FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

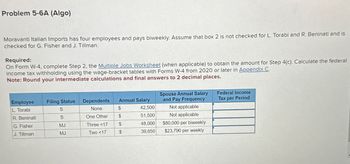

Transcribed Image Text:Problem 5-6A (Algo)

Moravanti Italian Imports has four employees and pays biweekly. Assume that box 2 is not checked for L. Torabi and R. Beninati and is

checked for G. Fisher and J. Tillman.

Required:

On Form W-4, complete Step 2, the Multiple Jobs Worksheet (when applicable) to obtain the amount for Step 4(c). Calculate the federal

income tax withholding using the wage-bracket tables with Forms W-4 from 2020 or later in Appendix C.

Note: Round your intermediate calculations and final answers to 2 decimal places.

Employee

L. Torabi

R. Beninati

G. Fisher

J. Tillman

Filing Status

S

S

MJ

MJ

Dependents

None

One Other

Three <17

Two <17

Annual Salary

$

$

$

$

42,500

51,500

48,000

39,650

Spouse Annual Salary

and Pay Frequency

Not applicable

Not applicable

$80,000 per biweekly

$23,790 per weekly

Federal Income

Tax per Period

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- PAYROLL REGISTER AND PAYROLL JOURNAL ENTRY Mary Losch operates a travel agency called Mary'sLuxury Travel. She has five employees,all of whom are paid on a weekly basis.The travel agency uses a payroll register, individual employee earnings records, and a generaljournal . Mary's Luxury Travel uses a weekly federal income tax withholding table like the one in Figure 8-4 on pages 288 and 289.The payroll data for each employee for the week ended March 22,20-, are given below_ Employees are paid 1Y,times the regular rate for working over 40 hours a week. $128,400 of earnings at the rate of 6.2%. Medicare tax is withheld at the rate of 1.45%, and city earnings tax at the rate of 1%, both applied to gross pay.Bacon and Leung have $15 withheld and Cole and Hicks have $10 withheld for health insurance.Bacon and Leung have$20 withheld to be invested in the travel agency's credit union. Cole has $38.75 withheld and Hicks has $18.75 withheld under a savings bond purchase plan. Mary's Luxury…arrow_forwardSubject: accountingarrow_forwardN3. Accountarrow_forward

- Ashavinbhaiarrow_forwardThe following salaried employees of Mountain Stone Brewery in Fort Collins, Colorado, are paid semimonthly. Some employees have union dues or garnishments deducted from their pay. You do not need to complete the number of hours. Required: Calculate their net pay using the percentage method for manual payroll systems with Forms W-4 from 2020 or later in Appendix C to determine federal income tax. Assume box 2 is not checked for any employee. Include Colorado income tax of 4.55 percent of taxable pay. No employee has exceeded the maximum FICA limit. Note: Round your intermediate calculations and final answers to 2 decimal places. Employee S. Bergstrom C. Pare L. Van der Hooven S. Lightfoot Filing Status, Dependents MJ-0 MJ-2 (<17) S-1 (Other) MJ-0 Pay 1,820 $ $ 3,740 $ $ 3,465 3,090 LA A Union Dues per Period $ $ 120 240 Garnishment per Period $ $ $ 50 75 100 Net Payarrow_forwardProblem 5-6A (Algo) Moravanti Italian Imports has four employees and pays biweekly. Assume that box 2 is not checked for L. Torabi and R. Beninati and is checked for G. Fisher and J. Tillman. Required: On Form W-4, complete Step 2, the Multiple Jobs Worksheet (when applicable) to obtain the amount for Step 4(c). Calculate the feder income tax withholding using the wage-bracket tables with Forms W-4 from 2020 or later in Appendix C. Note: Round your intermediate calculations and final answers to 2 decimal places. Employee L. Torabi Filing Status Dependents Annual Salary Spouse Annual Salary and Pay Frequency Federal Income Tax per Period S None $ 46,100 Not applicable R. Beninati S One Other $ 55,100 Not applicable G. Fisher MJ Three <17 $ 52,000 $80,000 per biweekly 292.31 J. Tillman MJ Two <17 $ 36,350 $21,810 per weeklyarrow_forward

- Edward Dorsey is a part-time employee, and during the biweekly pay period he earned $395. In addition, he is being paid a bonus of $300 along with his regular pay. If Dorsey is single and claims two withholding allowances, how much would be deducted from his pay for FIT? Hint: There are two ways to determine his deduction—do not use tables for percentage method. a. Wage-bracket table $ b. Percentage methodarrow_forwardVishuarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- ALT-TWO-PAYROLL-ENTRIES Using the data below, make the entry for the Employees' payrollI AND the employer's Payroll Taxes. Carnaby Company has five employees. The total salaries of the employees is $12,400. The company prepares the payroll entry, using a social security rate of 6%, and a Medicare rate of 1.5%. The Federal income tax withholding is given as $3,200. Prepare the entry for the employees' payroll. Salaries Expense Social Security Tax Payable Medicare Tax Payable Employee Federal Income Tax Payable Wages Payable SHOW FINAL BALANCES OF THESE ACCOUNTS AFTER BOTH ENTRIES Carnaby also makes the entry to accrue the payroll taxes. The company matches HAVE BEEN MADE. USE GREEN CELL FOR FINAL BALANCE. the social security and Medicare amounts, and computes State Unemployment at the rate of 5.4% of salaries earned. The Federal Unemployment rate is.8%. SOCIAL SEC. TAX PAYABLE Prepare the entry for the employer's payroll taxes. Payroll Tax Expense Social Security Tax Payable Medicare…arrow_forwardKk8.arrow_forwardayroll Register and Payroll Journal Entry 1. Prepare a payroll register for Mary’s Luxury Travel for the week ended March 22, 20--. (In the Taxable Earnings/Unemployment Compensation column, enter the same amounts as in the Social Security column.) Total the amount columns. Round your answers to the nearest cent. 2. Assuming that the wages for the week ended March 22 were paid on March 24, prepare the journal entry for the payment of the payroll. When required, enter amounts in dollars and cents. If an amount box does not require an entry, leave it blank. Mary Losch operates a travel agency called Mary’s Luxury Travel. She has five employees, all of whom are paid on a weekly basis. The travel agency uses a payroll register, individual employee earnings records, and a general journal. Mary’s Luxury Travel uses a weekly federal income tax withholding table. Refer to Figure 8-4 in the text. The payroll data for each employee for the week ended March 22, 20—, are given below. Employees…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education