FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

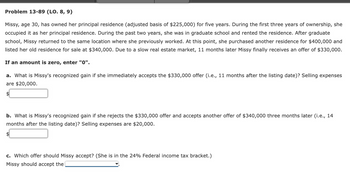

Transcribed Image Text:Problem 13-89 (LO. 8, 9)

Missy, age 30, has owned her principal residence (adjusted basis of $225,000) for five years. During the first three years of ownership, she

occupied it as her principal residence. During the past two years, she was in graduate school and rented the residence. After graduate

school, Missy returned to the same location where she previously worked. At this point, she purchased another residence for $400,000 and

listed her old residence for sale at $340,000. Due to a slow real estate market, 11 months later Missy finally receives an offer of $330,000.

If an amount is zero, enter "0".

a. What is Missy's recognized gain if she immediately accepts the $330,000 offer (i.e., 11 months after the listing date)? Selling expenses

are $20,000.

b. What is Missy's recognized gain if she rejects the $330,000 offer and accepts another offer of $340,000 three months later (i.e., 14

months after the listing date)? Selling expenses are $20,000.

c. Which offer should Missy accept? (She is in the 24% Federal income tax bracket.)

Missy should accept the

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- 4 0 Frankie purchased a freehold townhouse which she used to generate rental income. She originally acquired the unit at cost of $350,000. Over the years, she had claimed $27,000 in CCA, such that her UCC at the beginning of the year was $323,000. This year, she sold the unit for $325,000. She incurred selling expenses of $5,000. Frankie purchased another rental property before the end of the year for $225,000. What statement is true? Oa) Frankie has neither a recapture, nor a terminal loss. Ob) Frankie has a terminal loss of $3,000. Oc) Frankie has a recapture of $25,000. O d) Frankie has a terminal loss of $5,000.arrow_forwardInterview Notes Barbara is age 57 and was widowed in 2021. She owns her own home and providedall the cost of keeping up her home for the entire year. Her only income for 2021 was$36,000 in W-2 wages. Jenny, age 24, and her daughter Marie, age 3, moved in with her mother, Barbara,after she separated from her spouse in April of 2021. Jenny’s only income for 2021was $15,000 in wages. Jenny provided over half of her own support. Marie did notprovide more than half of her own support. Jenny will not file a joint return with her spouse. She did not receive advance childtax credit payments for 2021. All individuals in the household are U.S. citizens with valid Social Security numbers.No one has a disability. They lived in the United States all year but not in a communityproperty state. 10. Which of the following statements is true? A. Jenny is eligible to claim Marie for the EIC even though her filing status is married filing separate…arrow_forwardProblem 13-84 (LO. 8, 9) Karl purchased his residence on January 2, 2019, for $260,000, after having lived in it during 2018 as a tenant under a lease with an option to buy clause. On August 1, 2020, Karl sells the residence for $315,000. On June 13, 2020, Karl purchases a new residence for $367,000. If an amount is zero, enter "0". a. What is Karl's recognized gain? His basis for the new residence?Karl's recognized gain is $fill in the blank aa8a5403c02a012_1, and his basis for the new residence is $fill in the blank aa8a5403c02a012_2. b. Assume that Karl purchased his original residence on January 2, 2018 (rather than January 2, 2019). What is Karl's recognized gain? His basis for the new residence? Karl's recognized gain is $fill in the blank f8cfe3ffcff0ffc_1, and his basis for the new residence is $fill in the blank f8cfe3ffcff0ffc_2. c. In part (a), what could Karl do to minimize his recognized gain?To minimize his recognized gain, he can continue to…arrow_forward

- tekabhaiarrow_forwardIn the current year, Sandra rented her vacation home for 75 days, used it for personal use for 22 days, and left it vacant for the remainder of the year. Her income and expenses before allocation are as follows: Rental income 11,400 Real estate taxes 1,200 Utilities 1,350 Mortgage interest 3,200 Depreciation 6,000 Repairs and maintenance 810 equired: What is Sandra’s net income or loss from the rental of her vacation home? Use the Tax Court method. Note: Round your intermediate computations to 5 decimal places and final answers to nearest whole dollar value.arrow_forwardAnna owns an investment property in Sai Kung for many years which has been rented out at $30,000 per month. She holds a non refundable rental deposit of $90,000. In the year of assessment 2023/24, she was able to collect rent for the first three months only. She finally repossessed the property and rented the property on 1 February 2024 at a new rent of $20,000 per month. Rates and management fees paid by Anna during the year was $36,000 and $24,000 respectively. What is the net assessable value for property tax purposes for the year of assessment 2023/24?Question 21Select one: a. $192,000 b. $144,000arrow_forward

- Please help with the calculationarrow_forwardNonearrow_forwardThis year, Leron and Sheena sold their home for $1,036,000 after all selling costs. Under the following scenarios, how much taxable gain does the home sale generate for Leron and Sheena? Assume that the couple is married filing jointly. (Leave no answer blank. Enter zero if applicable.) Problem 5-81 Part-a (Algo) a. Leron and Sheena bought the home three years ago for $185,000 and lived in the home until it sold.arrow_forward

- Sale of a Personal Residence (LO 4.6) Larry Gaines, a single taxpayer, age 42, sells his personal residence on November 12, 2022, for $228,400. He lived in the house for 7 years. The expenses of the sale are $15,988, and he has made capital improvements of $6,852. Larry's cost basis in his residence is $132,472. On November 30, 2022, Larry purchases and occupies a new residence at a cost of $285,500. Calculate Larry's realized gain, recognized gain, and the adjusted basis of his new residence. If an amount is zero, enter "0". Description Amount a. Realized gain $fill in the blank 1 b. Recognized gain $fill in the blank 2 c. Adjusted basis of new residence $fill in the blank 3arrow_forwardAP 8-7 (Principal Residence Designation) Mr. Stewart Simms has lived most of his life in Vancouver. In 1997, he purchased a three bedroom home near English Bay for $125,000. In 2002, he acquired a cottage in the Whistler ski area at a cost of $40,000. In all subsequent years, he has spent at least a portion of the year living in each of the two locations. When he is not residing in these properties they are left vacant. On October 1, 2021, Mr. Simms sells the English Bay property for $515,000 and the cottage at Whistler for $320,000. Mr. Simms wishes to minimize any capital gains resulting from the sale of the two properties. Required: Describe how the two residences should be designated to optimize the use of the principal residence exemption. In addition, calculate the amount of the taxable capital gains that would arise under the designation that you have recommended. Show all supporting calculations.arrow_forwardPlease do not give image formatarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education