Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

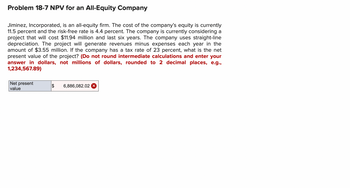

Transcribed Image Text:Problem 18-7 NPV for an All-Equity Company

Jiminez, Incorporated, is an all-equity firm. The cost of the company's equity is currently

11.5 percent and the risk-free rate is 4.4 percent. The company is currently considering a

project that will cost $11.94 million and last six years. The company uses straight-line

depreciation. The project will generate revenues minus expenses each year in the

amount of $3.55 million. If the company has a tax rate of 23 percent, what is the net

present value of the project? (Do not round intermediate calculations and enter your

answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g.,

1,234,567.89)

Net present

$ 6,886,082.02

value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- B V @7% b. 8% c. 9% d. 10% T O 10. Wetzlar Mining Company is considering an iron ore extraction project which requires an initial investment of SAR 6,340,000 and will yield annual cash flows of SAR 1,546,267 for 5 years. The company's hurdle rate is 9%. Calculate IRR.arrow_forwardProblem 13-22 Flotation Costs and NPV Landman Corporation (LC) manufactures time series photographic equipment. It is currently at its target debt-equity ratio of 75. It's considering building a new $57 million manufacturing facility. This new plant is expected to generate aftertax cash flows of $6.9 million in perpetuity. The company raises all equity from outside financing. There are three financing options: 1. A new issue of common stock. The flotation costs of the new common stock would be 8.7 percent of the amount raised. The required return on the company's new equity is 15 percent. 2. A new issue of 20-year bonds: The flotation costs of the new bonds would be 3.7 percent of the proceeds. If the company issues these new bonds at an annual coupon rate of 5.8 percent, they will sell at par. 3. Increased use of accounts payable financing. Because this financing is part of the company's ongoing daily business, it has no flotation costs and the company assigns it a cost that is the…arrow_forwardBhupatbhaiarrow_forward

- Problem 18-12 Eagle Products EBITDA is $500, its tax rate is 21%, depreciation is $30, capital expenditures are $80, and the planned increase in net working capital is $10. What is the free cash flow to the firm? (Round your answer to 2 decimal place.) Answer is complete but not entirely correct. $335.00 FCFFarrow_forwardQUESTION 30 Twin Buttes Mine Co. is considering two mutually exclusive projects. Both require an initial investment of $10,000 at t = 0. Project X has an expected life of 2 years with after-tax cash inflows of $6,000 and $8,500 at the end of Years 1 and 2, respectively. In addition, Project X can be repeated at the end of Year 2 with no changes in its cash flows. Project Y has an expected life of 4 years with after-tax cash inflows of $4,600 at the end of each of the next 4 years. Each project has a WACC of 11%. What is the equivalent annual annuity of the most profitable project? a. $1,345.50 O b. $1,346.30 O c. $1,361.52 O d. $1,376.74 O e. $1,411.15arrow_forwardNikularrow_forward

- Brief Exercise 12-9 Swift Oil Company is considering investing in a new oil well. It is expected that the oil well will increase annual revenues by $123,465 and will increase annual expenses by $67,000 including depreciation. The oil well will cost $481,000 and will have a $10,000 salvage value at the end of its 10-year useful life. Calculate the annual rate of return. (Round answer to 0 decimal places, e.g. 13%.) Annual rate of return % Click if you would like to Show Work for this question: Open Show Workarrow_forwardBaghibenarrow_forwardProblem 9-33 Working Capital (LO4) Better Mousetraps has developed a new trap. It can go into production for an initial investment in equipment of $6.3 million. The equipment will be depreciated straight-line over 6 years, but, in fact, it can be sold after 6 years for $519,000. The firm believes that working capital at each date must be maintained at a level of 10% of next year's forecast sales. The firm estimates production costs equal to $1.20 per trap and believes that the traps can be sold for $5 each. Sales forecasts are given in the following table. The project will come to an end in 6 years, when the trap becomes technologically obsolete. The firm's tax bracket is 40%, and the required rate of return on the project is 10%. Year: Sales (millions of traps) 0 1 2 0 0.5 0.6 3 0.7 4 5 0.7 0.5 6 0.2 Thereafter 0 Suppose the firm can cut its requirements for working capital in half by using better inventory control systems. By how much will this increase project NPV? Note: Do not…arrow_forward

- Question 6 "Axon Industries needs to raise $250,000 USDs for a new investment project. If the firm issues 1-year debt, it may have to pay an interest rate of 15%, although Axon's managers believe that 8.5% would be a fair rate given the level of risk. If the firm issues equity, they believe the equity may be underpriced by 11%.What is the cost (in USDs) to current shareholders of financing the project out of equity? Note: Express your answers in strictly numerical terms. For example, if the answer is $500arrow_forwardExercise 10-10A (Algo) Using the internal rate of return to compare investment opportunities LO 10-3 Velma and Keota (V&K) is a partnership that owns a small company. It is considering two alternative investment opportunitles. The first Investment opportunity will have a five-year useful life, will cost $9,869.02, and will generate expected cash inflows of $3,300 per year. The second investment is expected to have a useful life of three years, will cost $8,703.98, and will generate expected cash inflows of $3.500 per year. Assume that V&K has the funds available to accept only one of the opportunities. (PV.of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required o. Calculate the internal rate of return of each investment opportunity. (Do not round intermediate calculations.) b. Based on the internal rates of return, which opportunity should V&K select? Internal Rate of Return a First investment Second investmont bV&K should select thearrow_forwardQC 12.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education