FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:The Dorllane Compuny specializes in producing a set of wood patio furniture consisting of a table

PROBLEM 2-10 Cost Clhoolicatlon nnd Cont Bohavlor (LO2, LOB, LOOI

The Dorllane Compuny specializen in prolucing u ket of wood patio furniture consisting of a table

and four chairs. Tho sot enjoys grent popularity, und the company has ample orders to keep produc

thon going at its full eapacity of 2,000 sets per yenr, Annual cost data at full capacity follow:

$118,000

$50,000

$40,000

$3,500

$80,000

$2,500

$4,000

$12,000

$6,000

$10,000

$3,000

$60,000

$94,000

$20,000

Factory Inbor, direct..

Advortlsing..

Fnotory auporvision

Proporty taxes, taotory bullding

Salos commisslons

Insuranco, factory. ..

Doproclation, administrativo offlco oqulpment.

Loaso cost, factory oqulpmont.

Indiroct matorials, factory....

Doproclatlon, factory bullding .....

Adminlstrativo offlco supplies (billing)

Ádministrativo offico salarios .

Direct matorlals used (wood, bolts, atc.)

Utlitles, factory. .

..

Required:

1. Propare an answer sheet with the column headings shown below. Enter each cost item on your

answer sheet, placing the dollar amount under the appropriate headings. As examples, this has

been done already for the first two items in the list above, Note that each cost item is classified

in two ways: first, as variable or fixed with respect to the number of units produced and sold;

and second, as a selling and administrative cost or a product cost. (If the item is a product cost,

it should also be classified as either direct or indirect as shown.)

冰

Selling or

Administrative

Cost

Cost Bohavlor

Product Cost

Cost Item

Variable Fxed

Direct

Indirect

Factory labor, diroct.... $118,000

Advertising.

$118,000

.....'....

$50,000

$50,000

*To units of product.

2. Total the dollar amounts in cach of the columns in (1) above. Compute the average product

.cost of one patio set.

Assume that production drops to only 1,000 sets annually. Would you expect the average

product cost per set to increase, decrease, or remain unchanged? Explain. No computations

are necessary,

4. Refer to the original data. The president's brother-in-law has considered making himself a

patlo set and has prlced the necessary materials at a building supply store. The brother-in-law

has asked the presldent if he could purchase a patio set from the Dorilane Company "at cost,"

and the president agreed to let him do so.

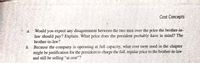

Transcribed Image Text:Cost Concepts

Would

you expect any disagreement between the two men over the price the brother-in-

a.

law should pay? Explain. What price does the president probably have in mind? The

brother-in-law?

b.

Bečause the company is operating at full capacity, what cost term used in the chapter

might be justification for the president to charge the full, regular price to the brother-in-law

and still be selling "at cost"?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assignment Get Homework He Saved Lincoln, Inc, which uses a volume-based cost system, produces cat condos that sell for $170 each, Direct materials cost $21 per unit, and direcd labor costs $17 per unit. Manufacturing overhead is applled at a rate of 200% of direct labor cost. Nonmanufacturing costs are $28 per unt What is the gross profit margln for the cat condos? (Round your Intermedlate calculatlons to nearest whole dollar.) Multiple Cholce 58.8% 57.6% 41.3% 41.2%arrow_forwardonly give me an answer for requirement 3arrow_forwardExercise 21.5 (Static) Special Order Decisions and Opportunity Costs (LO21-1, LO21-2, LO21-3, L021-4) Heavenly Treat manufactures cases of hot chocolate that are typically sold to restaurants. Its main factory has the capacity to produce and sell 12,000 cases per month. The following information is available for the factory. Sales price per case Variable cost per case: Direct materials Direct labor Variable overhead & sales commissions Fixed costs per month 40 12 10 $ 60,000 Wildwood Camps is a youth organization that serves hot chocolate at its camping facilities throughout Montana. The organization has offered Heavenly Treat $29 per case for a special-order batch of 1,000 cases. Each case would require a shrink-wrap covering because of moisture problems associated with the organization's storage warehouses. The cost to shrink-wrap the order is estimated at $3 per case. Selling costs associated with the order would be decreased by $1 per case because it would not include any sales…arrow_forward

