FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

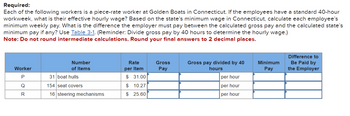

Transcribed Image Text:Required:

Each of the following workers is a piece-rate worker at Golden Boats in Connecticut. If the employees have a standard 40-hour

workweek, what is their effective hourly wage? Based on the state's minimum wage in Connecticut, calculate each employee's

minimum weekly pay. What is the difference the employer must pay between the calculated gross pay and the calculated state's

minimum pay if any? Use Table 3-1. (Reminder: Divide gross pay by 40 hours to determine the hourly wage.)

Note: Do not round intermediate calculations. Round your final answers to 2 decimal places.

Difference to

PCR

Worker

Р

Number

of Items

31 boat hulls

Rate

per Item

$ 31.00

Gross

Pay

Gross pay divided by 40

hours

Minimum

Pay

Be Paid by

the Employer

per hour

Q

154 seat covers

$ 10.27

per hour

16 steering mechanisms

$ 25.60

per hour

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following salaried employees of Mountain Stone Brewery in Fort Collins, Colorado, are paid semimonthly. Some employees have union dues or garnishments deducted from their pay. You do not need to complete the number of hours. Required: Calculate their net pay using the percentage method for manual payroll systems with Forms W-4 from 2020 or later in Appendix C to determine federal income tax. Assume box 2 is not checked for any employee. Include Colorado income tax of 4.55 percent of taxable pay. No employee has exceeded the maximum FICA limit. Note: Round your intermediate calculations and final answers to 2 decimal places. Employee S. Bergstrom C. Pare L. Van der Hooven S. Lightfoot Filing Status, Dependents MJ-0 MJ-2 (<17) S-1 (Other) MJ-0 Pay 1,820 $ $ 3,740 $ $ 3,465 3,090 LA A Union Dues per Period $ $ 120 240 Garnishment per Period $ $ $ 50 75 100 Net Payarrow_forwardYou are required to manually calculate the wages for Aaron for the week ending 22 July 2022 based on the information provided below. A template is provided for recording the calculations. • Aaron's hourly rate is $45 per hour and he is paid overtime at time and a half for hours in excess of 38 hours each week. He claims the tax free threshold for this job and PAYG is to be deducted in accordance with ATO requirements • Aaron has a salary sacrifice agreement with his employer and sacrifices $80 per week to superannuation. As part of this agreement Superannuation Guarantee payments are paid on ordinary time earnings prior to salary sacrifice. • Aaron is paid a car allowance at the standard ATO rate of 78 cents per kilometre For the week ended 22nd July 2022 Aaron worked a total of 42 hours and travelled 35 kilometres for work in his car. Complete the pay calculations for the week in the table below. Ensure that your calculations for PAYG withholding and superannuation guarantee comply…arrow_forwardAshvinarrow_forward

- Computing Net Pay Mary Sue Guild works for a company that pays its employees 1½ times the regular rate for all hours worked in excess of 40 per week. Guild's pay rate is $13.00 per hour. Her wages are subject to deductions for federal income tax, Social Security tax, and Medicare tax. She is married and claims four withholding allowances. Guild has a ½-hour lunch break during an 8½-hour day. Her time card is shown. Name Mary Sue Guild Week Ending March 30, 20-- Hours Worked Day In Out In Out Regular Overtime M 7:57 12:05 12:35 4:33 8 T 7:52 12:09 12:39 5:05 8 ½ W 7:59 12:15 12:45 5:30 8 1 T 8:00 12:01 12:30 6:31 8 2 F 7:56 12:05 12:34 4:30 8 S 8:00 10:31 2½ Complete the following for the week: a. fill in the blank 1 regular hours × $13.00 per hour $fill in the blank 2 b. fill in the blank 3 overtime hours × $19.50 per hour $fill in the blank 4 c. Total gross wages $fill in the blank 5 d. Federal income tax…arrow_forwardEdward Dorsey is a part-time employee, and during the biweekly pay period he earned $395. In addition, he is being paid a bonus of $300 along with his regular pay. If Dorsey is single and claims two withholding allowances, how much would be deducted from his pay for FIT? Hint: There are two ways to determine his deduction—do not use tables for percentage method. a. Wage-bracket table $ b. Percentage methodarrow_forwardThe following salaried employees of Mountain Stone Brewery in Fort Collins, Colorado, are paid semimonthly. Some employees have union dues or garnishments deducted from their pay. You do not need to complete the number of hours. Required: Calculate their net pay using the percentage method for manual payroll systems with Forms W-4 from 2020 or later in Appendix C to determine federal income tax. Assume box 2 is not checked for any employee. Include Colorado income tax of 4.55 percent of taxable pay. No employee has exceeded the maximum FICA limit. Note: Round your intermediate calculations and final answers to 2 decimal places. Employee S. Bergstrom C. Pare L. Van der Hooven S. Lightfoot Filing Status, Dependents MJ-0 MJ-2 (<17) S-1 (Other) MJ-0 Answer is complete but not entirely correct. Union Dues per Period Garnishment per Period S Pay $ 1,810 $ 3,720 $ 3,445 $ 3,070 $ S 120 240 $ $ 50 75 100 $ $ S $ Net Pay 1,489.02 2,906.45 x 2,575.44X 2.425.43arrow_forward

