FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

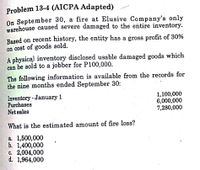

Transcribed Image Text:Problem 13-4 (AICPA Adapted)

On September 30, a fire at Elusive Company's only

warehouse caused severe damaged to the entire inventory.

Based on recent history, the entity has a gross profit of 30%

on cost of goods sold.

A physicąl inventory disclosed usable damaged goods which

can be sold to a jobber for P100,000.

The following information is available from the records for

the nine months ended September 30:

Inventory - January 1

Purchases

Net sales

1,100,000

6,000,000

7,280,000

What is the estimated amount of fire loss?

a. 1,500,000

b. 1,400,000

C. 2,004,000

d. 1,964,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sheridan Legler requires an estimate of the cost of goods lost by fire on March 9. Merchandise on hand on January 1 was $44,080. Purchases since January 1 were $83, 520; freight - in, $3, 944; purchase returns and allowances, $2,784. Sales are made at 33 1/3% above cost and totaled $135,000 to March 9. Goods costing $12, 644 were left undamaged by the fire; remaining goods were destroyedarrow_forwardRiverbed Inc.’s April 30 inventory was destroyed by the explosion of an underground oil tank. January 1 inventory was $322,000 and purchases for January through April totalled $790,000. Sales for the same period were $1.2 million. Riverbed 's normal gross profit percentage is 30%.Using the gross profit method, estimate the amount of Riverbed 's April 30 inventory that was destroyed. Estimated ending inventory destroyed in explosion $enter a dollar amount of the ending inventoryarrow_forwardOn 1st Jan 2006, a business had inventory of $19,000. During the month, sales totalled $32,500 and purchases $24,000. On 31st Jan 2006 a fire destroyed some of the inventory. The undamaged goods in inventory were valued at $11,000. The business operates with a standard gross profit margin of 30%. Based on this information, what is the cost of the inventory destroyed in the fire?arrow_forward

- On June 30, 2021, a fire at Norjanna Company’s only warehouse caused severe damage to itsinventory. Based on recent history, Norjanna has a gross profit of 25% on cost. The followinginformation is available from the records for the six months ended June 30, 2021:Inventory – January 1 4,000,000Net purchases 18,000,000Net sales 20,000,000A physical inventory disclosed undamaged goods with selling price of P1,000,000. On June 30, 2021,unsold goods on consignment with selling price of P1,500,000 are in the hands of the consignee. Whatis the estimated cost of inventory destroyed by fire? Judy Company uses the retail inventory method to approximate its ending inventory. The followinginformation is available for the current year: Cost RetailBeginning inventory 650,000 1,200,000Purchases…arrow_forwardSandhill Legler requires an estimate of the cost of goods lost by fire on March 9. Merchandise on hand on January 1 was $ 37,240. Purchases since January 1 were $ 70,560; freight-in, $ 3,332; purchase returns and allowances, $ 2,352. Sales are made at 33 1/3% above cost and totaled $ 111,000 to March 9. Goods costing $ 10,682 were left undamaged by the fire; remaining goods were destroyed.arrow_forwardOn January 1, a store had inventory of $48,000. January purchases were $46,000 and January sales were $95,000. On February 1 a fire destroyed most of the inventory. The rate of gross profit was 20% of sales. Merchandise with a selling price of $5,000 remained undamaged after the fire. Compute the amount of the fire loss, assuming the store had no insurance coverage. Label all figures.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education