Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

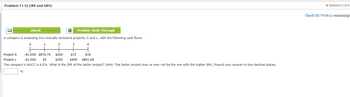

Transcribed Image Text:Problem 11.12 (IRR and NPV)

Problem Walk-Through

A company is analyzing two mutually exclusive projects, S and L, with the following cash flows:

0

1

4

eBook

%

2

3

-$1,000 $876.76 $260

Project S

Project L

$15 $10

$400 $801.65

-$1,000 $5

$250

The company's WACC is 8.0%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places.

◄ Question 2 of 6

Check My Work (1 remaining)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 0 1 4 2 3 $893.96 $250 $0 $240 Project S -$1,000 $5 $15 Project L -$1,000 $380 $862.46 The company's WACC is 10.0%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places. %arrow_forward24 Matterhorn Mountain Gear is evaluating two projects with the following cash flows: Project X Project Y -$ 320,000 -$ 300,100 145,800 137, 150 163,300 154,350 128,400 120, 100 Year 0 1 2 3 What interest rate will make the NPV for the projects equal?arrow_forwardConsider a project with the following cash flows: C0 C1 C2 C3 C4 -20,000 9,000 9,000 9,000 9,000 If the appropriate discount rate for this project is 15%, then the NPV is closest to: Select one: a. -$1,872 b. -$5,700 c. $1,872 d. $5,700arrow_forward

- man.1arrow_forwardConsider the following two projects: Cash flows Project A Project B C0�0 −$ 240 −$ 240 C1�1 100 123 C2�2 100 123 C3�3 100 123 C4�4 100 a. If the opportunity cost of capital is 8%, which of these two projects would you accept (A, B, or both)? b. Suppose that you can choose only one of these two projects. Which would you choose? The discount rate is still 8%. c. Which one would you choose if the cost of capital is 16%? d. What is the payback period of each project? e. Is the project with the shortest payback period also the one with the highest NPV? f. What are the internal rates of return on the two projects? g. Does the IRR rule in this case give the same answer as NPV? h. If the opportunity cost of capital is 8%, what is the profitability index for each project? i. Is the project with the highest profitability index also the one with the highest NPV? j. Which measure should you use to choose between the projects?arrow_forward3 https://pwcollege.brightspace.com/d21/le/content/6894/viewContent/7549/View?ou=6894 T 01 2 Cost Pay Back and NPV A company is considering investing in a project to expand the facilities for customers. There are two different ways of doing this and they have each been costed. Projected net cash flow into the company has also been estimated. Project 2 £115,000.00 Year Expected Contributions 1 3 4 Automatic Zoom 5 Project 1 £120,000.00 6 £50,000.00 £40,000.00 £50,000.00 £45,000.00 £50,000.00 £50,000,00 £40,000.00 £40,000.00 £45,000.00 £30,000.00 a. If the company used the payback method, when does each project pay for itself? b. If the company were to employ a discount rate of 12%, what would be the NPV of each project? CIRR to > A view as TexT DOWI £50,000.00 £30,000.00arrow_forward

- Nonearrow_forwardKLA Cost Ziege Systems is considering the following independent projects for the coming year Project Required Investorent Rate of Return Risk A $4 million 12.25% Hish High $5 million Low B C DEFGH $3 million $2 million $6 million $5 million $6 million $3 million 500 14.75 10.25 9.75 13.25 13.25 7.75 12.25 million Average High Average Low Low } If Ziege con only invest a total of $13 million what would be the dollar size of its capital budget? $ million What would be the dollar size of its capital budget? $arrow_forwardDetails WACC 0 SGWN-O 1 2 3 4 5 6 7.80% Project A Project B -1225 395 402 423 432 489 512 -2146 592.5 603 634.5 648 733.5 768 1. Construct NPV profile table by using cashflows from Project A and B above. 2. Draw NPV profile 3. Compute crossover rate To receive EC your work has to be done in Excel.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education