FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

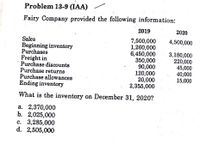

Transcribed Image Text:Problem 13-9 (IAA)

Fairy Company provided the following information:

2019

2020

Sales

Beginning inventory

Purchases

Freight in

Purchase discounts

Purchase returns

Purchase allowances

Ending inventory

7,500,000

1,260,000

6,450,000

350,000

90,000

120,000

20,000

2,355,000

4,500,000

3,180,000

220,000

45,000

40,000

15,000

What is the inventory on December 31, 2020?

a. 2,370,000

b. 2,025,000

c. 3,285,000

d. 2,505,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 8 points On January 1, 2024, Select Variety Store adopted the dollar-value LIFO retail inventory method. Accounting records provided the following information: Beginning inventory Net purchases Cost $ 41,000 162,240 Retail $82,000 Net markups Net markdowns Net sales Retail price index, end of year 340,000 8,000 10,000 317,000 1.04 During 2025 (the following year), purchases at cost and retail were $195,075 and $433,500, respectively. Net markups, net markdowns, and net sales for the year were $9,000, $10,000, and $350,000, respectively. The retail price Index at the end of 2025 was 1.06. Estimate ending inventory in 2025 using the dollar-value LIFO retall method. Note: Round ratio calculation to 2 decimal places and round other intermediate calculations and final answer to the nearest whole dollar. Answer is complete but not entirely correct. Ending inventory S 83,784arrow_forwardProblem 14-7 (AICPA Adapted) Empress Company used the retail inventory methed approximate the ending inventory. to The following information is available for the current ve. Cost Retail 650,000 9,000,000 200,000 300,000 150,000 200,000 Beginning inventory Purchases 1,200,000 14,700,000 Freight in Purchase returns Purchase allowances Departmental transfer in Net markup Net markdown Sales Sales discounts Employee discounts Estimated normal shoplifting losses Estimated normal shrinkage 500,000 300,000 300,000 1,000,000 9,500,000 100,000 500,000 600,000 400,000 1. What is the estimated cost of ending inventory using the conservative approach? а. 2,400,000 b. 2,460,000 c. 3,060,000 d. 2,700,000 2. What is estimated cost of ending inventory using the average cost approach? а. 2,560,000 b. 2,624,000 с. 3,264,000 d. 2,880,000arrow_forwardAL LUSE AL RELdi Beginning inventory Net purchases $127, 600 231,240 $256, 800 393, 600 Assume that in addition to estimating its ending Inventory by the retall method, Harmony Co. also took a physical Iinventory at the marked selling prices of the Inventory Items at the end of 2020. Assume further that the total of this physical Inventory at marked selling prices was $109,200. a. Determine the amount of this Inventory at cost. (Round your intermedlete calculatlons and final answer to 2 decimal places.) Inventory at cost b. Determine Harmony's 2020 Inventory shrinkage from breakage, theft, or other causes at retall and at cost. (Round your Intermedlate calculatlons and final answers to 2 decimal places.) At Cost At Retail Estimated inventory that should have been on hand Physical inventory Inventory shrinkagearrow_forward

- 3 Freeflow Inc uses Gross profit method to estimate its closing Inventory details for 2020 is given below Cost Retail Gross Sales $1,685,000.00 Freight $18,000.00 Markdown cancellation $8,000.00 Markup $71,000.00 Purchases $975,000.00 $1,834,000.00 Markup cancellation $18,000.00 purchase returns $23,000.00 $36,000.00 Sales returns $38,000.00 Op Inventory $220,000.00 $411,000.00 Markdowns $69,000.00 Freeflow has averaged 64.5% gross margin Based on this, what amount will Freeflow report as cost of goods sold Question 3 options: 605315 584685 422450 598175arrow_forwardPlease help mearrow_forwardRequired information Problem 9-13 (Algo) Retail inventory method; various applications [LO9-3, 9-4, 9-5] [The following information applies to the questions displayed below.] On January 1, 2021, Pet Friendly Stores adopted the retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2021 and 2022 are as follows: Beginning inventory Purchases Purchase returns Freight-in Net markups Net markdowns Net sales to customers Sales to employees (net of 20% discount) Normal spoilage Price Index: January 1, 2021 December 31, 2021 December 31, 2022 Problem 9-13 (Algo) Part 3 X Answer is complete but not entirely correct. Conventional Retail Method Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold $ $ $ 2021 950,400 X 725,191 X 725,191 x Cost Retail $105,400 $170,000 430,000 622,000 4,000 2,900 6,200 1.00 1.04 1.20 5,150 4,150 500,000 14,400 1,900 Cost 2022 Required: 3. Estimate the 2021 ending inventory and…arrow_forward

- Item 13 A company has determined its year-end inventory on a FIFO basis to be $530,000. Information pertaining to that inventory is as follows: Selling price $ 535,000 Costs to sell 37,500 Replacement cost 462,500 What should be the reported value of inventory if the company prepares its financial statements according to International Financial Reporting Standards (IFRS)?arrow_forwardQuestion 3 (5%) Inventory data for Hot Buys Company for January 2020 are as follows: January I balance January 10 purchase 100 units at $28 January 15 sale January 21 purchase 90 units at $32 January 28 sale 80 units at $25 120 units 110 units Using FIFO, compute ending inventory as of January 31, 2020, and determine cost of goods sold for January.arrow_forward9arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education