FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

What amount should be reported as warranty expense for 2019 of Bold Company?

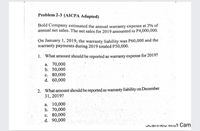

Transcribed Image Text:Problem 2-3 (AICPA Adapted)

Bold Company estimated the annual warranty expense at 2% of

annual net sales. The net sales for 2019 amounted to P4,000,000.

On January 1, 2019, the warranty liability was P60,000 and the

warranty payments during 2019 totaled P50,000.

1. What amount should be reported as warranty éxpense for 2019?

a. 70,000

b. 50,000

c. 80,000

d. 60,000

2. What amount should be reported as warranty liability on December

31, 2019?

a. 10,000

b. 70,000

c. 80,000

d. 90,000

OLalitu vVILn Cam

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- FIGURE 13-3 40. An employee earns a gross wage represented as W. The employee's payroll deductions are shown in Figure 13-4. What is the employee's net wage? Type of Deduction Amount of Deduction Federal Income Tax 0.22W Social Security 0.076W Health and Accident Insurance 0.065W Retirement 0.05W Miscellaneous 0.042W ⒸCengage Leaming 2013arrow_forwardRefer to the following list of liability balances t December 31, 2024. $23,000 Accounts Payable Employee Health Insurance Payable Employee Income Tax Payable Estimated Warranty Payable (Due 2025) Long - Term Notes Payable (Due 2028) FICA-OASDI Taxes Payable Sales Tax Payable 450 1,100 1,000 38.000 660 870 Mortgage Payable (Due 2029) Bonds Payable (Due 2030) Current Portion of Long - Term Notes Payable 8,000 53,000 11,500 What is the total amount of current liabilities? O A. $27,080 O B. $38,580 OC. $25,980 OD. $24,980arrow_forwardWhy did you put 2019 and 2020, when all expenses incurred in 2021 or 2022?arrow_forward

- Included in Bonita Company’s December 31, 2020, trial balance are the following accounts: Accounts Payable $243,100, Pension Liability $378,400, Discount on Bonds Payable $34,200, Unearned Rent Revenue $50,800, Bonds Payable $406,100, Salaries and Wages Payable $28,700, Interest Payable $13,060, and Income Taxes Payable $37,400.Prepare the long-term liabilities section of the balance sheet.arrow_forwardFor tax year 2020, the due date for filing paper forms with the SSA is: a. December 31 b. January 31 c. February 28 d. January 15arrow_forwardTo match revenues and expenses properly, should the expense for employee vacation pay be recorded in the period during which the vacation privilege is earned or during the period in which the vacation is taken?arrow_forward

- The following unemployment tax rate schedule is in effect for the calendar year 2019 in State A, which uses thereserve-ratio formula in determining employer contributions:Reserve Ratio Contribution Rate0.0% or more, but less than 1.0% ............................ 6.7%1.0% or more, but less than 1.2% ............................ 6.4%1.2% or more, but less than 1.4% ............................ 6.1%1.4% or more, but less than 1.6% ............................ 5.8%1.6% or more, but less than 1.8% ............................ 5.5%1.8% or more, but less than 2.0% ............................ 5.2%2.0% or more, but less than 2.2% ........................... 4.9%2.2% or more, but less than 2.4% ........................... 4.6%2.4% or more, but less than 2.6% ........................... 4.3%2.6% or more, but less than 2.8% ........................... 4.0%2.8% or more, but less than 3.0% ............................ 3.7%3.0% or more, but less than 3.2% ............................ 3.4%3.2% or…arrow_forwardRecord the appropriation of $77000 of retained earnings on December 31, 2022, by Jack Inc. to establish an appropriation for bond retirement. Record the entry to establish appropriation.arrow_forwardSophie Industries Inc. was a C-corporation that filed an S-election effective January 1, 2019. Which item has an impact on S-corporation’s AAA in 2019? a. Non-separately stated ordinary income earned in 2019. b. An additional capital contribution by a stockholder in 2019 c. Tax-exempt interest earned in 2019. d. A distribution from accumulated earnings and profits (AEP)arrow_forward

- The adjusted trial balance of Palm Realtors Ltd. at December 31, 2019, appears below: Palm Realtors Ltd.Adjusted Trial BalanceDecember 31, 2019Cash $ 8,950Accounts receivable 53,530Prepaid rent 2,200Equipment 45,690Accumulated amortization $ 18,930Accounts payable 15,900Interest payable 900Salary payable 3,500Income tax payable 4,700Note payable (due 2025) 19,500Common shares 8,000Retained earnings 29,325Dividends 30,000Commissions 227,480Depreciation expense 6,260Salary expense 140,500Rent expense 26,400Interest expense 1,500Income tax expense 13,205Total $328,235 $328,235 Prepare in good form a classified statement of financial position for Palm Realtors Ltd as at December 31, 2019,arrow_forwardForm 940 for 2020 (IRS), how do I determine the total payments to all employees?arrow_forwardSection 5-EMPLOYEE DATA: FORM W-4 AND STATE WITHHOLDING 0ALLOWANCE CERTIFICATES How long does a new employee have to submit a completed W-4? How must the employer withhold FIT until the W-4 is received from a new employee? On March 2, 2020, Mischa submits a new W-4. If payday is Friday, what is the date of the first paycheck that must reflect Mischa’s new W-4? On March 23,2020, Paul submits a new W-4. If Paul is paid the last weekday of each month, what is the date of the first paycheck that must reflect Paul’s new W-4? On October 2, 2020, Janet starts a part-time job. She did not owe federal income tax in 2019 and does not expect to earn enough to pay federal income tax for 2020, so she claims exempt from federal income tax withholding on her 2020 Form W-4. Does Janet need to submit a W-4 in 2021? If so, by when—and how does her employer withhold if she does not do this?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education