FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

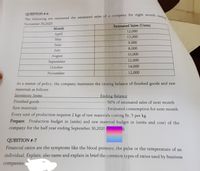

Transcribed Image Text:QUESTION & 6

The following are estimated the estimated sales of a company for eight month

Navember 30.2020

Escimated Sales (Units)

Manth

12,000

April

13,000

May

9,000

June

8,000

July

10,000

August

September

12,000

October

14,000

November

12,000

As a matter of policy, the company maintains the closing balance of finished goods and raw

materials as follows

Inventory Items

Finished goods

Ending Balance

-50% of estimated sales of next month

Raw materials

--Estimated consumption for next month

Every unit of production requires 2 kgs of raw materials costing Br, 5 per kg

Prepare: Production budget

company for the half year ending September 30,2020

(units) and raw material budget in (units and cost) of the

QUESTION #-7

Financial ratios are the symptoms like the blood pressure, the pulse or the temperature of an

individual. Explain. also name and explain in brief the common types of ratios used by business

companies.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Problem 1 Perpetual Inventory: Shortage, Entries. Canada Pipe Company uses a perpetual inventory system. The items on hand are inventoried on a rotation basis throughout the year so that all items are checked twice each year. At the end of the year, the following data relating to goods on hand are available: From Perpetual Inventory Units From Physical Count (units) 390 Product Unit Cost P12 A.. 450 B.. 1,500 2,000 8,000 13,000 5 1,520 1,950 7,980 13,100 ...... D....... E. . 426arrow_forwardWeighted Average Cost Method with Perpetual Inventory The beginning inventory for Midnight Supplies and data on purchases and sales for a three-month period are as follows: Date Transaction Numberof Units Per Unit Total Jan. 1 Inventory 7,500 $79.00 $592,500 10 Purchase 22,500 89.00 2,002,500 28 Sale 11,250 158.00 1,777,500 30 Sale 3,750 158.00 592,500 Feb. 5 Sale 1,500 158.00 237,000 10 Purchase 54,000 91.50 4,941,000 16 Sale 27,000 168.00 4,536,000 28 Sale 25,500 168.00 4,284,000 Mar. 5 Purchase 45,000 93.50 4,207,500 14 Sale 30,000 168.00 5,040,000 25 Purchase 7,500 94.00 705,000 30 Sale 26,250 168.00 4,410,000 Required: 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 5, using the weighted average cost method. Round unit cost to two decimal places, if necessary. Round…arrow_forwardRequired: 1. Compute estimated ending inventory and cost of goods sold for March applying the conventional retail method. Note: Round ratio calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34%.). Enter amounts to be deducted with a minus sign. Beginning inventory Purchases Freight-in Purchase returns Net markups Net markdowns Goods available for sale Cost-to-retail percentage (conventional retail method) Normal breakage Net sales: Sales Employee discounts Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold $ Cost 54,000 $ 221,000 18,358 293,358 $ Retail 74,000 414,000 7,200 495,200 495,200 495,200 Cost-to-Retail Ratio %arrow_forward

- Inventory Analysis A company reports the following: Cost of merchandise sold $569,400 Average merchandise inventory 87,600 Determine (a) the inventory turnover and (b) the number of days' sales in inventory. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume 365 days a year. a. Inventory turnover fill in the blank 1 b. Number of days' sales in inventory fill in the blank 2 daysarrow_forwardCurrent Attempt in Progress Oriole Corporation sells item A as part of its product line. Information as to balances on hand, purchases, and sales of item A are given in the following table for the first six months of 2020. Date January 11 January 24 February 8 March 16 June 11 Purchased 1,380 660 Ending inventory $ Save for Later Quantities Cost of goods sold $ Sold 360 610 Balance 460 1,840 1,480 870 1,530 Unit Price of Purchase $4.60 Compute the ending inventory at June 30 under the perpetual LIFO inventory pricing method. $4.9 $5.3 Compute the cost of goods sold for the first six months under the periodic FIFO inventory pricing method. Attempts: 0 of 1 used Submit Answerarrow_forwardQ10: What is 2021 Gross Margin Percentage?arrow_forward

- Current Attempt in Progress At May 1, 2020, Concord Company had beginning inventory consisting of 200 units with a unit cost of $5.40. During May, the company purchased inventory as follows: 870 units at $5,40 530 units at $7.00 The company sold 1160 units during the month for $14 per unit. Concord uses the average cost method. The average cost per unit for May is $5.900. $5,400. Ⓒ$6.400. Ⓒ$5.930.arrow_forward5- The annual production capacity of Enterprise A is 20,000 units. For the year 2020 of the enterprise; The breakdown of production-sales volume and some expense items is as follows. According to the normal cost method, how much is the end-of-period inventory cost of the business? a) 530,000 B) 425,000 NS) 480,000 D) 430,000 TO) 500,000arrow_forward28arrow_forward

- Review Score Review Results by Study Objective Keaton Accessories uses a perpetual inventory system. The company's beginning inventory of a particular product and its purchases during the month of January were as follows: Quantity Unit Cost Total Cost Beginning Inventory (Jan. 1) 180 $40 $7,200 Purchase (Jan. 9) 90 45 4,050 Purchase (Jan. 21) 90 46 4,140 Total 360 $15,390 On January 24, Keaton sold 200 units of this product. The other 160 units remain in inventory at January 31. i.) Determine the cost of goods sold using each of the following flow assumptions: LIFO FIFO Average Cost ii.) Determine the cost of the 160 units in inventory at January 31 using each of the following flow assumptions: LIFO FIFO Average Cost ***** *** x**** ****arrow_forwardCurrent Attempt in Progress The trial balance of Crane Company at the end of its fiscal year, August 31, 2022, includes these accounts: Inventory $35,000; Purchases $154,900; Sales Revenue $191,000; Freight-In $9,200; Sales Returns and Allowances $4,400; Freight-Out $1,900; and Purchases Returns and Allowances $6,900. The ending inventory is $28,000. Prepare a cost of goods sold section for the year ending August 31.arrow_forwardcan you solve this pease ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education