- Resource Constraint Fairy Godmother Inc. (FGI) makes two products: Glass Slippers and Crystal Balls. FGI estimates they can sell 30,000 Glass Slippers and 20,000 Crystal Balls. Both products must be processed by the glass sanding machine, which has a capacity of 25,000 machine hours. Fairy Godmother Inc Production Information Per Unit Information Glass Slippers Crystal Balls Selling Price 25 15 Direct Materials 8 5 Direct Labor 8 4 Variable Overhead 2 2 Variable Selling 1 1 Machine Hours 4 .75 What is the contribution margin per unit for Crystal Balls? Group of answer choices 1.50 3 6 4arrow_forwardneed 1,2,3 question ansarrow_forwardQuestion 2 Moon produces tow products the A and B. The direct costs of the two products are given below: Direct materials Direct Labour A £4.00 £3.00 Materials handling Production set up costs The budgeted production for 80,000 units of A and 30,000 units of B. The two main activities identified for the simple production process are material handling and production set ups. Product A requires large production runs and large transfers of materials from stores. However, product B is a more complex product with a number of different types of materials required and shorter and more frequent production runs. A Number Material Handling requisitions 100 Number of Production Set Ups 50 Required: B The budgeted fixed overheads of Caplan are £600,000 and they are made up as follows: £200,000 £400,000 £600,000 The use of these activities for each product is £4.20 £2.20 B 400 200 Total 500 250 Calculate the unit cost of each product using the costing method of Activity Based Costing.arrow_forward

- Izzy Ice Cream has the following price and cost information: Price per 2-scoop sundae Variable costs per sundae: Ingredients Direct labor Overhead Fixed costs per month. Required: Required 1 Required 2 $ 5.00 Break-even units Break-even sales 1.35 0.45 0.20 $ 6,300 Required 3 Required 4 Determine Izzy's break-even point in units and sales dollars. sundaesarrow_forwardRelevant Range and Fixed and Variable Costs Vogel Inc. manufactures memory chips for electronic toys within a relevant range of 100,800 to 165,600 memory chips per year. Within this range, the following partially completed manufacturing cost schedule has been prepared: Components produced 100,800 128,800 165,600 Total costs: Total variable costs . . . . . . . . . $41,328 (d) (j) Total fixed costs . . . . . . . . . . . . 46,368 (e) (k) Total costs . . . . . . . . . . . . . . . . . $87,696 (f) (l) Cost per unit: Variable cost per unit . . . . . . . (a) (g) (m) Fixed cost per unit . . . . . . . . . . (b) (h) (n) Total cost per unit . . . . . . . . . . (c) (i) (o) Complete the cost schedule below. When computing the cost per unit, round to two decimal places. Round all other values to the nearest dollar. Cost Report Components produced 100,800 128,800 165,600 Total costs: Total variable costs…arrow_forwardPlease help me with calculationarrow_forward

- Practice problem Lumber and Cabinetry. The Lumber Division is responsible for harvesting and preparing lumber for use; the Cabinetry Division produces custom-ordered cabinetry. The lumber produced by the Lumber Division has a variable cost of $3.00 per linear foot and full cost of $4.00. Comparable quality wood sells on the open market for $9.00 per linear foot.1. Assume you are the manager of the Cabinetry Division. Determine the maximum amount you would pay for lumber.2. Assume you are the manager of the Lumber Division. Determine the minimum amount you would charge for the lumber if you have excess capacity. Repeat assuming you have no excess capacity.arrow_forwardIzzy Ice Cream has the following price and cost information: Price per 2-scoop sundae Variable costs per sundae: Ingredients Direct labor Overhead Fixed costs per month Required: 1. Determine Izzy's break-even point in units and sales dollars. 2. Determine how many sundaes must be sold to generate a profit of $18,000. $5.00 3. Calculate Izzy's new break-even point in units for each of the following independent scenarios: a. Sales price decreases by $0.50. b. Fixed costs decrease by $300 per month. c. Variable costs increase by $0.50 per sundae. 4. Based on the original information, how many sundaes must Izzy sell to generate a profit of $50,000, if sales price increases by $0.50 and variable costs increase by $0.30? Required 1 Required 2 1.35 0.45 0.20 $ 9,000 Complete this question by entering your answers in the tabs below. Break-even units Break-even sales Required 3 Required 4 Determine Izzy's break-even point in units and sales dollars. sundaesarrow_forwardssarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education