. reducing the book balance by $90 C. increasing the bank balance by 590 D. reducing the bank balance by $90arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education