FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

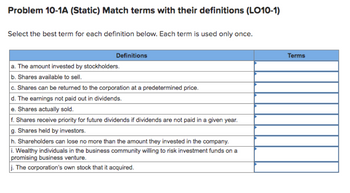

Transcribed Image Text:Problem 10-1A (Static) Match terms with their definitions (LO10-1)

Select the best term for each definition below. Each term is used only once.

Definitions

a. The amount invested by stockholders.

b. Shares available to sell.

c. Shares can be returned to the corporation at a predetermined price.

d. The earnings not paid out in dividends.

e. Shares actually sold.

f. Shares receive priority for future dividends if dividends are not paid in a given year.

g. Shares held by investors.

h. Shareholders can lose no more than the amount they invested in the company.

i. Wealthy individuals in the business community willing to risk investment funds on a

promising business venture.

j. The corporation's own stock that it acquired.

Terms

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- When using the equity method of accounting, when is revenue recorded on the books of the investor company?a. When the fair value of the affiliate stock increases.b. When a dividend is received from the affiliate.c. When the affiliate company reports net income.d. Both b and c above.arrow_forwardTRUE OR FALSE Outstanding shares are the number of shares sold or conveyed to owners.arrow_forwardWhich of the following would NOT be reported for capital stock in the contributed capital section of a classified balance sheet? Group of answer choices A.Dividends per share B.Shares issued C,Shares outstanding D.Shares authorizedarrow_forward

- Describe Earnings Available to Common Shareholders.arrow_forwardWhich of the following is true about dividends: Group of answer choices Increasing dividends can impact retained earnings. Dividends must always be paid if the company makes profit. Dividends are split equally between stockholders and bondholders. Dividends paid reduce the net income that is reported on a company's income statement.arrow_forwardAll of the following would appear in the contributed capital section of shareholders' equity on the balance sheet except a. bonds payable b. additional paid-in capital from stock conversions c. preferred stock d. share rights and optionsarrow_forward

- Distinguish between accounting for retired shares and for treasury shares.arrow_forwardWhich of the following can not be used for redemption of preference shares? A. Insurance Fund B. Workmen's Compensation Fund C. General Reserve D. Profit Prior to Incorporationarrow_forwardProperty or services received in exchange for capital stock should be recorded at the par or stated value of the shares issued. True or Falsearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education