EBK CFIN

6th Edition

ISBN: 9781337671743

Author: BESLEY

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:6

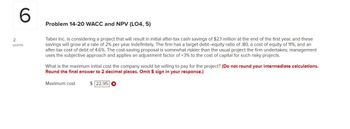

Problem 14-20 WACC and NPV (LO4, 5)

2

points

Taber Inc. is considering a project that will result in initial after-tax cash savings of $2.1 million at the end of the first year, and these

savings will grow at a rate of 2% per year indefinitely. The firm has a target debt-equity ratio of .80, a cost of equity of 11%, and an

after-tax cost of debt of 4.6%. The cost-saving proposal is somewhat riskier than the usual project the firm undertakes; management

uses the subjective approach and applies an adjustment factor of +3% to the cost of capital for such risky projects.

What is the maximum initial cost the company would be willing to pay for the project? (Do not round your intermediate calculations.

Round the final answer to 2 decimal places. Omit $ sign in your response.)

Maximum cost

$22.95

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- M2arrow_forward14 NuPress Valet has a proposed investment with an initial cost of $62 million and cash flows of $12.5 million for 5 years. Debt represents 44 percent of the capital structure. The cost of equity is 13.7 percent, the pretax cost of debt is 8.5 percent, and the tax rate is 34 percent. What is the company's WACC?arrow_forwardProblem 13-16 WACC and NPV Lebleu, Incorporated, is considering a project that will result in initial aftertax cash savings of $1.86 million at the end of the first year, and these savings will grow at a rate of 2 percent per year indefinitely. The company has a target debt-equity ratio of .8, a cost of equity of 12.6 percent, and an aftertax cost of debt of 5.4 percent. The cost- saving proposal is somewhat riskier than the usual projects the firm undertakes; management uses the subjective approach and applies an adjustment factor of +3 percent to the cost of capital for such risky projects. What is the maximum initial cost the company would be willing to pay for the project? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89) Maximum cost ..........arrow_forward

- 3 NPV and IRR Benson Designs has prepared the following estimates for a long-term project it is considering. The initial investment is $18,250, and the project will yield cash inflows of $4,000 per year for 7 years. The firm has a cost of capital of 10%. a. Determine the net present value (NPV) for the project. b. Determine the internal rate of return (IRR) for the project. c. Would you recommend that the firm accept or reject the project? a. The NPV of the project is $ (Round to the nearest cent.) b. The IRR of the project is%. (Round to two decimal places.) c. Would you recommend that the firm accept the project? (Select the best answer below.) OYes O Noarrow_forwardProblem 11-13 Flotation Cost (LG11-2) A firm is considering a project that will generate perpetual after-tax cash flows of $23,500 per year beginning next year. The project has the same risk as the firm's overall operations and must be financed externally. Equity flotation costs 12 percent and debt issues cost 5 percent on an after-tax basis. The firm's D/E ratio is 0.7. What is the most the firm can pay for the project and still earn its required return? Note: Do not round Intermediate calculations. Round your answer to the nearest whole dollar. Maximum the firm can payarrow_forward17arrow_forward

- 5arrow_forwardaj.7 Steve's Stoves Company, which desires a minimum rate of return on its investment projects of 15%, has two proposals under consideration. Their costs and expected cash flows are: A B Initial Investment $96,000 $132,000 Expected after-tax cash flows: Year 1 $40,000 $52,000 Year 2 $32,000 $56,000 Year 3 $48,000 $40,000 Year 4 $24,000 $32,000 In addition, proposal B has an expected cash salvage value at the end of four years of $8,000. The present value of $1 due in 1, 2, 3, and 4 years at 15% is .86957, .75614, .65752, and .57175, respectively.Using the profitability index method, determine which project, if either, should be accepted by the company.arrow_forward5arrow_forward

- Saved Help Sa Problem 12-16 WACC and NPV Pink, Inc., is considering a project that will result in Initial aftertax cash savings of $1.77 million at the end of the first year, and these savings will grow at a rate of 1 percent per year indefinitely. The firm has a target debt-equity ratio of 75, a cost of equity of 11.7 percent, and an aftertax cost of debt of 4.5 percent. The cost-saving proposal is somewhat riskler than the usual projects the firm undertakes; management uses the subjective approach and applies an adjustment factor of +2 percent to the cost of capital for such risky projects. What is the maximum initial cost the company would be willing to pay for the project? (Do not round intermedlate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g, 1,234,567.89.) Maximum cost S 180,986,062.00arrow_forward17. Problem 11.20 (NPV) eBook A project has annual cash flows of $6,000 for the next 10 years and then $10,500 each year for the following 10 years. The IRR of this 20-year project is 11.42%. If the firm's WACC is 8%, what is the project's NPV? Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forward#28arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning