Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:13. Mortgage payments

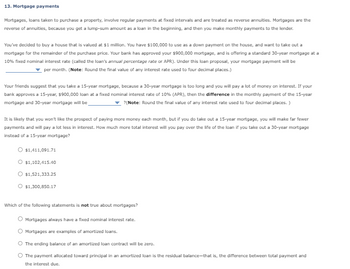

Mortgages, loans taken to purchase a property, involve regular payments at fixed intervals and are treated as reverse annuities. Mortgages are the

reverse of annuities, because you get a lump-sum amount as a loan in the beginning, and then you make monthly payments to the lender.

You've decided to buy a house that is valued at $1 million. You have $100,000 to use as a down payment on the house, and want to take out a

mortgage for the remainder of the purchase price. Your bank has approved your $900,000 mortgage, and is offering a standard 30-year mortgage at a

10% fixed nominal interest rate (called the loan's annual percentage rate or APR). Under this loan proposal, your mortgage payment will be

per month. (Note: Round the final value of any interest rate used to four decimal places.)

Your friends suggest that you take a 15-year mortgage, because a 30-year mortgage is too long and you will pay a lot of money on interest. If your

bank approves a 15-year, $900,000 loan at a fixed nominal interest rate of 10% (APR), then the difference in the monthly payment of the 15-year

mortgage and 30-year mortgage will be

?(Note: Round the final value of any interest rate used to four decimal places.)

It is likely that you won't like the prospect of paying more money each month, but if you do take out a 15-year mortgage, you will make far fewer

payments and will pay a lot less in interest. How much more total interest will you pay over the life of the loan if you take out a 30-year mortgage

instead of a 15-year mortgage?

$1,411,091.71

O $1,102,415.40

$1,521,333.25

O $1,300,850.17

Which of the following statements is not true about mortgages?

Mortgages always have a fixed nominal interest rate.

Mortgages are examples of amortized loans.

The ending balance of an amortized loan contract will be zero.

The payment allocated toward principal in an amortized loan is the residual balance-that is, the difference between total payment and

the interest due.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A. what is the Monthly Payment ? what is the total interest paid ? B. time to pay off mortgage if extra $100 is added ? total interest saved ? I will rate thakn you!arrow_forward(Q) You would like to purchase a home and are interested to find out how much you can borrow. When your lender calculates your debt to income ratio, he determines that your maximum monthly payment can be no more than $3, 200. You would like to have a 30 year fully amortizing loan and the interest rate offered on such a loan is currently 8.5%. Given these constraints, what is the largest loan you can obtain?arrow_forwardAnswer the following question using a spreadsheet and the material in the appendix. You would like to buy a house. Assume that given your income, you can afford to pay $12,000 a year to a lender for the next 30 years. If the interest rate is 7% how much can you borrow today based on your ability to pay? What about if the interest rate is 3%? Maximum mortgage at 7%: $ Maximum mortgage at 3%: $arrow_forward

- Suppose you want to purchase a house. Your take-home pay is $4270 per month, and you wish to stay within the recommended guidelines for mortgage amounts by only spending 1/4 of your take-home pay on a house payment. You have $18,500 saved for a down payment and you can get an APR from your bank of 5.7%, compounded monthly. What is the total cost of a house you could afford with a 3030-year mortgage? Round your answer to the nearest cent, if necessary.arrow_forwardWhat is amortization? Describe other types of loan arrangements. If you could afford to pay cash for a home, is it worth it to take a mortgage out anyway? If no, why not. If yes, why. Here are the variables:30 year amortized mortgage at 5% fixedInvestment opportunity at 3.5% fixedPrice of the home is $500,000. You’ll either invest $400,000 and make a down payment on the house of $100,000 and mortgage the rest. Hint: Find out if the interest earned on the investment is more or less than the interest made on the investment.arrow_forwardYour have just sold your house for $1,000,000 in cash. Your mortgage was originally a 30-year mortgage with monthly payments and an initial balance of $800,000. The mortgage is currently exactly 18.50 years old, and you have just made a payment. If the interest rate on the mortgage is 5.25% (APR), how much cash will you have from the sale once you pay off the mortgage? (Ignore any real estate transaction costs.) .…. The discount rate is % per month. The monthly mortgage payment is $ The remaining balance is $ (Round to the nearest dollar.) The cash that remains after payoff of the mortgage is $ (Round to five decimal places.) (Round to the nearest cent.) (Round to the nearest dollar.)arrow_forward

- a You want to buy house that costs $170,000. You have $17,000 for a down payment, but your credit is such that mortgage companies will not lend you the required $153,000. However, the realtor persuades the seller to take $153,000 mortgage called a seller take-back mortgage) at a rate of 8% provided the loan is paid off in full in 3 years. expect to inhent $170,000 in 3 years, but light now all you have is $17,000 and you can afford to make payments of no more than $19,000 per year given your salary. (The loan would call for monthly payments, but assume things.) end-of-year annual payments to simplify p a) If the loan was amortized over 3 years, how large would each annual payment be? Round your answer to the nearest cent b) If the loan was amortized over 30 years, What would each payment be? Round your answer to the nearest cent. C) To satisfy the seller, the 30-year mortgage loan would be written as a balloun note, which means at the end of the third year, you would have to make thearrow_forward17) You want to buy a house and will need to borrow $215,000. The interest rate on your loan is 5.41 percent compounded monthly and the loan is for 30 years. What are your monthly mortgage payments?arrow_forwardYou own a home that was recently appraised for $370,000. The balance on your existing mortgage is $129,350. If your bank is willing to loan up to 70% of the appraised value, what is the potential amount (in $) of credit available on a home equity loan? 2$arrow_forward

- Subject: Financearrow_forward13) Some financial advisors recommend that your monthly mortgage payment be no higher than 28% of your monthly net income. What is 28% of your monthly net income, as determined in question twelve? This is the estimated amount you can afford per month for a mortgage. 4,518*0.28 $1,265 28% of my monthly net income is $1,265. 14) We can calculate how much of a house you can afford using the loan formula. In question thirteen, you determined the monthly mortgage payment you can afford. Using this value for the regular monthly payment, calculate the present value (P), assuming you receive a 30-year mortgage (loan) with an annual interest rate of 6.328% with monthly compounding. (Note: This rate is realistic for a mortgage initiated in January 2024.) I need to use Loan formula to find the present value (P). please help mearrow_forwardMany mortgage company allow youto "buy down" your interest rate of your loan by buying points. A point is equal to 1% of your mortgage amount (or $1,000 for every $100,000). You're essentially paying some interest up front in exchange for a lower interest rate over the life of your loan. Find the following payments and total cost (including points) of a $170,000.00 that is borrowed for 30 years with a) 6, % compounded monthly with no points $ The total cost would be $ 1 b) 6– % compounded monthly with 1 point $ 4. The total cost would be $ c) 6% compounded monthly with 2 points $ The total cost would be $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education