FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

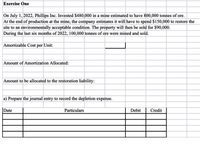

Transcribed Image Text:Exercise One

On July 1, 2022, Phillips Inc. Invested $480,000 in a mine estimated to have 800,000 tonnes of ore.

At the end of production at the mine, the company estimates it will have to spend $150,000 to restore the

site to an environmentally acceptable condition. The property will then be sold for $90,000.

During the last six months of 2022, 100,000 tonnes of ore were mined and sold.

Amortizable Cost per Unit:

Amount of Amortization Allocated:

Amount to be allocated to the restoration liability:

a) Prepare the journal entry to record the depletion expense.

Date

Particulars

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardA company purchased land containing mineral deposits for $6,400,000 on January 1, 2021. The company expects to mine 1,600,000 tons of mineral over the next six years. The company has also purchased mining equipment for $800,000. The equipment has an estimated residual value of $160,000 and an expected life of 10 years and can be used at other mining sites. By the end of 2021, the company has mined and sold 240,000 tons. Management calculates depreciation of the equipment to be $96,000 [($800,000 − $160,000) × (240,000 tons/1,600,000 tons)]. Which of the following statements is correct? Multiple Choice Management should depreciate the equipment evenly over six years. Management should not subtract the residual value in calculating depreciation. Management should depreciate the equipment over 10 years. Management’s calculation is correct.arrow_forwardOn April 17, 2024, the Loadstone Mining Company purchased the rights to a copper mine. The purchase price plus additional costs necessary to prepare the mine for extraction of the copper totaled $5,200,000. The company expects to extract 1,040,000 tons of copper during a four-year period. During 2024, 254,000 tons were extracted and sold immediately. Required: Calculate depletion for 2024. Is depletion considered part of the product cost and included in the cost of inventory?arrow_forward

- Depletion On January 2, 2016, Spring Company purchased land for $470,000, from which it is estimated that 360,000 tons of ore could be extracted. It estimates that the present value of the cost necessary to restore the land is $67,000, after which it could be sold for $22,000. During 2016, Spring mined 79,000 tons and sold 59,000 tons. During 2017, Spring mined 99,000 tons and sold 109,000 tons. At the beginning of 2018, Spring spent an additional $110,000, which increased the reserves by 62,000 tons. In 2018, Spring mined 129,000 tons and sold 109,000 tons. Spring uses a FIFO cost flow assumption. Required: 1. Calculate the depletion included in the income statement and ending inventory for 2016, 2017, and 2018. Round the depletion rate to the nearest cent. If required, round the final answers to the nearest dollar.2016 Depletion deducted from income 84,370Depletion included in inventory 28,6002017 Depletion deducted from income 155,870Depletion included…arrow_forwardA coal company invests $20 million in a mine estimated to have 25 million tons of coal and no salvage value. It is expected that the mine will be in operation for 5 years. In the first year, 1070000 tons of coal are extracted and sold. What is the depletion for the first year? O $85600 O $856000 $256800 O Cannot be determined from the information providedarrow_forwardff1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education