FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

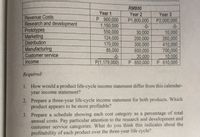

Transcribed Image Text:RM800

Year 1

P 900,000

1,150,000

550,000

124,000

170,000

85,000

-0-

P(1,179,000)

Year 2

Year 3

Revenue Costs

Research and development

Prototypes

Marketing

Distribution

P2,000,000

-0-

P1,800,000

-0-

30,000

200,000

300,000

600,000

20,000

P 650,000

10,000

260,000

410,000

700,000

10,000

P 610,000

Manufacturing

Customer service

Income

Required:

1. How would a product life-cycle income statement differ from this calendar-

year income statement?

2. Prepare a three-year life-cycle income statement for both products. Which

product appears to be more profitable?

3. Prepare a schedule showing each cost category as a percentage of total

annual costs. Pay particular attention to the research and development and

customer service categories. What do you think this indicates about the

profitability of each product over the three-year life cycle?

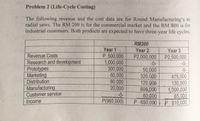

Transcribed Image Text:Problem 2 (Life-Cycle Costing)

The following revenue and the cost data are for Round Manufacturing's to

radial saws. The RM 200 is for the commercial market and the RM 800 is for

industrial customers. Both products are expected to have three-year life cycles.

RM200

Year 1

Year 2

Year 3

Revenue Costs

Research and development

Prototypes

Marketing

Distribution

P 500,000

1,000,000

300,000

60,000

80,000

20,000

-0-

P(960,000)

P2,000,000

P2,500,000

-0-

-0-

50,000

320,000

120,000

808,000

60,000

P 650,000 P 810,000

-0-

475,000

130,000

1,000,000

85,000

Manufacturing

Customer service

Income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Relevant range and fixed and variable costsVogel Inc. manufactures memory chips for electronic toys within a relevant range of 45,000 to 75,000 memory chips per year. Within this range, the following partially completed Manufacturing cost schedule has been preparedarrow_forwardRelevant Range and Fixed and Variable Costs Child Play Inc. manufactures electronic toys within a relevant range of 20,000 to 150,000 toys per year. Within this range, the following partially completed manufacturing cost schedule has been prepared: Complete the cost schedule. When computing the cost per unit, round to two decimal places. Toys produced 40,000 80,000 120,000 Total costs: Total variable costs $720,000 d. $ j. $ Total fixed costs 600,000 k. е. Total costs $1,320,000 f. $ I. $ Cost per Unit Variable cost per unit а. $ g. $ m. $ Fixed cost per unit b. h. n. Total cost per unit с. $ i. $ o. $arrow_forwardUnits of concrete panels produced and sold Sellling price Direct Materials (volume of concrete) Direct Materials cost / each volume of concrete Manufacturing processing capcaity (volume of concrete) Conversion cost (all manufacturing cost except direct materials) Conversion cost per unit of capacity R&D employees R&D costs R&D cost per employee Market growth 2020 20,000 2,400 2,500,000 11.50 400,000 18,000,000 45.00 5 200,000 40,000 What was the change in revenue from growth component? 4,800,000 F O 4,800,000 U 2,400,000 F 480,000 F 480,000 U 2021 22,000 2,200. 2,300,000 12.00 300,000 16,000,000 53.33 4 160,000 40,000 10%arrow_forward

- Relevant Range and Fixed and Variable Costs Vogel Inc. manufactures memory chips for electronic toys within a relevant range of 100,800 to 158,400 memory chips per year. Within this range, the following partially completed manufacturing cost schedule has been prepared: Components produced 100,800 123,200 158,400 Total costs: Total variable costs . . . . . . . . . $40,320 (d) (j) Total fixed costs . . . . . . . . . . . . 44,352 (e) (k) Total costs . . . . . . . . . . . . . . . . . $84,672 (f) (l) Cost per unit: Variable cost per unit . . . . . . . (a) (g) (m) Fixed cost per unit . . . . . . . . . . (b) (h) (n) Total cost per unit . . . . . . . . . . (c) (i) (o) Complete the cost schedule below. When computing the cost per unit, round to two decimal places. Round all other values to the nearest dollar. Cost Report Components produced 100,800 123,200 158,400 Total costs: Total variable costs $40,320 (d)…arrow_forward21.0 Need helparrow_forwardAssume a company has two divisions, Division A and Division B. Division A has provided the following information regarding the one product that it manufactures and sells on the outside market: Selling price per unit (on the outside market). Variable cost per unit $ 60 $ 44 Fixed costs per unit (based on capacity) Capacity in units $ 4 20,000 Division B could use Division A's product as a component part in the manufacture of 4,000 units of its own newly-designed product. Division B has received a quote of $58 from an outside supplier for a component part that is comparable to the one that Division A makes. If the company's divisional managers are evaluated based their division's profits and Division A is currently selling 18,000 units on the outside market, what is Division A's lowest acceptable transfer price if it were to sell 4,000 units to Division B?arrow_forward

