Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

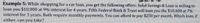

Transcribed Image Text:Example 5: While shopping for a car loan, you get the following offers: Solid Savings & Loan is willing to

loan you $10,000 at 9% interest for 4 years. Fifth Federal Bank & Trust will loan you the $10,000 at 7%

interest for 3 years. Both require monthly payments. You can afford to pay $250 per month. Which loan, if

either, can you take?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 2. Remi deposits $2,000 into a savings account at her bank. If the interest rate is 3.25 percent, how much money will she have in her account after 5 years? 7. You are Co introductory rate months and the rate be entered into a drawin commercial. You pay $50 a you switch? Use the smart dec mathematically and include an emarrow_forwardThe formula below finds the monthly payment for a loan (car, mortgage, student): P=I (r/1-(1+r)-n ) 7. If you want to buy a car that costs $16,000 with a loan at 3% APR how many years should you finance the car if you want your payment to be below $230? Do this problem any way you want, but clearly communicate your thinking.arrow_forwardYou take out a 5-year car loan with monthly payments of $425. The interest rate for the loan is 4.75%. How much total interest will you pay over the life of the loan? Group of answer choices $1,575.06 $22,658.31 $25,500.00 $2,841.69arrow_forward

- Give typing answer with explanation and conclusion you want to borrow $71,400 from your local bank to buy a nee sailboat. you can afford to make monthly paymnets of $1,480 but no more. assuming monthly compounding, what is the highest rate per year you can afford on a 78- month-loan?arrow_forwardI. M. Greedy Mortgage Bank offers you a $60,000, eleven-year term loan at a 5% annual interest rate to help you buy a home. What will your annual loan payment be?arrow_forwardPlease build an excel spreadsheet and show the formulas to answer a. through g. using the information below You bought a house with price of $250,000. Your LTV (loan-to-value ratio) is 80%. You choose the 30-year mortgage with interest rate 6%. Assuming the total transaction cost is $10,000. a. What is your loan amount? b. What is your monthly payment? c. What will be the loan balance at the end of nine years? d. What is the effective borrowing cost if the loan will be prepaid at the end of nine years? e. In the monthly payment, how much you pay for the principle and how much you pay for the interest in the 1st and the 2nd month? f. What will be your interest payments for the first 5 years (year 1 to year 5) and the last 5 years (year 26 to year 30)? g. What is your annual percentage rate (APR)?arrow_forward

- You have decided to purchase a new car that costs $44,500. You need to make a 20% down payment, then you will finance the rest with a loan. Your bank will extend you a car loan where the APR is 4.32% and you will make monthly payments over five years. What is the monthly payment on the vehicle? O $593.33 O $660.78 O $512.79 O $825.98arrow_forwardYou have agreed to loan some money to a friend at a simple interest rate of 62% your friend needs a $1470 loan you tell him to pay you back $3200.When should you tell him to pay you back if you want to hold that interest rate of 62%?arrow_forwardSuppose that you decide to borrow $15,000 for a new car. You can select one of the following loans, each requiring regular monthly payments. Installment Loan A: three-year loan at 6.3% Installment Loan B: five-year loan at 4.8% PA [¹-(1+] Use PMT= -nt7 to complete parts (a) through (c) below. a. Find the monthly payments and the total interest for Loan A. The monthly payment for Loan A is $. (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forward

- A friend asks to borrow $54 from you and in return will pay you $57 in one year. If your bank is offering a 5.7% interest rate on deposits and loans: a. How much would you have in one year if you deposited the $54 instead? b. How much money could you borrow today if you pay the bank $57 in one year? c. Should you loan the money to your friend or deposit it in the bank? a. How much would you have in one year if you deposited the $54 instead? If you deposit the money in the bank today you will have $ in one year. (Round to the nearest cent.)arrow_forwardQuestion 3: You just got a loan for $15,000 and you plan to pay it off in three years. Your monthly payments are $500 each. What is the interest rate that the bank is charging you? What if you did bi- monthly payments of $250? How much sooner will the loan be paid off?arrow_forwardQuestion 5. Attached is a similar question answeredarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education