Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

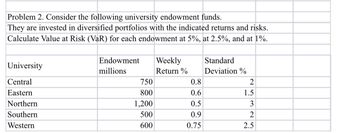

Problem. Consider the following university endowment funds.

They are invested in diversified portfolios with the indicated returns and risks.

Calculate Value at Risk (VaR) for each endowment at 5%, at 2.5%, and at 1%.

Transcribed Image Text:Problem 2. Consider the following university endowment funds.

They are invested in diversified portfolios with the indicated returns and risks.

Calculate Value at Risk (VaR) for each endowment at 5%, at 2.5%, and at 1%.

University

Central

Eastern

Northern

Southern

Western

Endowment

millions

750

800

1,200

500

600

Weekly

Return%

0.8

0.6

0.5

0.9

0.75

Standard

Deviation %

2

1.5

3

2

2.5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You became a fund manager in UAlbany Bank. After research, you pulled up two potential assets to invest. The assets' anticipated gains per share next year are: Asset 1, 324 Asset 2,324 Asset 1, 14 Probability Which asset is riskier and what is its variance per share? Asset 2, 14 0.40 0.40 0.20 Asset 1 -$10 $20 $35 Asset 2 $10 $15 $5arrow_forwardWhat are the advantages of evaluating fund performance based on Internal Rate of Return (IRR)? Why would an investor prefer to evaluate a fund based on a cash-on-cash return?arrow_forward10.-From the following options, choose the four that correspond to the application of financial management in the long term. A) Preparing financial reports B) Long-term investments C) Manage working capital D) Capital structure E) Support in identifying SWOT F) Budgeting G) Financial strategy (Class excercise)arrow_forward

- In the above $110K allocation problem, you decided to allocate 30% weight in A, 50% weight in B, 20% weight in C, and you want to find its AVG return. Which of the following is the appropriate method to find the mean (AVG) return on the $100K fund invested? a. Weighted Average (WAVG ) b. Simple Average c. Geometric Average d. Arithmetic Averagearrow_forwardClick on the quadrant that will yield the best capital budgeting decision. - NPV Hi IRR Low IRR + NPVarrow_forward(Related to Checkpoint 8.1) (Expected rate of return) James Fromholtz is considering whether to invest in a newly formed investment fund. The fund's investment objective is to acquire home mortgage securities at what it hopes will be bargain prices. The fund sponsor has suggested to James that the fund's performance will hinge on how the national economy performs in the coming year. Specifically, he suggested the following possible outcomes: a. Based on these potential outcomes, what is your estimate of the expected rate of return from this investment opportunity? b. Would you be interested in making such an investment? Note that you lose all your money in one year if the economy collapses into the worst state or you double your money if the economy enters into a rapid expansion. a. The expected rate of return from this investment opportunity is %. (Round to two decimal places) Data Table State of Economy Rapid expansion and recovery Modest growth Continued recession Falls into…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education