- Relevant Range and Fixed and Variable Costs Vogel Inc. manufactures memory chips for electronic toys within a relevant range of 76,800 to 128,000 memory chips per year. Within this range, the following partially completed manufacturing cost schedule has been prepared: Complete the cost schedule below. When computing the cost per unit, round to two decimal places. Round all other values to the nearest dollar. Memory chips produced 76,800 96,000 128,000 Total costs: Total variable costs $27,648 d. $fill in the blank 1 j. $fill in the blank 2 Total fixed costs 30,720 e. fill in the blank 3 k. fill in the blank 4 Total costs $58,368 f. $fill in the blank 5 l. $fill in the blank 6 Cost per unit Variable cost per unit a. $fill in the blank 7 g. $fill in the blank 8 m. $fill in the blank 9 Fixed cost per unit b. fill in the blank 10 h. fill in the blank 11 n. fill in the blank 12 Total cost per unit c. $fill in the blank 13 i. $fill in the blank 14 o.…arrow_forwardRelevant Range and Fixed and Variable Costs Vogel Inc. manufactures memory chips for electronic toys within a relevant range of 61,600 to 100,800 memory chips per year. Within this range, the following partially completed manufacturing cost schedule has been prepared: Components produced 61,600 79,200 100,800 Total costs: Total variable costs . . . . . . . . . $19,712 (d) (j) Total fixed costs . . . . . . . . . . . . 22,176 (e) (k) Total costs . . . . . . . . . . . . . . . . . $41,888 (f) (l) Cost per unit: Variable cost per unit . . . . . . . (a) (g) (m) Fixed cost per unit . . . . . . . . . . (b) (h) (n) Total cost per unit . . . . . . . . . . (c) (i) (o) Complete the cost schedule below. When computing the cost per unit, round to two decimal places. Round all other values to the nearest dollar. Cost Report Components produced 61,600 79,200 100,800 Total costs: Total variable costs $19,712 (d)…arrow_forwardQuestion 6 Amundsen Company makes 60,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows: Direct Materials Direct Labor Variable Manufacturing Overhead Fixed Manufacturing Overhead Variable Selling Fixed Selling Total $ 10.10 $17.40 $ 2.70 $15.00 $ 2.75 $ 3.25 $51.20 An outside supplier has offered to sell the company all of these parts it needs. If the company accepts this offer, the facilities now being used to make the part would be idle and fixed manufacturing overhead would be reduced by 80% of current cost. The variable selling costs would be reduced to 40% of current cost. Required: What is the maximum amount the company should be willing to pay an outside supplier per unit for the part?arrow_forward

- Relevant Range and Fixed and Variable Costs Child Play Inc. manufactures electronic toys within a relevant range of 88,400 to 142,800 toys per year. Within this range, the following partially completed manufacturing cost schedule has been prepared: Complete the cost schedule below. When computing the cost per unit, round to two decimal places. Round all other values to the nearest dollar. Toys produced 88,400 109,200 142,800 Total costs: Total variable costs $33,592 d. $fill in the blank 1 j. $fill in the blank 2 Total fixed costs 37,128 e. fill in the blank 3 k. fill in the blank 4 Total costs $70,720 f. $fill in the blank 5 l. $fill in the blank 6 Cost per unit: Variable cost per unit a. $fill in the blank 7 g. $fill in the blank 8 m. $fill in the blank 9 Fixed cost per unit b. fill in the blank 10 h. fill in the blank 11 n. fill in the blank 12 Total cost per unit c. $fill in the blank 13 i. $fill in the blank 14 o. $fill in…arrow_forwardSubject:- accountingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education