FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

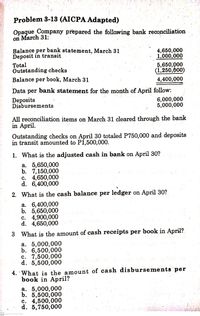

Transcribed Image Text:Problem 3-13 (AICPA Adapted)

Opaque Company prepared the following bank reconciliation

on March 31:

4,650,000

1,000,000

5,650,000

(1,250,000)

per bank statement, March 31

Balance

Deposit in transit

Total

Outstanding checks

Balance per book, March 31

4,400,000

Data per bank statement for the month of April follow:

Deposits

Disbursements

6,000,000

5,000,000

All reconciliation items on March 31 cleared through the bank

in April.

Outstanding checks on April 30 totaled P750,000 and deposits

in transit amounted to Pi,500,000.

1. What is the adjusted cash in bank on April 30?

а. 5,650,000

b. 7,150,000

c. 4,650,000

d. 6,400,000

2. What is the cash balance per ledger on April 30?

а. 6,400,000

b. 5,650,000

c. 4,900,000

d. 4,650,000

3 What is the amount of cash receipts per book in April?

а. 5,000,000

b. 6,500,000

c. 7,500,000

d. 5,500,000

4. 'What is the amount of cash disbursements per

book in April?

а. 5,000,000

b. 5,500,000

c. 4,500,000

d. 5,750,000

cs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hello please give me Answerarrow_forwardGunnar Company gathered the following reconciling information in preparing its September bank reconciliation: Line Item Description Amount Cash balance per company’s records, September 30 $3,019 Deposits in transit 450 Note receivable and interest collected by bank 895 Bank charge for check printing 31 Outstanding checks 1,286 NSF check 169 Determine the adjusted balance that would appear in the company section of the bank reconciliation on September 30. a. $3,047. b. $2,183. c. $2,878. d. $3,714.arrow_forwardBank Reconciliation Components ldentify the requested amount in each of the following situations: a. Howell Company's August 31 bank reconciliation shows deposits in transit of $3.400 The general ledger Cash in Bank account shows total cash receipts during September of $92.200. The September bank statement shows total cash deposits (and no credit memos) of $89.000. What amount of deposits in transit should appear in the September 30 bank reconciliation? b Wright Corporation's March 31 bank reconciliation shows deposits in transit of $2.600. The general ledger Cash in Bank account shows total cash receipts during April of S64 100. The April bank statement shows total cash deposits of S67200 (including $3,000. from the collection of a note: the note collection has not yet been recorded by Wright what amount of deposits in transit should appear in the April 30 bank reconciliation? Braddock Company's october 31 bank reconciliation shows outstanding checks of $3600.…arrow_forward

- Bank Reconciliation and Entries The cash account for Brentwood Bike Co. at May 1 indicated a balance of $14,370. During May, the total cash deposited was $71,780 and checks written totaled $66,650. The bank statement indicated a balance of $24,330 on May 31. Comparing the bank statement, the canceled checks, and the accompanying memos with the records revealed the following reconciling items: Checks outstanding totaled $10,840. A deposit of $8,830, representing receipts of May 31, had been made too late to appear on the bank statement. The bank had collected for Brentwood Bike Co. $4,670 on a note left for collection. The face of the note was $4,310. A check for $490 returned with the statement had been incorrectly charged by the bank as $940. A check for $520 returned with the statement had been recorded by Brentwood Bike Co. as $250. The check was for the payment of an obligation to Adkins Co. on account. Bank service charges for May amounted to $50. A check for $1,080 from Jennings…arrow_forwardMazaya Company gathered the following reconciling information in preparing its November bank reconciliation: Cash balance per books (11/30) R.O.4,400; Deposits in transit R.O. 6oo; Notes receivable and interest collected by bank R.O. 1,400; Bank charge for check printingarrow_forward3. Bank Reconciliation Barb Lee Inc. (BLI) is about to reconcile its bank statement for the month of May. Pertinent information follows: Bank statement balance $11,003.74. General ledger balance $8, 284.07. BLI mailed a deposit of $899.14 to the bank on May 28. The bank had not yet received it by month end. BLI issued cheques # 124 for $2,041.25; # 126 for $951.56; and #129 for $1,000 in May; however, these were not returned with the May 31 bank statement. BLI received notification that a cheque for $313 deposited to BLI's account was returned NSE. The bank levied a $32 returned cheque charge. The bank statement included a $29 service charge for the month.Required:a) Prepare the cash reconciliation for Barb Lee Inc. as at May 31. b) Prepare adjusting journal entries to correct for items noted in the cash reconciliations.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education