- Assume that you are working with a payroll application that produces weekly paychecks, including paystubs. Listed below are 20 data elements that would appear on the paycheck/paystub. For each numbered item, indicate the immediate (versus ultimate) source of the item. For instance, the immediate source of the number of exemptions for an employee would be the employee master data, as opposed to the ultimate source, which is the W-4 form filed by the employee. Some items may have more than one source, as in the case of item 1. You have the following choices: Arrange your answer as follows: The items to be considered are as follows:arrow_forwardThe following salaried employees of Mountain Stone Brewery in Fort Collins, Colorado, are paid semimonthly. Some employees have union dues or garnishments deducted from their pay. You do not need to complete the number of hours. Required: Calculate their net pay using the percentage method for manual payroll systems with Forms W-4 from 2020 or later in Appendix C to determine federal income tax. Assume box 2 is not checked for any employee. Include Colorado income tax of 4.55 percent of taxable pay. No employee has exceeded the maximum FICA limit. Note: Round your intermediate calculations and final answers to 2 decimal places. Employee S. Bergstrom C. Pare L. Van der Hooven S. Lightfoot Filing Status, Dependents MJ-0 MJ-2 (<17) S-1 (Other) MJ-0 Pay Union Dues per Period $ 1,870 $ 3,840 $ $ 3,565 $ $ 3,190 Garnishment per Period $ 120 240 $ 69 $ 50 75 100 Net Payarrow_forwardI FIGURE OUT A AND B. JUST NEED HELP WITH LETTER C. Carrie Overwood works fluctuating work schedules. Besides her fixed salary of $1,044 per week, her employment agreement provides for overtime pay at an extra half-rate for hours worked over 40. This week she worked 48 hours. Compute the following amounts. Round all divisions to two decimal places and use the rounded amounts in subsequent computations. Round your final answers to the nearest cent. a. The overtime earning $87.04 b. The total earnings $1,131.04 c. If this was a BELO plan with a pay rate of $23.45 per hour and a maximum of 48 hours, how much would Overwood be paid for 42 hours? $ NOTE: For a Belo Plan multiply maximum hours by hourly rate. Add this to ½ times the regular rate multiplied by the number of hours over 40 = Belo Pay.arrow_forward

- vertime Pay = Overtime Rate x Overtime Hours Worked otal Pay = Straight-Time Pay + Overtime Pay . Kelsey Newberg is a robotics technician. She earns $21.50 per hour for 40 hours and time and a half for overtime over 40 hours. If she worked 6 hours overtime, what is her total pay? E. Naveen Borah is a maintenance worker. He earns $12.80 per hour for 40 hours and time and a half for overtime. He worked 48 hours last week. What is his pay for the week? . Kim Sperazo is a sign-language interpreter. She earns $19.65 per hour and time and a half for overtime. Last week she worked her regular 40 hours plus 7 hours of overtime. What was her total pay for the week? . As a children's librarian, Jodi Hassam earns $15.35 an hour plus tim her regular 40 hours plus 16 hours on the weekend. What was her total pay for the week? nd a for weekend work. Last week she worked . Heather Allen works for the public works department as an electrical inspector. She earns $17.60 per hour for a 36-hour week. Her…arrow_forwardMoravanti Italian Imports has four employees and pays biweekly. Assume that box 2 is not checked for L. Torabi and R. Beninati and is checked for G. Fisher and J. Tillman. Required: On Form W-4, complete Step 2, the Multiple Jobs Worksheet (when applicable) to obtain the amount for Step 4(c). Calculate the federal income tax withholding using the wage-bracket tables with Forms W-4 from 2020 or later in Appendix C Note: Round your intermediate calculations and final answers to 2 decimal places. Employee L Torabit Filing Status S Dependents None Annual Salary Spouse Annual Salary and Pay Frequency Federal Income Tax per Period $ 50,900 Not applicable R. Beninat S One Other $ 59,900 Not applicable G. Fisher MJ Three <17 $ 21,000 $30,000 per biweekly J. Tillman MJ Two <17 $ 31,950 $19,170 per weeklyarrow_forwardEdward Dorsey is a part-time employee, and during the biweekly pay period he earned $395. In addition, he is being paid a bonus of $300 along with his regular pay. If Dorsey is single, how much would be deducted from his pay for FIT, based on the two methods outlined below? Hint: There are two ways to determine the deduction. Do NOT use the table for the percentage method. a. Wage-bracket table $fill in the blank 1 b. Percentage method $fill in the blank 2 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or LaterBIWEEKLY Payroll Period If the Adjusted Wage Amount (line 1h) is Married Filing Jointly Head of Household Single or Married Filing Separately At least But less than Standard Withholding Form W-4, Step 2, Checkbox Withholding Standard Withholding Form W-4, Step 2, Checkbox Withholding Standard Withholding Form W-4, Step 2, Checkbox Withholding The Tentative Withholding Amount is: $380$390$400$410$420 $390$400$410$420$430…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education