FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I do not know which part I did wrong. Could you help me how to complete it correctly, please?

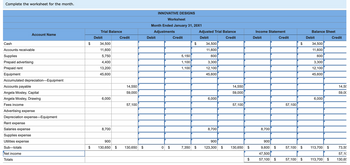

Transcribed Image Text:Complete the worksheet for the month.

Account Name

Cash

Accounts receivable

Supplies

Prepaid advertising

Prepaid rent

Equipment

Accumulated depreciation-Equipment

Accounts payable

Angela Mosley, Capital

Angela Mosley, Drawing

Fees income

Advertising expense

Depreciation expense-Equipment

Rent expense

Salaries expense

Supplies expense

Utilities expense

Sub-totals

Net income

Totals

$

$

Trial Balance

Debit

34,500

11,600

5,750

4,400

13,200

45,600

6,000

8,700

Credit

14,550

59,000

57,100

900

130,650 $ 130,650

$

INNOVATIVE DESIGNS

Worksheet

Month Ended January 31, 20X1

Adjustments

Debit

0 $

Credit

5,150

1,100

1,100

7,350

$

$

Adjusted Trial Balance

Debit

Credit

34,500

11,600

600

3,300

12,100

45,600

6,000

8,700

900

123,300

$

14,550

59,000

57,100

130,650 $

$

Income Statement

Debit

8,700

900

9,600

47,500

57,100 $

$

Credit

57,100

57,100

$

$

57,100 $

Balance Sheet

Debit

34,500

11,600

600

3,300

12,100

45,600

6,000

113,700 $

113,700

$

Credit

14,55

59,00

73,55

57,10

130,65

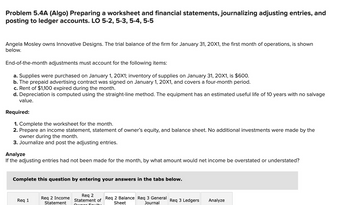

Transcribed Image Text:Problem 5.4A (Algo) Preparing a worksheet and financial statements, journalizing adjusting entries, and

posting to ledger accounts. LO 5-2, 5-3, 5-4, 5-5

Angela Mosley owns Innovative Designs. The trial balance of the firm for January 31, 20X1, the first month of operations, is shown

below.

End-of-the-month adjustments must account for the following items:

a. Supplies were purchased on January 1, 20X1; inventory of supplies on January 31, 20X1, is $600.

b. The prepaid advertising contract was signed on January 1, 20X1, and covers a four-month period.

c. Rent of $1,100 expired during the month.

d. Depreciation is computed using the straight-line method. The equipment has an estimated useful life of 10 years with no salvage

value.

Required:

1. Complete the worksheet for the month.

2. Prepare an income statement, statement of owner's equity, and balance sheet. No additional investments were made by the

owner during the month.

3. Journalize and post the adjusting entries.

Analyze

If the adjusting entries had not been made for the month, by what amount would net income be overstated or understated?

Complete this question by entering your answers in the tabs below.

Req 1

Req 2 Income

Statement

Req 2

Statement of

Owner Equity

Req 2 Balance Req 3 General

Sheet

Journal

Req 3 Ledgers Analyze

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I'm confused as to how to startarrow_forwardPlease do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!arrow_forwardHello, the explanation you offered is not very clear. Can you tell me what I did wrong?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education