FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

a. prepare a four-column reconciliation showing adjusted balances

b. prepare

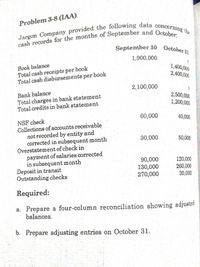

Transcribed Image Text:Jargon Company provided the following data concerning the

September 30 October 31

Problem 3-8 (IAA)

1,900,000

Book balance

Total cash receipts per book

Total cash disbursements per book

1,400,000

2,400,000

2,100,000

Bank balance

Total charges in bank statement

Total credits in bank statement

2,500,000

1,200,000

60,000

40,000

NSF check

Collections of accounts receivable

not recorded by entity and

corrected in subsequent month

Overstatement of check in

payment of salaries corrected

in subsequent month

Deposit in transit

Outstanding checks

30,000

50,000

90,000

130,000

270,000

120,000

260,000

30,000

Required:

a. Prepare a four-column reconciliation showing adjusted

balances.

b. Prepare adjusting entries on October 31.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- (10) After the closing entries have been journalized and posted, but prior to the next accounting period, which of the following accounts would have a balance? a. Fund Balance--Unassigned b. Appropriations c. Other Financing Uses d. Revenuesarrow_forwardOn December 31, 2020, Ditka Inc. had Retained Earnings of $286, 800 before its closing entries were prepared and posted. During 2020, the company had service revenue of $187, 100 and interest revenue of $90,800. The company used supplies in the amount of $97,400, advertising expenses were $18,300, salaries and wages totaled $21,150, and income tax expense was calculated as $17,500. During the year, the company declared and paid dividends of $7,900. Required: Prepare the closing entries dated December 31, 2020. Prepare T-account for the Retained Earnings account. Enter the beginning balance into the T-account, post the closing entries, and then determine the ending balance. Record the entry for closing revenue and expense account. Record the entry for closing dividend account.arrow_forwardNonearrow_forward

- Which of the following statements about an adjusted trial balance is correct? A. It is used to prepare financial statements. B. It is prepared to ensure assets equal liabilities. C. It is prepared at the beginning of the year. D. It is prepared before the adjusting journal entries have been made.arrow_forwardGIVE A DETAILED ANSWER Describe the effect on the financial statements when an adjustment is prepared that records (a) unrecorded revenue and (b) unrecorded expense. On the basis of what you have learned about adjustments, why do you think that adjusting entries are made on the last day of the accounting period rather than at several times during the accounting period?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education