FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

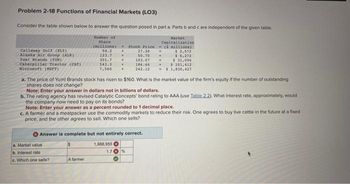

Transcribed Image Text:Problem 2-18 Functions of Financial Markets (LO3)

Consider the table shown below to answer the question posed in part a. Parts b and c are independent of the given table.

Market

capitalization

(5 millions)

Callaway Golf (ELY)

Alaska Air Group (ALK)

Yum! Brands (YUM)

Caterpillar Tractor (CAT)

Microsoft (MSFT)

Number of

M

Share

(millions)

94.2

123.7 M

301.7 X

543.3 X

7,560

a. Market value.

b. Interest rate

c. Which one sells?

Answer is complete but not entirely correct.

1,988,955

A farmer

$ 2,572

Stock Price

27.30

50.70

103.07

$ 31,096

186.66 - $ 101,412

242.12

$1,830,427

$ 6,272

a. The price of Yum! Brands stock has risen to $160. What is the market value of the firm's equity if the number of outstanding

shares does not change?

Note: Enter your answer in dollars not in billions of dollars.

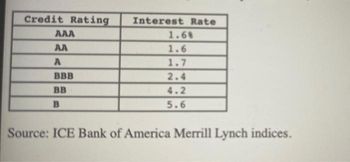

b. The rating agency has revised Catalytic Concepts' bond rating to AAA (use Table 2.2). What interest rate, approximately, would

the company now need to pay on its bonds?

Note: Enter your answer as a percent rounded to 1 decimal place.

c. A farmer and a meatpacker use the commodity markets to reduce their risk. One agrees to buy live cattle in the future at a fixed

price, and the other agrees to sell. Which one sells?

1.7 %

-

-

-

Transcribed Image Text:Credit Rating

AAA

AA

A

BBB

BB

B

Interest Rate

1.68

1.6

1.7

2.4

4.2

5.6

Source: ICE Bank of America Merrill Lynch indices.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- b Preview File Edit View Go Tools Window Help ♥ mgt120h-a17.pdf Page 2 of 10 Market value of common shares Number of common shares outstanding Par value of common shares Retained earnings a. $2,250,000 b. $2,600,000 c. $2,500,000 d. $2,400,000 e. $2,750,000 Cost-Volume-Profit Analysis 3. Common, Inc. has just issued a 10% stock dividend. The following information was available just prior to issuing the dividend. 40 The Effect Of Prepaid Taxes On Assets And Liabili... O Debenture Valuation D What is the proper balance in Retained Earnings immediately after issuing the stock dividend? CC 7 V ↑ Search (Cª Sat Apr 15 3:04 PM $25 each 100,000 $10 per share $2,500,000 Allstate Inc, has 10.000 shares of $8, no par value, cumulative preferred shares and 100,000 shares of no par value common shares outstanding at December 31, 2016. If the board of directors declares a $60,000 dividend, the Preferred shareholders will receive 1/10 of what b. Preferred shareholders will rece of what the common…arrow_forwardhello, I need help pleasearrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- A7 please help....arrow_forwardEsc Chapter 12 Practice Problems 1. Suppose a stock had an initial price of $77 per share, paid a dividend of $1.35 per share during the year, and had an ending share price of $83. Compute the percentage total return. Q Search 1 Q A N @ 2 W S F2 X # 3 E F3 D $ 4 R F DII % 5 F5 T G * F6 A 6 Y B * H & 7 PrtScn U N * 8 Home 1 M 9 Page K End о F10 ) 0 PgUp F11 Parrow_forwardWhat technical aspects does it study? As an investor what would you conclude from this chart? Chart 2 280- 240- 200- 160- 120- 80- 40- 0- 1996 1998 S Apple Share Price Jan. 1995 to Apr. 2010 2000 C יויייןווון-וון זון ון ***** 2002 2004 2006 2008 2010arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education