Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

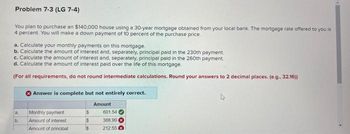

Transcribed Image Text:Problem 7-3 (LG 7-4)

You plan to purchase an $140,000 house using a 30-year mortgage obtained from your local bank. The mortgage rate offered to you is

4 percent. You will make a down payment of 10 percent of the purchase price.

a. Calculate your monthly payments on this mortgage.

b. Calculate the amount of interest and, separately, principal paid in the 230th payment.

c. Calculate the amount of interest and, separately, principal paid in the 260th payment.

d. Calculate the amount of interest paid over the life of this mortgage.

(For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places. (e.g.. 32.16))

a,

b.

Answer is complete but not entirely correct.

Amount

Monthly payment

Amount of interest

Amount of principal

$

$

$

601.54

388.99

212.55

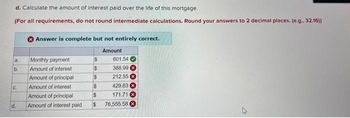

Transcribed Image Text:d. Calculate the amount of interest paid over the life of this mortgage.

(For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16))

a.

b.

C.

d.

Answer is complete but not entirely correct.

Amount

Monthly payment

Amount of interest

Amount of principal

Amount of interest

Amount of principal

Amount of interest paid

$

$

601.54

388.99 X

212.55

$ 429.83

$

171.71

$ 76,555.58

$

2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 12. Amortized loans Mortgages and other amortized loans (meaning equal or blended payments) involve regular payments at fixed intervals. These are sometimes called reverse annuities, because you get a lump-sum amount as a loan in the beginning, and then you make the periodic payments (usually monthly or more frequently, depending on the agreement) to the lender. You've decided to buy a house that is valued at $1 million. You have $400,000 to use as a down payment on the house, and you take out a mortgage for the rest. Your bank has approved your mortgage for the balance amount of $600,000 and is offering you a 25-year mortgage with 12% fixed nominal interest rate (called the APR, or Annual Percentage Rate) compounded semiannually. According to this proposal, what will be your monthly mortgage payment? OOO $7,740 $6,192 $8,359 $9,598 Your friends suggest that you take a 15-year mortgage, because a 25-year mortgage is too long and you will lose a lot of money on interest. If your bank…arrow_forwardaa.2 Joe purchases a $100,000 home. Mortgage payments are to be made monthly for 30 years, with the first payment to be made one month from now. The annual effective rate of interest is 5%. After 10 years, the amount of each monthly payment is increased by $325.40 in order to repay the mortgage more quickly. Calculate the amount of interest paid over the duration of the loan.arrow_forwardQuestion 1 A family has a 30-year $880, 000 mortgage at 8% compounded monthly. (1) Find the monthly payment and the total interest paid (2) After 10 years, suppose the family decides to add an extra $150 to its mortgage payment each month. How long will it take the family to pay off the remain mortgage? (3) How much interest will the family save?arrow_forward

- Date Name Section 8.7 - Worksheet The Cost of Home Ownership Comparing Mortgage Interest for 30-year rate vs 15-year rate. In the lesson notes example, the $175,500 mortgage was financed with a 30-year fixed rate at 7.5%. The total interest paid over 30 years was approximately $266,220. a) Use the loan payment formula for installment loans to find the monthly payment if the time of the mortgage is reduced to 15 years. Round to the nearest dollar. b) Find the total interest paid over 15 years. c) How much interest is saved by reducing the mortgage from 30 to 15 years?arrow_forwardson.3arrow_forwardChapter 7 Self Test Problem #2arrow_forward

- 13. Mortgage payments Mortgages, loans taken to purchase a property, involve regular payments at fixed intervals and are treated as reverse annuities. Mortgages are the reverse of annuities, because you get a lump-sum amount as a loan in the beginning, and then you make monthly payments to the lender. You've decided to buy a house that is valued at $1 million. You have $100,000 to use as a down payment on the house, and want to take out a mortgage for the remainder of the purchase price. Your bank has approved your $900,000 mortgage, and is offering a standard 30-year mortgage at a 10% fixed nominal interest rate (called the loan's annual percentage rate or APR). Under this loan proposal, your mortgage payment will be per month. (Note: Round the final value of any interest rate used to four decimal places.) Your friends suggest that you take a 15-year mortgage, because a 30-year mortgage is too long and you will pay a lot of money on interest. If your bank approves a 15-year, $900,000…arrow_forwardProblem 6-10 A borrower is making a choice between a mortgage with monthly payments or biweekly payments. The loan will be $200,000 at 6 percent interest for 20 years. Required: a. What would be the maturity period if payments are bi-weekly? How much will the borrower pay in total under each payment option? Which choice would be less costly to the borrower? b. Assume that the bi-weekly loan was available for 575% What would be the maturity period if payments are bi-weekly? How much will the borrower pay in total under each payment option? Which choice would be less costly to the borrower? Complete this question by entering your answers in the tabs below. Required A Required B What would be the maturity period if payments are bi-weekly? How much will the borrower pay in total under each payment option? Which choice would be less costly to the borrower? (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Maturity period Total monthly payments Total…arrow_forwardWhat interest rate would it take for a 30 year mortgage to buy a $415,000 house with a $2,000 monthly payment? 3. A) 3.636% 4. B) 4.078% 5. C) 4.276% 6. D) 4.897% N= 360arrow_forward

- Narrative 14-1For problems in this section, use Table 14-1 from your text to find the monthly mortgage payments, whennecessary. Refer to Narrative 14-1. You purchase a home for $69,750 at 6.75% for 30 years. The property taxes are $2,450per year, and the hazard insurance premium is $256 semiannually. Find the monthly PITI payment. Group of answer choices 699.51 $594.73 $1,059.40 $246.83arrow_forwardQUESTIONS 1,2,3 ARE CONNECTED. I SOLVED QUESTIONS 1 and 2 and need help solving QUESTION 3 ONLY 1. A bank customer obtains a $150,000 mortgage with a term of 15 years and a nominal interest rate of 4.20%. The monthly debt service/payment for the mortgage : Answer - $1,124.63 2) If the homeowner makes the minimum monthly required payments on the mortgage, what is the balance on the mortgage after 5 years – i.e. after the 60th payment is made: Answer - $110,043.38 3) Assume the homeowner has made the minimum required monthly payments on the mortgage and 5 years have passed. If the homeowner’s income has increased and he/she decides to increase the monthly payments to $1500, how many months and years will it take to retire the mortgage? Months Years? *PLEASE SOLVE #3 USING EXCEL ONLY AND SHOW THE FUNCTIONS/FORMULAS USED*arrow_forwardProblem 7-3 (LG 7-4) You plan to purchase an $110,000 house using a 15-year mortgage obtained from your local bank. The mortgage rate offered to you is 4.25 percent. You will make a down payment of 12 percent of the purchase price. a. Calculate your monthly payments on this mortgage. b. Calculate the amount of interest and, separately, principal paid in the 100th payment. c. Calculate the amount of interest and, separately, principal paid in the 115th payment. d. Calculate the amount of interest paid over the life of this mortgage. (For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) a. Monthly payment b. Amount of interest Amount of principal C. Amount of interest Amount of principal d. Amount of interest paid Amountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education